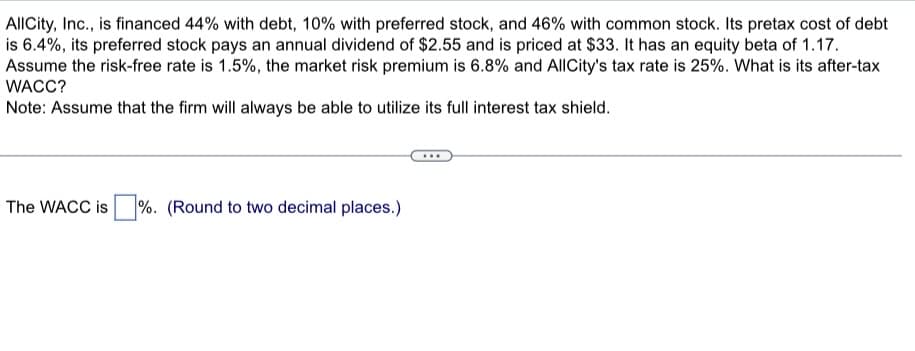

AllCity, Inc., is financed 44% with debt, 10% with preferred stock, and 46% with common stock. Its pretax cost of debt is 6.4%, its preferred stock pays an annual dividend of $2.55 and is priced at $33. It has an equity beta of 1.17. Assume the risk-free rate is 1.5%, the market risk premium is 6.8% and AllCity's tax rate is 25%. What is its after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield. The WACC is %. (Round to two decimal places.)

AllCity, Inc., is financed 44% with debt, 10% with preferred stock, and 46% with common stock. Its pretax cost of debt is 6.4%, its preferred stock pays an annual dividend of $2.55 and is priced at $33. It has an equity beta of 1.17. Assume the risk-free rate is 1.5%, the market risk premium is 6.8% and AllCity's tax rate is 25%. What is its after-tax WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield. The WACC is %. (Round to two decimal places.)

Chapter9: The Cost Of Capital

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:AllCity, Inc., is financed 44% with debt, 10% with preferred stock, and 46% with common stock. Its pretax cost of debt

is 6.4%, its preferred stock pays an annual dividend of $2.55 and is priced at $33. It has an equity beta of 1.17.

Assume the risk-free rate is 1.5%, the market risk premium is 6.8% and AllCity's tax rate is 25%. What is its after-tax

WACC?

Note: Assume that the firm will always be able to utilize its full interest tax shield.

The WACC is

%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT