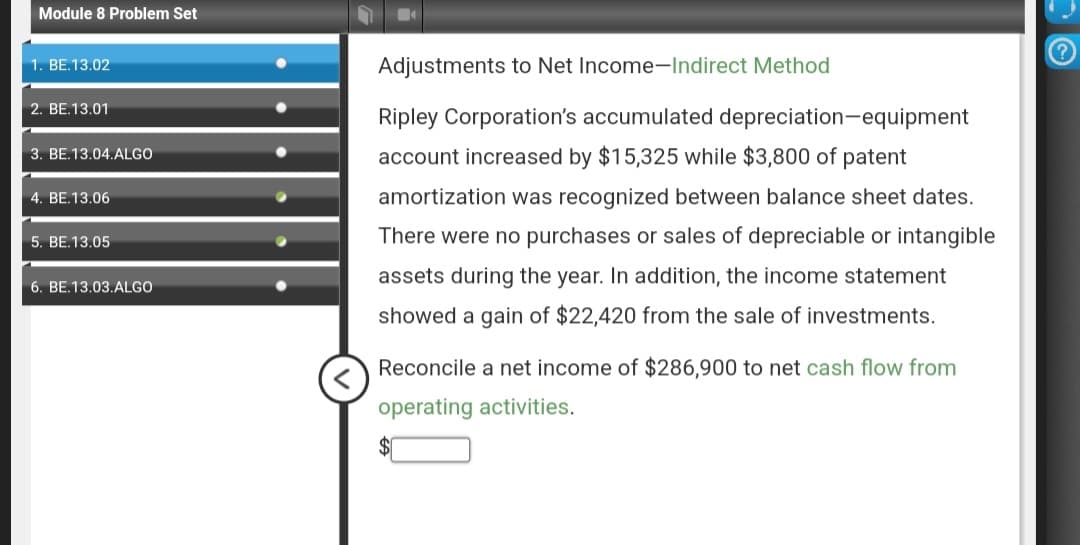

Adjustments to Net Income-Indirect Method Ripley Corporation's accumulated depreciation-equipment account increased by $15,325 while $3,800 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $22,420 from the sale of investments. Reconcile a net income of $286,900 to net cash flow from operating activities.

Adjustments to Net Income-Indirect Method Ripley Corporation's accumulated depreciation-equipment account increased by $15,325 while $3,800 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $22,420 from the sale of investments. Reconcile a net income of $286,900 to net cash flow from operating activities.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13.2BE: Adjustments to net incomeindirect method Ripley Corporations accumulated depreciationequipment...

Related questions

Question

100%

Not a previously submitted question.

Thank you

Transcribed Image Text:Module 8 Problem Set

1. BE.13.02

2. BE.13.01

3. BE.13.04.ALGO

4. BE.13.06

5. BE.13.05

6. BE.13.03.ALGO

Adjustments to Net Income-Indirect Method

Ripley Corporation's accumulated depreciation-equipment

account increased by $15,325 while $3,800 of patent

amortization was recognized between balance sheet dates.

There were no purchases or sales of depreciable or intangible

assets during the year. In addition, the income statement

showed a gain of $22,420 from the sale of investments.

Reconcile a net income of $286,900 to net cash flow from

operating activities.

(?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,