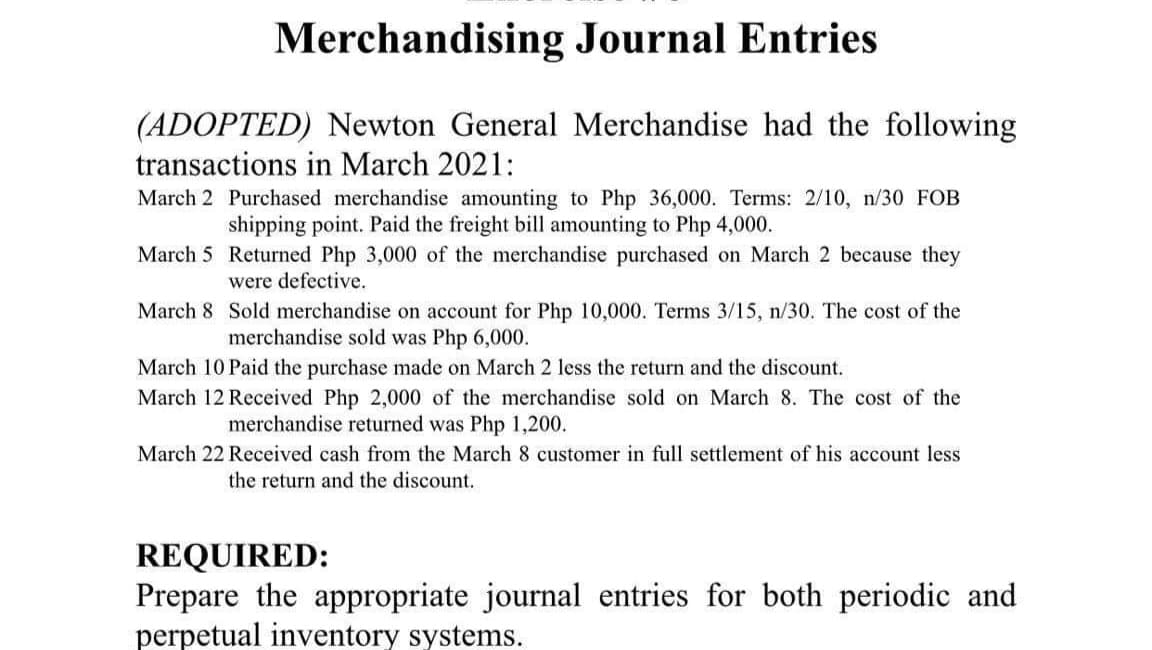

(ADOPTED) Newton General Merchandise had the following transactions in March 2021: March 2 Purchased merchandise amounting to Php 36,000. Terms: 2/10, n/30 FOB shipping point. Paid the freight bill amounting to Php 4,000. March 5 Returned Php 3,000 of the merchandise purchased on March 2 because they were defective. March 8 Sold merchandise on account for Php 10,000. Terms 3/15, n/30. The cost of the merchandise sold was Php 6,000. March 10 Paid the purchase made on March 2 less the return and the discount. March 12 Received Php 2,000 of the merchandise sold on March 8. The cost of the merchandise returned was Php 1,200. March 22 Received cash from the March 8 customer in full settlement of his account less the return and the discount. REQUIRED: Prepare the appropriate journal entries for both periodic and perpetual inventory systems.

(ADOPTED) Newton General Merchandise had the following transactions in March 2021: March 2 Purchased merchandise amounting to Php 36,000. Terms: 2/10, n/30 FOB shipping point. Paid the freight bill amounting to Php 4,000. March 5 Returned Php 3,000 of the merchandise purchased on March 2 because they were defective. March 8 Sold merchandise on account for Php 10,000. Terms 3/15, n/30. The cost of the merchandise sold was Php 6,000. March 10 Paid the purchase made on March 2 less the return and the discount. March 12 Received Php 2,000 of the merchandise sold on March 8. The cost of the merchandise returned was Php 1,200. March 22 Received cash from the March 8 customer in full settlement of his account less the return and the discount. REQUIRED: Prepare the appropriate journal entries for both periodic and perpetual inventory systems.

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 2PA: Record journal entries for the following transactions of Barrera Suppliers. A. May 12: Sold 32...

Related questions

Question

Transcribed Image Text:Merchandising Journal Entries

(ADOPTED) Newton General Merchandise had the following

transactions in March 2021:

March 2 Purchased merchandise amounting to Php 36,000. Terms: 2/10, n/30 FOB

shipping point. Paid the freight bill amounting to Php 4,000.

March 5 Returned Php 3,000 of the merchandise purchased on March 2 because they

were defective.

March 8 Sold merchandise on account for Php 10,000. Terms 3/15, n/30. The cost of the

merchandise sold was Php 6,000.

March 10 Paid the purchase made on March 2 less the return and the discount.

March 12 Received Php 2,000 of the merchandise sold on March 8. The cost of the

merchandise returned was Php 1,200.

March 22 Received cash from the March 8 customer in full settlement of his account less

the return and the discount.

REQUIRED:

Prepare the appropriate journal entries for both periodic and

perpetual inventory systems.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning