Alpha and Beta are partners who share income in the ratio of 12 and have capital balances of $40,000 and $70,000, respectively, at the time they decide to terminate the partnership. Noncash assets with a book value of $110,000 are sold for $50,000. What amount of loss on realization should be allorated to dInh?

Alpha and Beta are partners who share income in the ratio of 12 and have capital balances of $40,000 and $70,000, respectively, at the time they decide to terminate the partnership. Noncash assets with a book value of $110,000 are sold for $50,000. What amount of loss on realization should be allorated to dInh?

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1EB: The partnership of Michelle, Amal, and Maureen has done well. The three partners have shared profits...

Related questions

Question

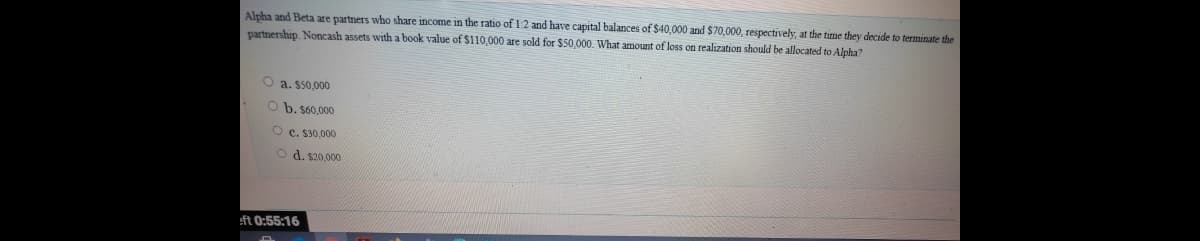

Transcribed Image Text:Alpha and Beta are partners who share income in the ratio of 12 and have capital balances of $40,000 and $70,000, respectively, at the time they decide to terminate the

partnership. Noncash assets with a book value of $110,000 are sold for $50.000. What amount of loss on realization should be allocated to Alpha?

O a. $50,000

O b. $60,000

O c. $30,000

O d. s20,000

eft 0:55:16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT