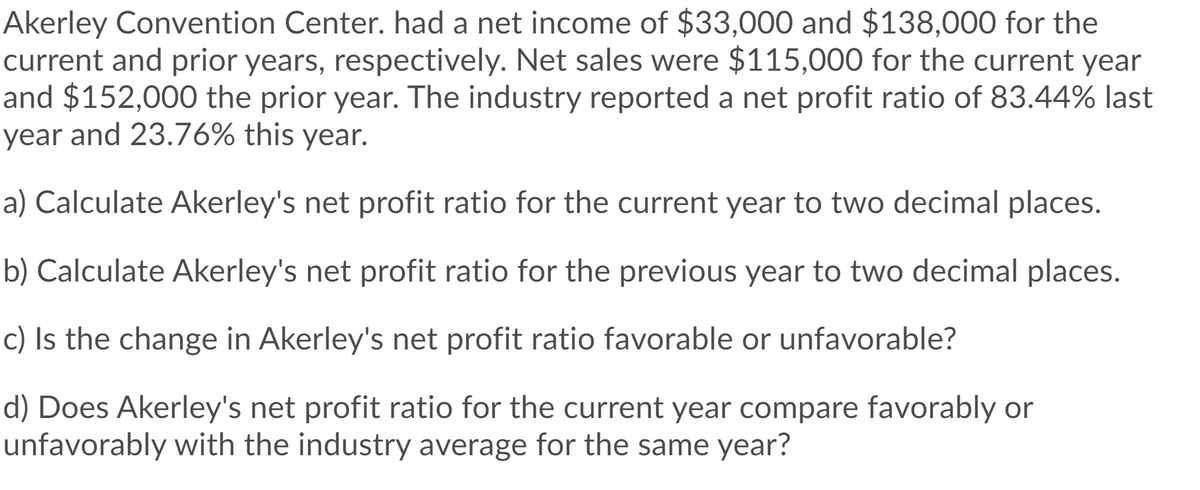

Akerley Convention Center. had a net income of $33,000 and $138,000 for the current and prior years, respectively. Net sales were $115,000 for the current year and $152,000 the prior year. The industry reported a net profit ratio of 83.44% last year and 23.76% this year. a) Calculate Akerley's net profit ratio for the current year to two decimal places. b) Calculate Akerley's net profit ratio for the previous year to two decimal places. c) Is the change in Akerley's net profit ratio favorable or unfavorable?

Akerley Convention Center. had a net income of $33,000 and $138,000 for the current and prior years, respectively. Net sales were $115,000 for the current year and $152,000 the prior year. The industry reported a net profit ratio of 83.44% last year and 23.76% this year. a) Calculate Akerley's net profit ratio for the current year to two decimal places. b) Calculate Akerley's net profit ratio for the previous year to two decimal places. c) Is the change in Akerley's net profit ratio favorable or unfavorable?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 51E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Transcribed Image Text:Akerley Convention Center. had a net income of $33,000 and $138,000 for the

current and prior years, respectively. Net sales were $115,000 for the current year

and $152,000 the prior year. The industry reported a net profit ratio of 83.44% last

year and 23.76% this year.

a) Calculate Akerley's net profit ratio for the current year to two decimal places.

b) Calculate Akerley's net profit ratio for the previous year to two decimal places.

c) Is the change in Akerley's net profit ratio favorable or unfavorable?

d) Does Akerley's net profit ratio for the current year compare favorably or

unfavorably with the industry average for the same year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning