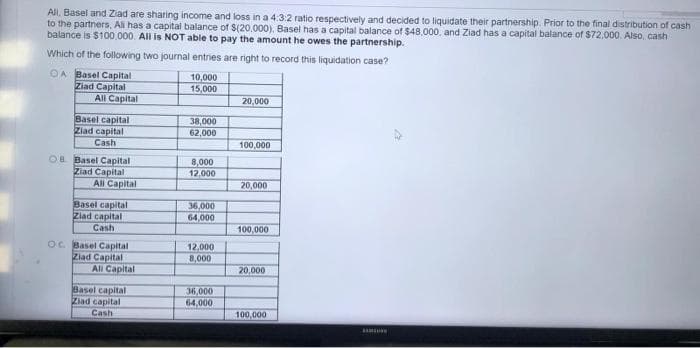

All. Basel and Ziad are sharing income and loss in a 4:3:2 ratio respectively and decided to liquidate their partnership. Prior to the final distribution of cash to the partners. All has a capital balance of $(20,000). Basel has a capital balance of $48,000, and Ziad has a capital balance of $72,000. Also, cash balance is $100,000. All is NOT able to pay the amount he owes the partnership. Which of the following two journal entries are right to record this liquidation case? OA Basel Capital 10,000 Ziad Capital 15,000 20,000 38,000 Basel capital Ziad capital Cash 62,000 100,000 OB Basel Capital 8,000 Ziad Capital 12,000 All Capital 20,000 Basel capital 36,000 64,000 Ziad capital Cash 100,000 OC Basel Capital 12,000 Ziad Capital 8,000 20,000 Basel capital 36,000 Ziad capital Cash 64,000 100,000 All Capital All Capital

All. Basel and Ziad are sharing income and loss in a 4:3:2 ratio respectively and decided to liquidate their partnership. Prior to the final distribution of cash to the partners. All has a capital balance of $(20,000). Basel has a capital balance of $48,000, and Ziad has a capital balance of $72,000. Also, cash balance is $100,000. All is NOT able to pay the amount he owes the partnership. Which of the following two journal entries are right to record this liquidation case? OA Basel Capital 10,000 Ziad Capital 15,000 20,000 38,000 Basel capital Ziad capital Cash 62,000 100,000 OB Basel Capital 8,000 Ziad Capital 12,000 All Capital 20,000 Basel capital 36,000 64,000 Ziad capital Cash 100,000 OC Basel Capital 12,000 Ziad Capital 8,000 20,000 Basel capital 36,000 Ziad capital Cash 64,000 100,000 All Capital All Capital

Chapter21: Partnerships

Section: Chapter Questions

Problem 57P

Related questions

Question

Transcribed Image Text:All, Basel and Ziad are sharing income and loss in a 4:3:2 ratio respectively and decided to liquidate their partnership. Prior to the final distribution of cash

to the partners, All has a capital balance of $(20,000), Basel has a capital balance of $48.000, and Ziad has a capital balance of $72,000. Also, cash

balance is $100,000. All is NOT able to pay the amount he owes the partnership.

Which of the following two journal entries are right to record this liquidation case?

OA Basel Capital

Ziad Capital

10,000

15,000

All Capital

20,000

Basel capital

38,000

62,000

Ziad capital

Cash

100,000

OB Basel Capital

8,000

Ziad Capital

12,000

20,000

36,000

Basel capital

Ziad capital

Cash

64,000

100,000

OC. Basel Capital

12,000

Ziad Capital

8,000

20,000

36,000

Basel capital

Ziad capital

64,000

Cash

100,000

All Capital

All Capital

SAMU

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT