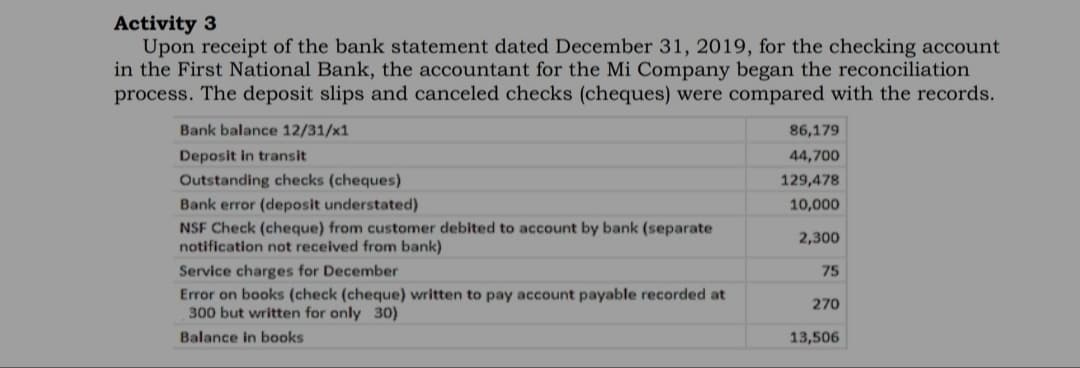

Activity 3 Upon receipt of the bank statement dated December 31, 2019, for the checking account in the First National Bank, the accountant for the Mi Company began the reconciliation process. The deposit slips and canceled checks (cheques) were compared with the records. Bank balance 12/31/x1 86,179 Deposit in transit 44,700 Outstanding checks (cheques) 129,478 Bank error (deposit understated) 10,000 NSF Check (cheque) from customer debited to account by bank (separate notification not received from bank) 2,300 Service charges for December Error on books (check (cheque) written to pay account payable recorded at 300 but written for only 30) 75 270 Balance in books 13,506

Activity 3 Upon receipt of the bank statement dated December 31, 2019, for the checking account in the First National Bank, the accountant for the Mi Company began the reconciliation process. The deposit slips and canceled checks (cheques) were compared with the records. Bank balance 12/31/x1 86,179 Deposit in transit 44,700 Outstanding checks (cheques) 129,478 Bank error (deposit understated) 10,000 NSF Check (cheque) from customer debited to account by bank (separate notification not received from bank) 2,300 Service charges for December Error on books (check (cheque) written to pay account payable recorded at 300 but written for only 30) 75 270 Balance in books 13,506

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.3BE

Related questions

Question

Prepare a bank reconciliation statement

Transcribed Image Text:Activity 3

Upon receipt of the bank statement dated December 31, 2019, for the checking account

in the First National Bank, the accountant for the Mi Company began the reconciliation

process. The deposit slips and canceled checks (cheques) were compared with the records.

Bank balance 12/31/x1

86,179

Deposit in transit

Outstanding checks (cheques)

Bank error (deposit understated)

44,700

129,478

10,000

NSF Check (cheque) from customer debited to account by bank (separate

notification not received from bank)

2,300

Service charges for December

75

Error on books (check (cheque) written to pay account payable recorded at

300 but written for only 30)

270

Balance in books

13,506

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning