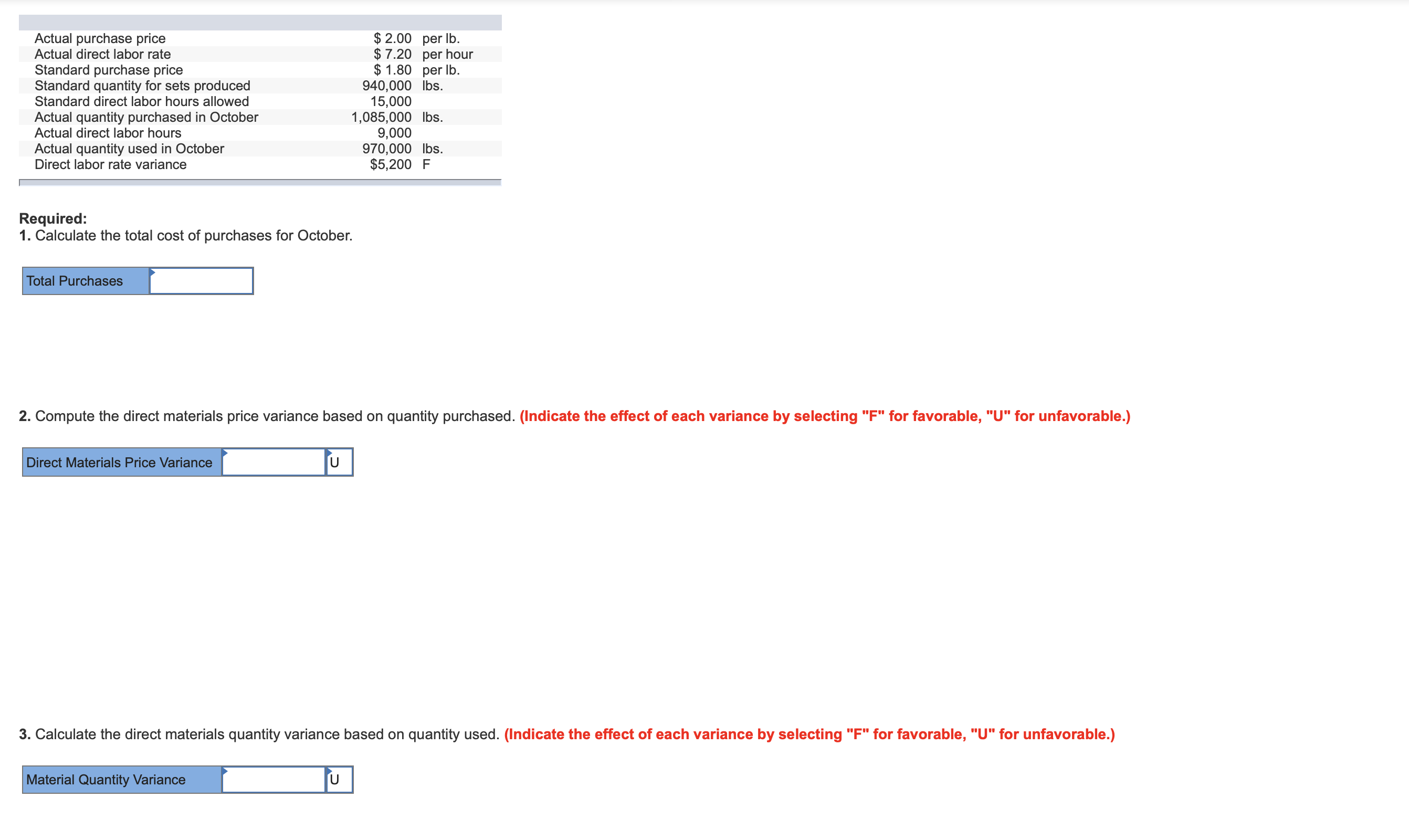

Actual purchase price Actual direct labor rate Standard purchase price Standard quantity for sets produced Standard direct labor hours allowed $ 2.00 per lb. $7.20 per hour $ 1.80 per lb 940,000 lbs. 15,000 1,085,000 lbs. 9,000 970,000 lbs. $5,200 F Actual quantity purchased in October Actual direct labor hours Actual quantity used in October Direct labor rate variance Required: 1. Calculate the total cost of purchases for October. Total Purchases 2. Compute the direct materials price variance based on quantity purchased. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) U Direct Materials Price Variance 3. Calculate the direct materials quantity variance based on quantity used. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) U Material Quantity Variance

Actual purchase price Actual direct labor rate Standard purchase price Standard quantity for sets produced Standard direct labor hours allowed $ 2.00 per lb. $7.20 per hour $ 1.80 per lb 940,000 lbs. 15,000 1,085,000 lbs. 9,000 970,000 lbs. $5,200 F Actual quantity purchased in October Actual direct labor hours Actual quantity used in October Direct labor rate variance Required: 1. Calculate the total cost of purchases for October. Total Purchases 2. Compute the direct materials price variance based on quantity purchased. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) U Direct Materials Price Variance 3. Calculate the direct materials quantity variance based on quantity used. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.) U Material Quantity Variance

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 3BE: Variable costingsales exceed production The beginning inventory is 52,800 units. All of the units...

Related questions

Question

i do not understand how to solve this problem

Transcribed Image Text:Actual purchase price

Actual direct labor rate

Standard purchase price

Standard quantity for sets produced

Standard direct labor hours allowed

$ 2.00 per lb.

$7.20 per hour

$ 1.80 per lb

940,000 lbs.

15,000

1,085,000 lbs.

9,000

970,000 lbs.

$5,200 F

Actual quantity purchased in October

Actual direct labor hours

Actual quantity used in October

Direct labor rate variance

Required:

1. Calculate the total cost of purchases for October.

Total Purchases

2. Compute the direct materials price variance based on quantity purchased. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.)

U

Direct Materials Price Variance

3. Calculate the direct materials quantity variance based on quantity used. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable.)

U

Material Quantity Variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,