oday I advised the president of Crane Corporation regarding his November 25 letter. Crane Corporation had 2,000 shares of stock outstanding. It redeemed 500 shares for $370,000, when it had paid-in capital of $300,000 and E & P of $1,200,000. The edemption qualifies for sale or exchange treatment for the shareholder. Crane incurred $13,000 of accounting and legal fees with respect to the redemption

oday I advised the president of Crane Corporation regarding his November 25 letter. Crane Corporation had 2,000 shares of stock outstanding. It redeemed 500 shares for $370,000, when it had paid-in capital of $300,000 and E & P of $1,200,000. The edemption qualifies for sale or exchange treatment for the shareholder. Crane incurred $13,000 of accounting and legal fees with respect to the redemption

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 65P

Related questions

Question

Q 4.

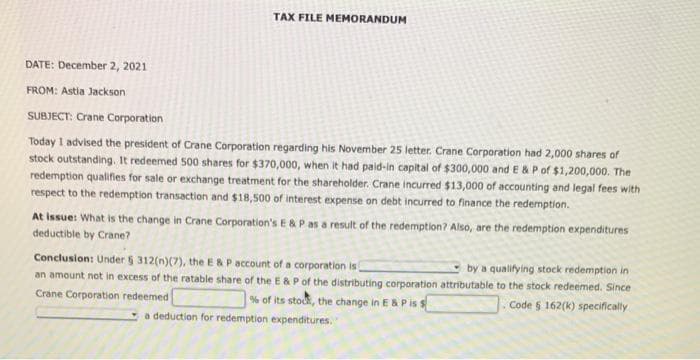

Transcribed Image Text:DATE: December 2, 2021

FROM: Astia Jackson.

TAX FILE MEMORANDUM

SUBJECT: Crane Corporation

Today I advised the president of Crane Corporation regarding his November 25 letter. Crane Corporation had 2,000 shares of

stock outstanding. It redeemed 500 shares for $370,000, when it had paid-in capital of $300,000 and E & P of $1,200,000. The

redemption qualifies for sale or exchange treatment for the shareholder. Crane incurred $13,000 of accounting and legal fees with

respect to the redemption transaction and $18,500 of interest expense on debt incurred to finance the redemption.

At Issue: What is the change in Crane Corporation's E & P as a result of the redemption? Also, are the redemption expenditures

deductible by Crane?

Conclusion: Under § 312(n)(7), the E & P account of a corporation is

by a qualifying stock redemption in

an amount not in excess of the ratable share of the E & P of the distributing corporation attributable to the stock redeemed. Since

Crane Corporation redeemed

Code 5 162(k) specifically

% of its stock, the change in E & P is s

a deduction for redemption expenditures. "

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT