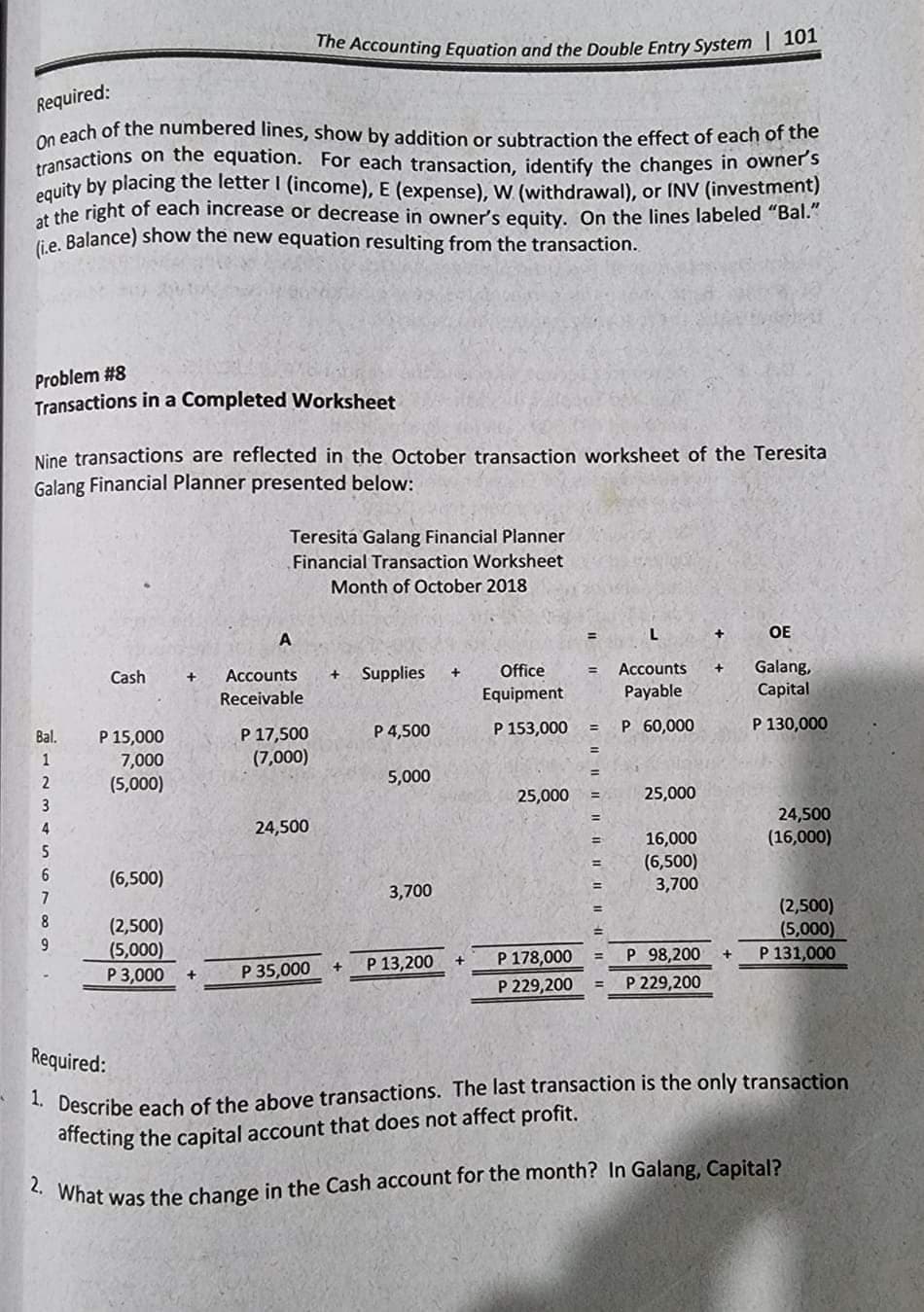

affecting the capital account that does not affect profit. 2. What was the change in the Cash account for the month? In Galang, Capital? Nine transactions are reflected in the October transaction worksheet of the Teresita Galang Financial Planner presented below: Teresita Galang Financial Planner Financial Transaction Worksheet Month of October 2018 OE %3D Galang, Capital + Supplies Office Accounts %3D Cash Accounts Receivable Equipment Payable P 4,500 P 153,000 P 60,000 P 130,000 P 17,500 (7,000) %3D P 15,000 7,000 (5,000) Bal. %3D %3D 2 5,000 25,000 25,000 %3D 3 24,500 %3D 4 24,500 (16,000) 16,000 (6,500) 3,700 5 (6,500) %3D 7 3,700 (2,500) (5,000) P 131,000 8 (2,500) (5,000) P 3,000 P 178,000 P 98,200 %3D P 35,000 P 13,200 P 229,200 P 229,200 %3D Required: 1. Describe each of the above transactions. The last transaction is the only transaction affecting the capital account that does not affect profit.

affecting the capital account that does not affect profit. 2. What was the change in the Cash account for the month? In Galang, Capital? Nine transactions are reflected in the October transaction worksheet of the Teresita Galang Financial Planner presented below: Teresita Galang Financial Planner Financial Transaction Worksheet Month of October 2018 OE %3D Galang, Capital + Supplies Office Accounts %3D Cash Accounts Receivable Equipment Payable P 4,500 P 153,000 P 60,000 P 130,000 P 17,500 (7,000) %3D P 15,000 7,000 (5,000) Bal. %3D %3D 2 5,000 25,000 25,000 %3D 3 24,500 %3D 4 24,500 (16,000) 16,000 (6,500) 3,700 5 (6,500) %3D 7 3,700 (2,500) (5,000) P 131,000 8 (2,500) (5,000) P 3,000 P 178,000 P 98,200 %3D P 35,000 P 13,200 P 229,200 P 229,200 %3D Required: 1. Describe each of the above transactions. The last transaction is the only transaction affecting the capital account that does not affect profit.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter2: Analyzing Transactions: The Accounting Equation

Section: Chapter Questions

Problem 4SEB: EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first...

Related questions

Question

Transcribed Image Text:2. What was the change in the Cash account for the month? In Galang, Capital?

equity by placing the letter I (income), E (expense), W (withdrawal), or INV (investment)

transactions on the equation. For each transaction, identify the changes in owner's

On each of the numbered lines, show by addition or subtraction the effect of each of the

me Accounting Equation and the Double Entry System | 101

Required:

at the right of each increase or decrease in owner's equity, On the lines labeled "Bal."

ie Balance) show the new equation resulting from the transaction.

Problem #8

Transactions in a Completed Worksheet

Nine transactions are reflected in the October transaction worksheet of the Teresita

Galang Financial Planner presented below:

Teresita Galang Financial Planner

Financial Transaction Worksheet

Month of October 2018

L

OE

Galang,

Capital

Supplies

Office

Accounts

%3D

Cash

+

Accounts

Receivable

Equipment

Payable

P 4,500

P 153,000

P 60,000

P 130,000

P 15,000

7,000

(5,000)

P 17,500

(7,000)

Bal.

1

2

5,000

25,000

25,000

3

24,500

4

24,500

(16,000)

16,000

(6,500)

3,700

(6,500)

7

3,700

(2,500)

(5,000)

P 131,000

8

(2,500)

(5,000)

P 3,000

P 13,200

P 178,000

P 98,200

+

P 35,000

P 229,200

P 229,200

Required:

1. Describe each of the above transactions. The last transaction is the only transaction

affecting the capital account that does not affect profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning