deducting credit balances of custc , 500 verdraft of P22,650

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 5AP

Related questions

Question

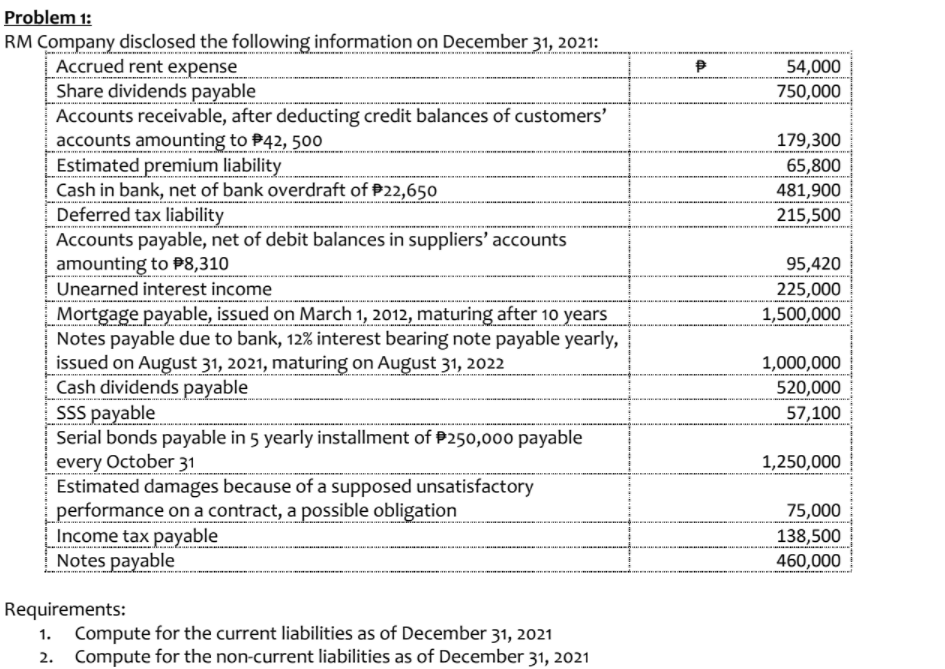

Transcribed Image Text:Problem 1:

RM Company disclosed the following information on December 31, 2021:

Accrued rent expense

Share dividends payable

Accounts receivable, after deducting credit balances of customers'

accounts amounting to P42, 500

Estimated premium liability

Cash in bank, net of bank overdraft of P22,650

Deferred tax liability

Accounts payable, net of debit balances in suppliers' accounts

amounting to P8,310

Unearned interest income

54,000

750,000

179,300

65,800

481,900

215,500

95,420

225,000

1,500,000

Mortgage payable, issued on March 1, 2012, maturing after 10 years

Notes payable due to bank, 12% interest bearing note payable yearly,

issued on August 31, 2021, maturing on August 31, 2022

Cash dividends payable

SSS payable

Serial bonds payable in 5 yearly installment of P250,000 payable

every October 31

Estimated damages because of a supposed unsatisfactory

„performance on a contract, a possible obligation

Income tax payable

Notes payable

1,000,000

520,000

57,100

1,250,000

75,000

138,500

460,000

Requirements:

1. Compute for the current liabilities as of December 31, 2021

2. Compute for the non-current liabilities as of December 31, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning