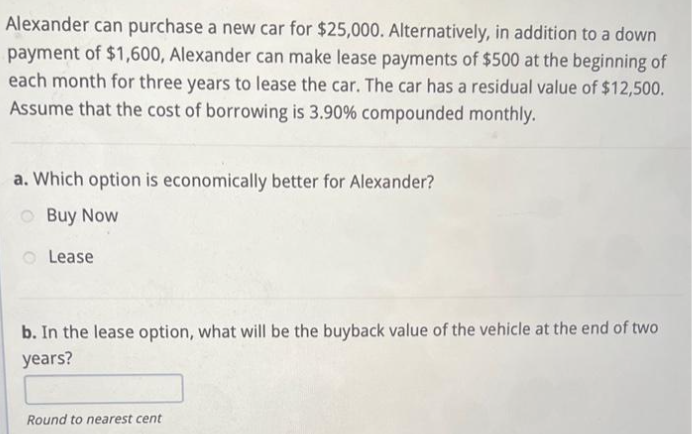

Alexander can purchase a new car for $25,000. Alternatively, in addition to a down payment of $1,600, Alexander can make lease payments of $500 at the beginning of each month for three years to lease the car. The car has a residual value of $12,500. Assume that the cost of borrowing is 3.90% compounded monthly. a. Which option is economically better for Alexander? Buy Now Lease b. In the lease option, what will be the buyback value of the vehicle at the end of two years? Round to nearest cent

Alexander can purchase a new car for $25,000. Alternatively, in addition to a down payment of $1,600, Alexander can make lease payments of $500 at the beginning of each month for three years to lease the car. The car has a residual value of $12,500. Assume that the cost of borrowing is 3.90% compounded monthly. a. Which option is economically better for Alexander? Buy Now Lease b. In the lease option, what will be the buyback value of the vehicle at the end of two years? Round to nearest cent

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 3P

Related questions

Question

Ef 351.

Transcribed Image Text:Alexander can purchase a new car for $25,000. Alternatively, in addition to a down

payment of $1,600, Alexander can make lease payments of $500 at the beginning of

each month for three years to lease the car. The car has a residual value of $12,500.

Assume that the cost of borrowing is 3.90% compounded monthly.

a. Which option is economically better for Alexander?

Buy Now

Lease

b. In the lease option, what will be the buyback value of the vehicle at the end of two

years?

Round to nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub