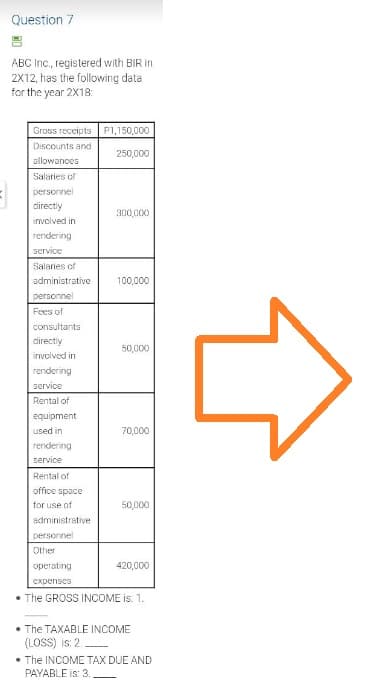

BC Inc., registered with BIR in 2X12, has the following data or the year 2018 Gross receipts P1,150,000 Discounts and 250,000 allowances Salaries of personnel directly 300,000 involved in rendering service Salaries of administrative 100,000 personnel Fees of consultants directly 50,000 involved in rendering service Rental of equipment used in 70,000 rendering service Rental of office space 50,000 for use of administrative personnel Other operating 420,000 expenses • The GROSS INCOME is: 1. The TAXABLE INCOME (LOSS) is: 2 The INCOME TAX DUE AND PAYABLE is: 3.

BC Inc., registered with BIR in 2X12, has the following data or the year 2018 Gross receipts P1,150,000 Discounts and 250,000 allowances Salaries of personnel directly 300,000 involved in rendering service Salaries of administrative 100,000 personnel Fees of consultants directly 50,000 involved in rendering service Rental of equipment used in 70,000 rendering service Rental of office space 50,000 for use of administrative personnel Other operating 420,000 expenses • The GROSS INCOME is: 1. The TAXABLE INCOME (LOSS) is: 2 The INCOME TAX DUE AND PAYABLE is: 3.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2RE: Refer to RE5-1. Prepare a single-step income statement for Brandt Corporation for the current year.

Related questions

Question

Transcribed Image Text:Question 7

ABC Inc., registered with BIR in

2X12, has the following data

for the year 2X18:

Gross receipts

P1,150,000

Discounts and

250,000

allowances

Salaries of

personnel

directly

300,000

involved in

rendering

service

Salaries of

administrative

100,000

personnel

Fees of

consultants

directly

50,000

involved in

rendering

service

Rental of

equipment

used in

70,000

rendering

service

Rental of

office space

for use of

50,000

administrative

personnel

Other

operating

420,000

expenses

• The GROSS INCOME is: 1.

• The TAXABLE INCOME

(LOSS) is: 2.

• The INCOME TAX DUE AND

PAYABLE is: 3.

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning