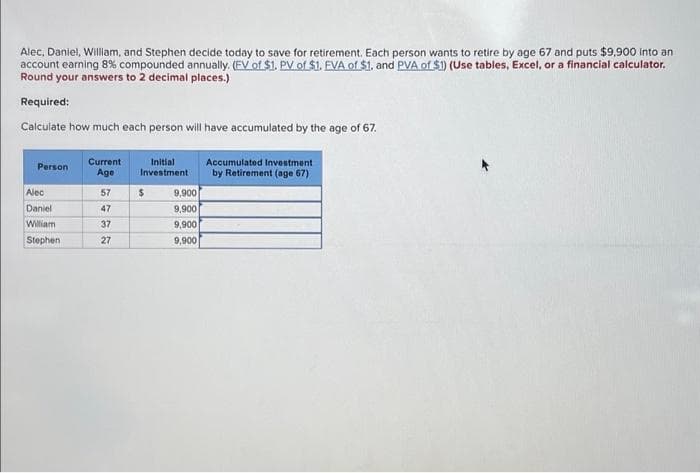

Alec, Daniel, William, and Stephen decide today to save for retirement. Each person wants to retire by age 67 and puts $9,900 into an account earning 8% compounded annually. (FV of $1. PV of $1. EVA of $1. and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) Required: Calculate how much each person will have accumulated by the age of 67. Person Alec Daniel William Stephen Current Age 57 47 37 27 Initial Investment $ 9,900 9,900 9,900 9,900 Accumulated Investment by Retirement (age 67)

Alec, Daniel, William, and Stephen decide today to save for retirement. Each person wants to retire by age 67 and puts $9,900 into an account earning 8% compounded annually. (FV of $1. PV of $1. EVA of $1. and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) Required: Calculate how much each person will have accumulated by the age of 67. Person Alec Daniel William Stephen Current Age 57 47 37 27 Initial Investment $ 9,900 9,900 9,900 9,900 Accumulated Investment by Retirement (age 67)

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

3

Transcribed Image Text:Alec, Daniel, William, and Stephen decide today to save for retirement. Each person wants to retire by age 67 and puts $9,900 into an

account earning 8% compounded annually. (FV of $1. PV of $1. EVA of $1. and PVA of $1) (Use tables, Excel, or a financial calculator.

Round your answers to 2 decimal places.)

Required:

Calculate how much each person will have accumulated by the age of 67.

Person

Alec

Daniel

William

Stephen

Current

Age

57

47

37

5

27

Initial

Investment

$

9,900

9,900

9,900

9,900

Accumulated Investment

by Retirement (age 67)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT