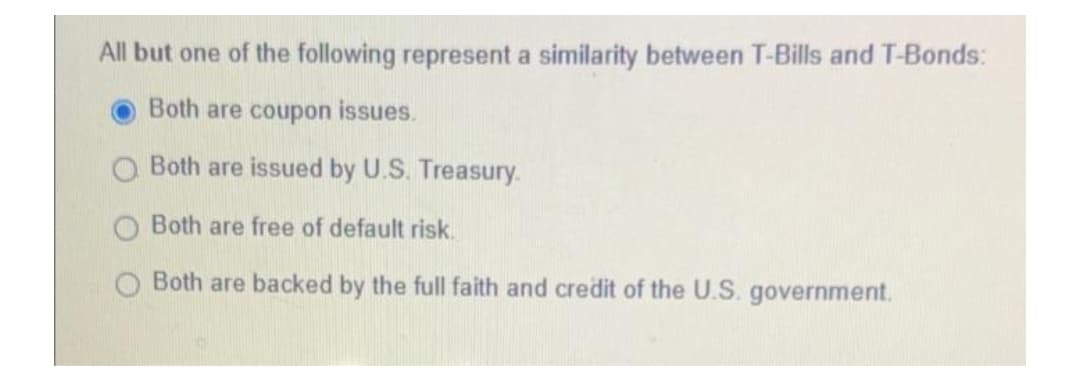

All but one of the following represent a similarity between T-Bills and T-Bonds: Both are coupon issues. O Both are issued by U.S. Treasury. Both are free of default risk. Both are backed by the full faith and credit of the U.S. government.

Q: Consider Bond CCC Ce Corny Coupon Fete: 10,5% per yea Vield to maturity: 7,955% per year Settlement…

A: Accrued interest is the interest that is calculated from the date of the bond to the settlement…

Q: The Building and Personal Property Coverage Form cover all of the following EXCEPT: a. Building…

A: Fixed assets or non-current assets are those assets that help long-term benefits to the company.…

Q: To pay its supplier, Tokyo Corporation requires P300,000. The bank of Tokyo Corporation offers a…

A: Compensating balance Sometimes it is required at bank to keep a deposit of funds to qualify for the…

Q: Stock A has expected return of 15% and standard deviation (s.d.) 20%. Stock B has expected return…

A: Expected Return : expected return of an investor is the total amount of money they expect to gain or…

Q: You are deciding between two mutually exclusive investment opportunities. Both require the same…

A: Given: Cost of capital 6.60% Growth rate 2.30% Year Particulars Investment A…

Q: Question 2 The owner of an apartment building can rent all 60 suites (is) if $120 per month is…

A: At present 60 suites can be given for rent for $120 per month for each suite. And that will be…

Q: a year. John's Workshop electric bills are Ș He wants to reduce them by using solar electricity, so…

A: The present worth method is a capital budgeting technique used to evaluate the best project or…

Q: educe its salary cash expense by $2,000,000 per year. The system has a five-year life, it will be…

A: When compared to other investment evaluation methods such as payback period, rate of return, and…

Q: (Related to Checkpoint 6.5) (Present value of a growing perpetuity) What is the present value…

A: Year one cash flow = $2500 Growth rate = 0.02 Discount rate = 0.13 Discount rate = 0.11 Present…

Q: PT XYZ is a garment company that produces batik and other traditional clothing. The company's…

A: Weighted average cost of capital shows a company average cost of capital from all the sources that…

Q: A washer- dryer combination listed at $ 1136 has a net price of $ 760. What is the rate of discount?

A: Listed price can be defined as the price at which an item is listed to be sold. It is the price…

Q: Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a…

A: Buy back price = $10,000,090 Purchase price = $9,999,827 Day to maturity = 5

Q: Consider the following data for three divisions of a company, X, Y, and Z: Divisional: X Y Z…

A: The question is related to Profitability Ratio based on sales. The return on Sales is calculated…

Q: (Related to Checkpoint 6.4) (Present value of a perpetuity) What is the present value of a…

A: The present value of a perpetuity is determined by dividing cash flows by the discount rate.

Q: Payback period and discounted payback period (using 5% rate of return) Initial Investment is…

A: Payback period is one of the methods of capital budgeting to evaluate the project. This shows a time…

Q: Q2- Calculate the future worth and draw cash flow diagram as shown - P=3232 - F=? - 1=8% - Y=3

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: allable bonds provide benefit to the______ and hence offer_______rate of return than non-callable…

A: Callable bonds are bonds which have options to be called before maturity at any time as per issuer…

Q: The CC value is determined to be $

A: CC Value: It represents the current value of the account at a future date.

Q: What is CAPM and how it used in portfolio management?

A: Risk and return are the two main parts of any investment and before investing in any security or…

Q: An effective method to recover water used for regeneration of ion exchange resins is to use a…

A: Answer - Putting in Equation, −(920+360)(A/P,10%,5) – 1.28x,3 )– 3.10x = −3850(A/P,10%,5) –…

Q: Brendon Walsh wants to borrow $40,000 from the bank. The interest rate is 6% and the term is for 5…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: A $42,000 loan is repaid with semiannual payments of $5,000. What is the $4,125.09 $4.227.79…

A: Here, To Find: Size of the last payment =?

Q: Your factory has been offered a contract to produce a part for a new printer. The contract would…

A: Initial cash flow = - $8.07 million Annual Cash flow = $5.21 million discount rate = 0.076 (i.e.…

Q: How would you set up the function in Excel to get the IRR of an investment of $22,500 over 6 years,…

A: Internal Rate of Return: Internal Rate of Return (IRR) is the required rate of return at which the…

Q: Number of years to provide a given return In the information given in following case, determine the…

A: Solution:- When an equal amount is invested each period at end of period, it is called ordinary…

Q: A sales man is giving the following conditions: Problem: Example: Total cost bought = 1. A discount…

A: Discount of 10% if Total cost bought is equal to or greater than 1000 but not greater than 15000 A…

Q: What is the size of the final payment of money is borrowed at 6% Compounded semi annually?

A: Loan payment: These are periodic payments made by the borrower to the lender for the amount of…

Q: Figure 2 shows the payments and revenues of a small project. If M.R.R.R= %15, Evaluate the project…

A: Explanation : NPV is Capital budgeting technique which help for decision making the project…

Q: How can you use net present value in a startup

A: A startup is an entrepreneurial venture which is in the first stage of its operations. A startup…

Q: Consider a bond with a 4% annual coupon and a face value of $1000. Complete the following table.…

A: Bonds are issued by the company to raise long-term debt. It is a part of external financing.…

Q: What is the present value of a perpetual stream of cash flows that pays $70,000 at the end of…

A: Year one cash flow = $70,000 Discount rate = 0.11 Growth rate = 0.05 Present value is the current…

Q: 1. Meagan invested $1,200 each year in an IRA for 12 years in an account that earned 5% compounded…

A: IRA means individual retirement account. This problem can be solved in light of future value of…

Q: Suppose that you are in the fall of your senior year and are faced with the choice of either getting…

A: Given, Salary that can be earned is $35,000 Growth in salary is 4%

Q: Calvin Johnson has a $ 5,000 debt balance on his Visa card that charges 15.7 percent APR…

A: Here,

Q: What is the relationship between principle-agency theory, separation of ownership, and controversy?

A: Corporation there are shareholders who are the owners of the company but they do not run the company…

Q: Randy’s, a family-owned restaurant chain operating in Alabama, has grown to the point that expansion…

A: Going public: A well established (private) company which has bright growth prospects can go public…

Q: You have just paid $1,135.90 for a bond, which has 10 years before it, matures. It pays interest…

A: Bond Price = $1,135.90 Par value = $1,000 Yield = 8% Time Period = 10 Years

Q: Finance Explain why cross-border tax-related disputes can arise in different ways?

A: Taxes is referred as the mandatory contributions, which used to levy on the companies or individuals…

Q: to

A: COVID 19 CRISIS - Most people infected with the virus will experience mild to moderate illness and…

Q: A machine can be purchased at t=0 for $20,000. The estimated life is 15 years, with an estimated…

A: While evaluating the project, cash inflow should be higher than cash outflow in present value terms.…

Q: A firm reported the following income statement (all figures are in thousands of dollars): Net…

A: Tax is charged on the net earnings after deduction of all operating and finance costs. EBT or…

Q: The following is an extraction from an amortisation schedule for a filling station. The loan will be…

A: A loan amortization schedule is used to show the components of each payment and how much of the…

Q: The basic principle of valuation states that the value of any asset is: O The sum of the present…

A: The present value of an asset is the sum of all future cash flows discounted at the discount rate.

Q: What is the future value of $3,078 invested for 8 years at 6 percent compounded annually? Multiple…

A: Time value of money (TVM) concept refers to the method used to measure the value of money at…

Q: How much should you deposit at the end of each quarter into an account that pays 4.4% annual…

A: The principle refers to the amount you committed to repay at the outset. The expense of borrowing…

Q: a. How much money will be saved? b. How much will be owed after 2 years?

A: Time value of money (TVM) refers to the method used to measure the amount of money at different…

Q: Bond price is: O Inversely related to cOupon rate and positively related to interest rate. O…

A: Bond are fixed interest bearing instrument that is issued to raise funds and has a fixed matuity…

Q: Panda Toys Inc. plans to sell one line of its panda toys for $ 20. The material cost per unit is $4…

A: Here, Selling price per unit = $20 Material Cost per unit = $4 Unit Labor cost = $6 Annual overhead…

Q: Match the following ✓ A premium over and above the risk-free rate. A. Financial Leverage ✓ The…

A: Answer - Match the Following : Particulars A premium over and above the risk free rate C.…

Q: Are the following statements true or false? Justify your answer. Mergers inspired by vertical…

A: Merger is referred as an agreement, which used to unite for two existing corporations into new…

Step by step

Solved in 2 steps

- National governments issue debt securities known as sovereign bonds, which can be denominated in either local currency or global reserve currencies, like the U.S. dollar or euro. For this discussion question, first define what these bonds are. Why are these issued? Then discuss the issues that can arise when investors invest in these types of bonds. What are the advantages and disadvantages of these bonds? Are there unique issues that can arise only with this type of bond? Would you invest in sovereign bonds?Which of the statement is incorrect? i) Eurobond is a bond issued by an international investor and sold to borrowers in countries with currencies other than the currency in which the bond is denominated. ii) Foreign bond is a bond issued in a host country’s financial market, in the host country’s currency, by a foreign borrower. iii) Eurobond is a bond issued by an international borrower and sold to investors in countries with currencies other than the currency in which the bond is denominated. iv) In contrast, a foreign bond is a bond issued in a host country’s financial market, in the foreign currency, by a foreign borrower.To strengthen the dollar using sterilized intervention, the Fed would simultaneously Treasury securities. O buy, buy O buy; sell O sell; sell O sell; buy dollars and

- National governments issue debt securities known as sovereign bonds, which can be denominated in either local currency or global reserve currencies, like the U.S. dollar or euro. (source (Links to an external site.)Links to an external site.). For this discussion question, first define what these bonds are. Why are these issued? Then discuss the issues that can arise when investors invest in these types of bonds. What are the advantages and disadvantages of these bonds? Are there unique issues that can arise only with this type of bond? Would you invest in sovereign bonds?Sovereign debt (issued bonds) are typically considered as proxies for risk free. 1. Discuss the reasons why sovereign debt may not be risk free. 2. Why might credit ratings agencies give different credit ratings to sovereign debt issued by the same country, depending on coupons denominated in domestic or foreign currency.Do you agree or disagree with the statement? Explain your answer. When the Treasury of the United States issues bonds and sells them to the public to finance the deficit, the money supply remains unchanged because every dollar of money taken in by the Treasury goes right back into circulation through government spending. This is not true when the Fed sells bonds to the public.

- Compare the risk of buying a U.S. government bond to that of buying acorporate bond.a) What is the difference between a Foreign Bond and a Eurobond? Explain you answer with examples. b) Define Equity, Debt and Derivative. c) Describe the main types of non-bank Financial Institutions (FI). Give two examples of non-bank FI’s that are allowed to accept deposits.For each of the following monetary policy tools:A. The BSP buys securities in the open market.B. The BSP sells foreign exchange currentC. The BSP increases the reserve requirement ratio.D. The BSP applies its moral suasion ability requesting commercial banks to lowerdown interest rates.E. The government decided to deposit funds at the BSP.1. Determine whether the monetary tool imposed by the BSP is an expansionary or acontractionary policy.

- Critique the distinctions between foreign bonds and Eurobonds, and explain why the Eurobonds have become the most popular form of international bond financing.Select all of the following correct statements regarding Eurobonds and Foreign Bonds: Group of answer choices An example of a Eurobond would be if Bayer AG, a German corporation, issues EUR-denominated debt in Germany. An example of a foreign bond would be if Bayer AG, a German corporation, issues USD-denominated debt in Germany. An example of a foreign bond would be if Bayer AG, a German corporation, issues USD-denominated debt in the United States. An example of a Eurobond would be if Bayer AG, a German corporation, issues USD-denominated debt in Germany.Let's say that the data shows how the spread between the interest rates on corporate bonds and U.S. treasury bonds has been very large during the Covid - 19 pandemic . What would explain this difference ? Use the bond supply and demand analysis to answer this question . Be as specific as you can be and make sure you explain the channels clearly?