AL the beginning of the current year, CFAS Company declared a 10% share dividend. The market price of the entity's 300.000 outstanding shares of PS0 par value was P111 per share on that date The share dividend was distributed on July 1 when the market price was P100 per share What amount should be credited to share premium for the share dividend?

AL the beginning of the current year, CFAS Company declared a 10% share dividend. The market price of the entity's 300.000 outstanding shares of PS0 par value was P111 per share on that date The share dividend was distributed on July 1 when the market price was P100 per share What amount should be credited to share premium for the share dividend?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 4SEA: STOCK DIVIDENDS Kaufman Company currently has 200,000 shares of 1 par common stock outstanding. On...

Related questions

Question

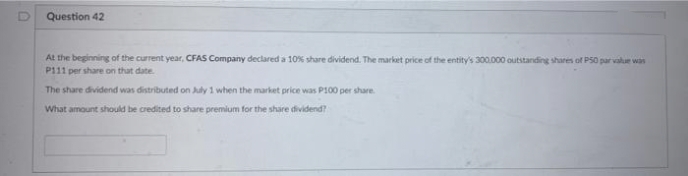

Transcribed Image Text:Question 42

At the beginning of the current year, CFAS Company declared a 10% share dividend. The market price of the entity's 300.000 outstanding shares of PS0 par value was

P111 per share on that date.

The share dividend was distributed on July 1 when the market price was P100 per share.

What amount should be credited to share premium for the share dividend?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning