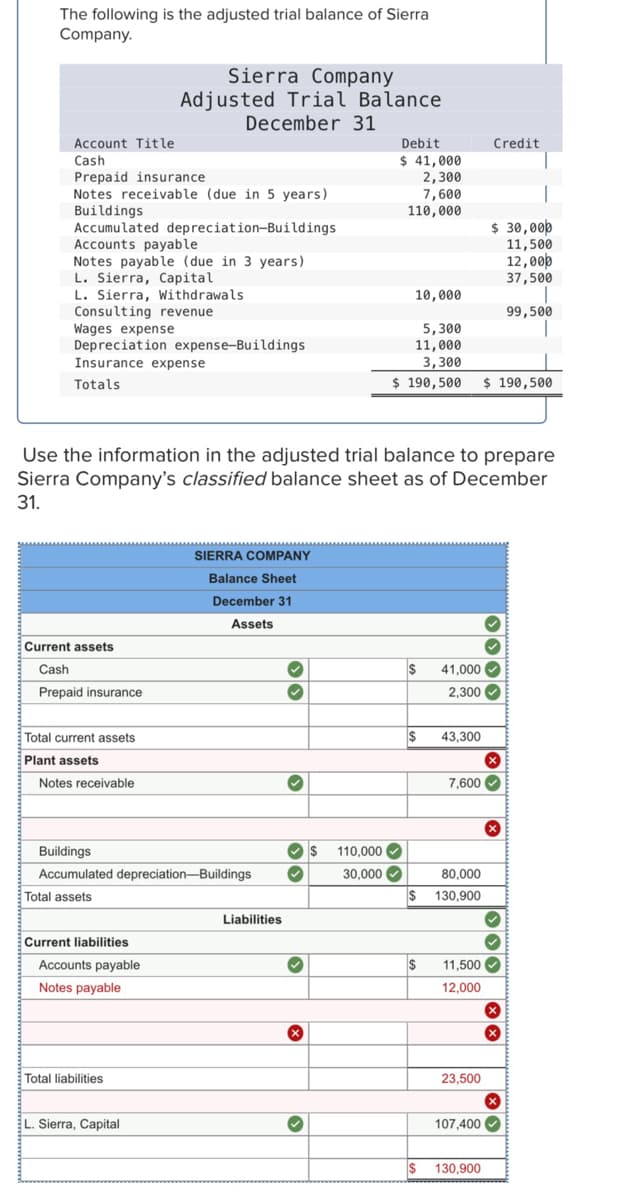

Adjusted Trial Balance December 31 Account Title Debit Credit $ 41,000 2,300 Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) L. Sierra, Capital L. Sierra, Withdrawals Consulting revenue Wages expense Depreciation expense-Buildings 7,600 110,000 $ 30,00p 11,500 12,00p 37,500 10,000 99,500 5,300 11,000 3,300 $ 190,500 Insurance expense Totals $ 190,500

Adjusted Trial Balance December 31 Account Title Debit Credit $ 41,000 2,300 Cash Prepaid insurance Notes receivable (due in 5 years) Buildings Accumulated depreciation-Buildings Accounts payable Notes payable (due in 3 years) L. Sierra, Capital L. Sierra, Withdrawals Consulting revenue Wages expense Depreciation expense-Buildings 7,600 110,000 $ 30,00p 11,500 12,00p 37,500 10,000 99,500 5,300 11,000 3,300 $ 190,500 Insurance expense Totals $ 190,500

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

Can you fix this for me ?

Transcribed Image Text:The following is the adjusted trial balance of Sierra

Company.

Sierra Company

Adjusted Trial Balance

December 31

Account Title

Debit

Credit

$ 41,000

2,300

7,600

110,000

Cash

Prepaid insurance

Notes receivable (due in 5 years)

Buildings

Accumulated depreciation-Buildings

Accounts payable

Notes payable (due in 3 years)

L. Sierra, Capital

L. Sierra, Withdrawals

Consulting revenue

Wages expense

Depreciation expense-Buildings

$ 30,00b

11,500

12,00p

37,500

10,000

99,500

5,300

11,000

3,300

$ 190,500 $ 190,500

Insurance expense

Totals

Use the information in the adjusted trial balance to prepare

Sierra Company's classified balance sheet as of December

31.

SIERRA COMPANY

Balance Sheet

December 31

Assets

Current assets

Cash

$

41,000 O

Prepaid insurance

2,300 O

Total current assets

43,300

Plant assets

Notes receivable

7,600 O

Buildings

110,000

Accumulated depreciation-Buildings

30,000 O

80,000

Total assets

$ 130,900

Liabilities

Current liabilities

Accounts payable

2$

11,500 O

Notes payable

12,000

Total liabilities

23,500

L. Sierra, Capital

107,400

130,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning