1. What are the Harry's cash proceeds from issuance of these bonds, presuming that the selling price is 8712? 2. How much bond interest expense will be recognized over the life of these bonds? 3. How much bond interest expense will Harry record on the first interest payment date? Complete this question by entering your answers in the tabr holow

1. What are the Harry's cash proceeds from issuance of these bonds, presuming that the selling price is 8712? 2. How much bond interest expense will be recognized over the life of these bonds? 3. How much bond interest expense will Harry record on the first interest payment date? Complete this question by entering your answers in the tabr holow

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 3P

Related questions

Question

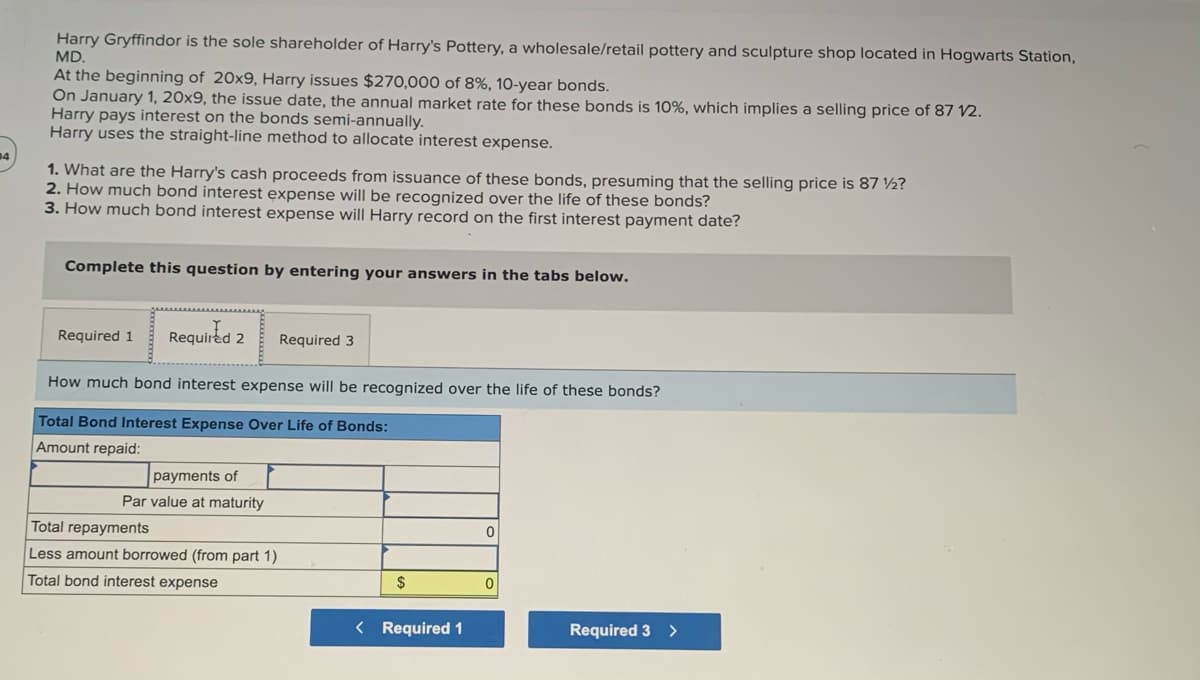

Transcribed Image Text:Harry Gryffindor is the sole shareholder of Harry's Pottery, a wholesale/retail pottery and sculpture shop located in Hogwarts Station,

MD.

At the beginning of 20x9, Harry issues $270,000 of 8%, 10-year bonds.

On January 1, 20x9, the issue date, the annual market rate for these bonds is 10%, which implies a selling price of 87 12.

Harry pays interest on the bonds semi-annually.

Harry uses the straight-line method to allocate interest expense.

1. What are the Harry's cash proceeds from issuance of these bonds, presuming that the selling price is 87 12?

2. How much bond interest expense will be recognized over the life of these bonds?

3. How much bond interest expense will Harry record on the first interest payment date?

Complete this question by entering your answers in the tabs below.

Required 2

How much bond interest expense will be recognized over the life of these bonds?

Total Bond Interest Expense Over Life of Bonds:

Amount repaid:

Required 1

payments of

Par value at maturity

Total repayments

Less amount borrowed (from part 1)

Total bond interest expense

Required 3

$

< Required 1

0

0

Required 3

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning