Acquired Company (in thousands) Lancope, Inc Technology Useful life (in years) Amount $79,000 240,000 in Limited Lives 5 Jasper Technologies, Inc 6 Customer Relationships Useful life (in years) 6 7 Amount $29,000 75,000 Indefinite Lives IPR&D Amount $121,000 23,000

Acquired Company (in thousands) Lancope, Inc Technology Useful life (in years) Amount $79,000 240,000 in Limited Lives 5 Jasper Technologies, Inc 6 Customer Relationships Useful life (in years) 6 7 Amount $29,000 75,000 Indefinite Lives IPR&D Amount $121,000 23,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 62E

Related questions

Question

Transcribed Image Text:Amortization and Impairment Testing of Identifiable Intangible Assets

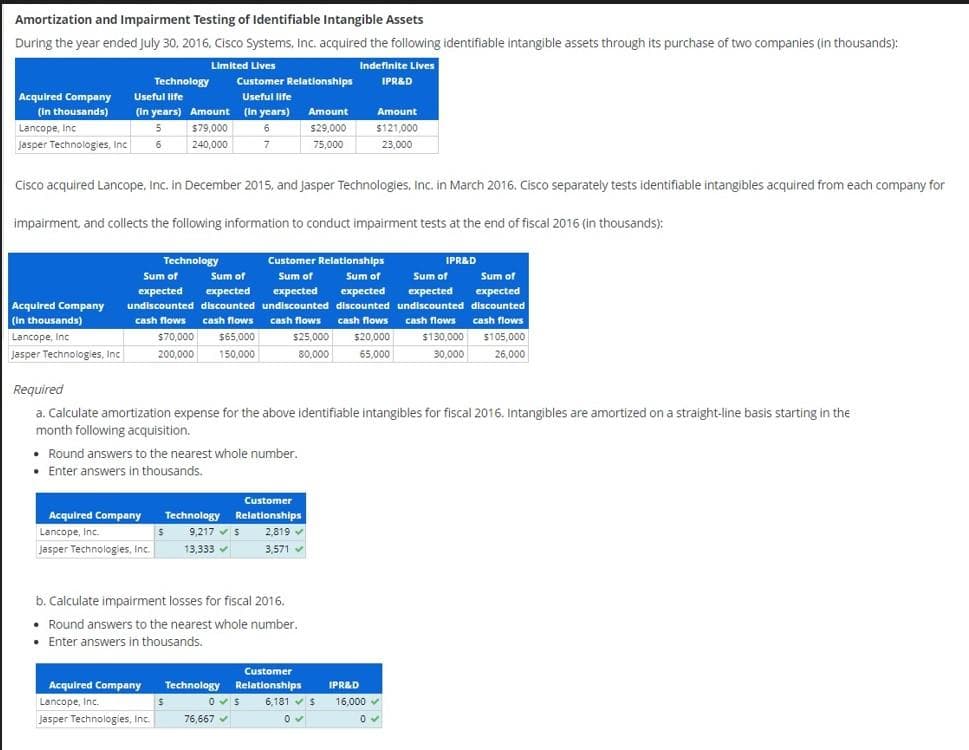

During the year ended July 30, 2016, Cisco Systems, Inc. acquired the following identifiable intangible assets through its purchase of two companies (in thousands):

Limited Lives

Indefinite Lives

IPR&D

Acquired Company

(in thousands)

Lancope, Inc

Jasper Technologies, Inc

Technology

Useful life

(in years) Amount

5 $79,000

6

240,000

Acquired Company

(in thousands)

Lancope, Inc

Jasper Technologies, Inc

Technology

Sum of Sum of

expected

expected

undiscounted discounted

Cisco acquired Lancope, Inc. in December 2015, and Jasper Technologies, Inc. in March 2016. Cisco separately tests identifiable intangibles acquired from each company for

impairment, and collects the following information to conduct impairment tests at the end of fiscal 2016 (in thousands):

IPR&D

Customer Relationships

Sum of

Sum of

Sum of

expected expected expected

undiscounted discounted undiscounted

cash flows cash flows

$25,000 $20,000

80,000 65,000

cash flows

$130,000

30,000

cash flows cash flows

$70,000

$65,000

200,000 150,000

Customer Relationships

Useful life

(in years)

6

7

• Round answers to the nearest whole number.

• Enter answers in thousands.

Acquired Company Technology

Lancope, Inc.

Jasper Technologies, Inc.

Required

a. Calculate amortization expense for the above identifiable intangibles for fiscal 2016. Intangibles are amortized on a straight-line basis starting in the

month following acquisition.

$

Acquired Company

Lancope, Inc.

Jasper Technologies, Inc.

S

Customer

Relationships

9,217 ✔ S

13,333

b. Calculate impairment losses for fiscal 2016.

• Round answers to the nearest whole number.

• Enter answers in thousands.

76,667

Amount

$29,000

75,000

2,819✔

3,571

Customer

Technology Relationships

05 6,181 ✔ S

0✓

Amount

$121,000

23,000

Sum of

expected

discounted

cash flows

$105,000

26,000

IPR&D

16,000 ✓

0✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning