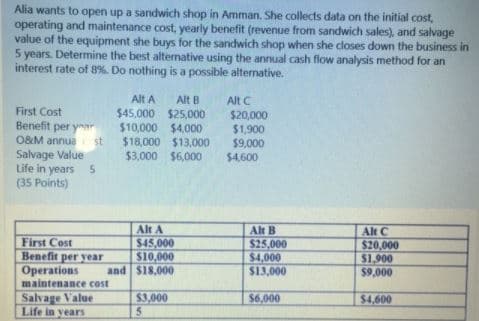

Alia wants to open up a sandwich shop in Amman. She collects data on the initial cost, operating and maintenance cost, yearly benefit (revenue from sandwich sales), and salvage value of the equipment she buys for the sandwich shop when she closes down the business in 5 years. Determine the best alternative using the annual cash flow analysis method for an interest rate of 8%. Do nothing is a possible alternative. Alt B $45,000 $25,000 $10,000 $4,000 $18,000 $13,000 $3,000 $6,000 Alt A First Cost Benefit per yr O&M annua st Salvage Value Life in years 5 (35 Points) Alt C $20,000 $1,900 $9,000 $4,600 Alt A $45,000 $10,000 and $18,000 Alt B $25,000 $4,000 $13,000 Alt C $20,000 $1.900 $9,000 First Cost Benefit per year Operations maintenance cost Salvage Value Life in years $3,000 $6.000 $4,600

Alia wants to open up a sandwich shop in Amman. She collects data on the initial cost, operating and maintenance cost, yearly benefit (revenue from sandwich sales), and salvage value of the equipment she buys for the sandwich shop when she closes down the business in 5 years. Determine the best alternative using the annual cash flow analysis method for an interest rate of 8%. Do nothing is a possible alternative. Alt B $45,000 $25,000 $10,000 $4,000 $18,000 $13,000 $3,000 $6,000 Alt A First Cost Benefit per yr O&M annua st Salvage Value Life in years 5 (35 Points) Alt C $20,000 $1,900 $9,000 $4,600 Alt A $45,000 $10,000 and $18,000 Alt B $25,000 $4,000 $13,000 Alt C $20,000 $1.900 $9,000 First Cost Benefit per year Operations maintenance cost Salvage Value Life in years $3,000 $6.000 $4,600

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Alia wants to open up a sandwich shop in Amman. She collects data on the initial cost,

operating and maintenance cost, yearly benefit (revenue from sandwich sales), and salvage

value of the equipment she buys for the sandwich shop when she closes down the business in

5 years. Determine the best alternative using the annual cash flow analysis method for an

interest rate of 8%. Do nothing is a possible alternative.

Alt B

$45,000 $25,000

$10,000 $4,000

$18,000 $13,000

$3,000 $6,000

Alt A

First Cost

Benefit per yr

O&M annua st

Salvage Value

Life in years 5

(35 Points)

Alt C

$20,000

$1,900

$9,000

$4,600

Alt A

$45,000

$10,000

and $18,000

Alt B

$25,000

$4,000

$13,000

Alt C

$20,000

$1.900

$9,000

First Cost

Benefit per year

Operations

maintenance cost

Salvage Value

Life in years

$3,000

$6.000

$4,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College