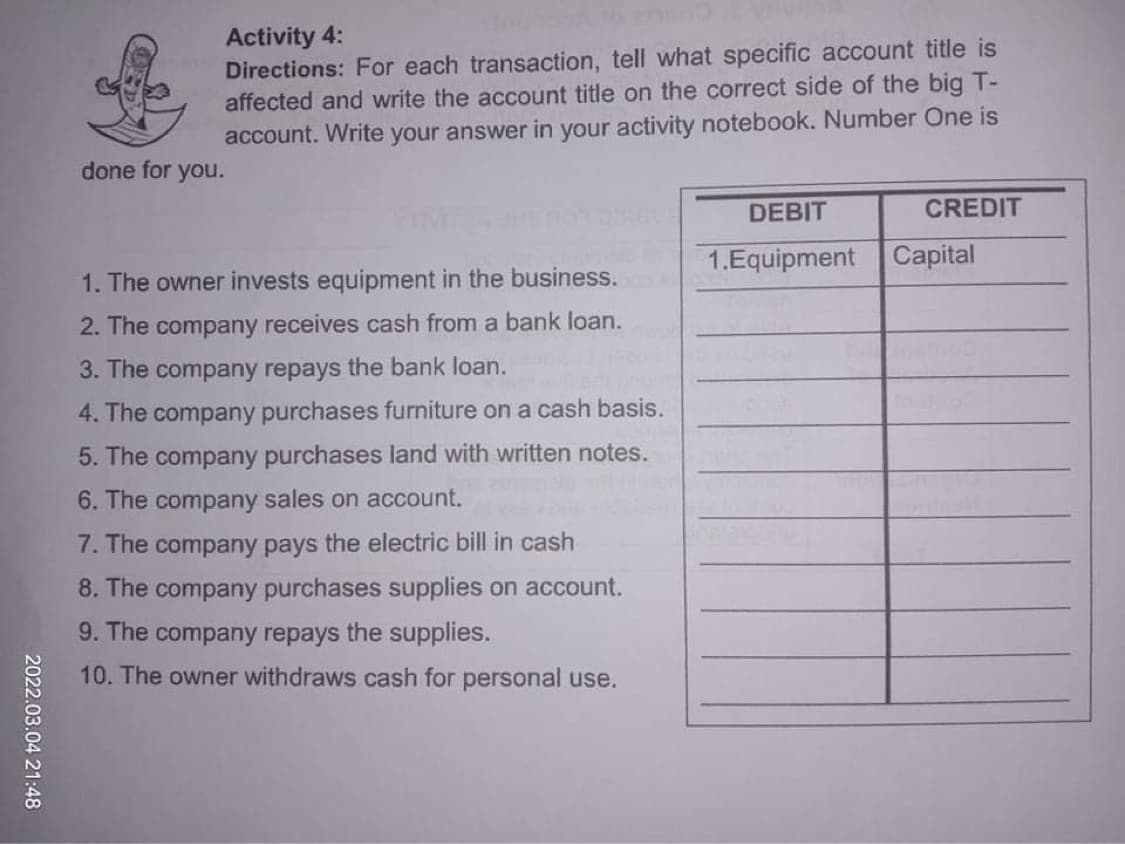

Activity 4: Directions: For each transaction, tell what specific account title is affected and write the account title on the correct side of the big T- account. Write your answer in your activity notebook. Number One is done for you. DEBIT CREDIT 1. The owner invests equipment in the business. 1.Equipment Capital 2. The company receives cash from a bank loan. 3. The company repays the bank loan. 4. The company purchases furniture on a cash basis.

Activity 4: Directions: For each transaction, tell what specific account title is affected and write the account title on the correct side of the big T- account. Write your answer in your activity notebook. Number One is done for you. DEBIT CREDIT 1. The owner invests equipment in the business. 1.Equipment Capital 2. The company receives cash from a bank loan. 3. The company repays the bank loan. 4. The company purchases furniture on a cash basis.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 5SEB: TRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following...

Related questions

Topic Video

Question

Transcribed Image Text:Activity 4:

Directions: For each transaction, tell what specific account title is

affected and write the account title on the correct side of the big T-

account. Write your answer in your activity notebook. Number One is

done for you.

DEBIT

CREDIT

1.Equipment

Capital

1. The owner invests equipment in the business.

2. The company receives cash from a bank loan.

3. The company repays the bank loan.

4. The company purchases furniture on a cash basis.

5. The company purchases land with written notes.

6. The company sales on account.

7. The company pays the electric bill in cash

8. The company purchases supplies on account.

9. The company repays the supplies.

10. The owner withdraws cash for personal use.

2022.03.04 21:48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning