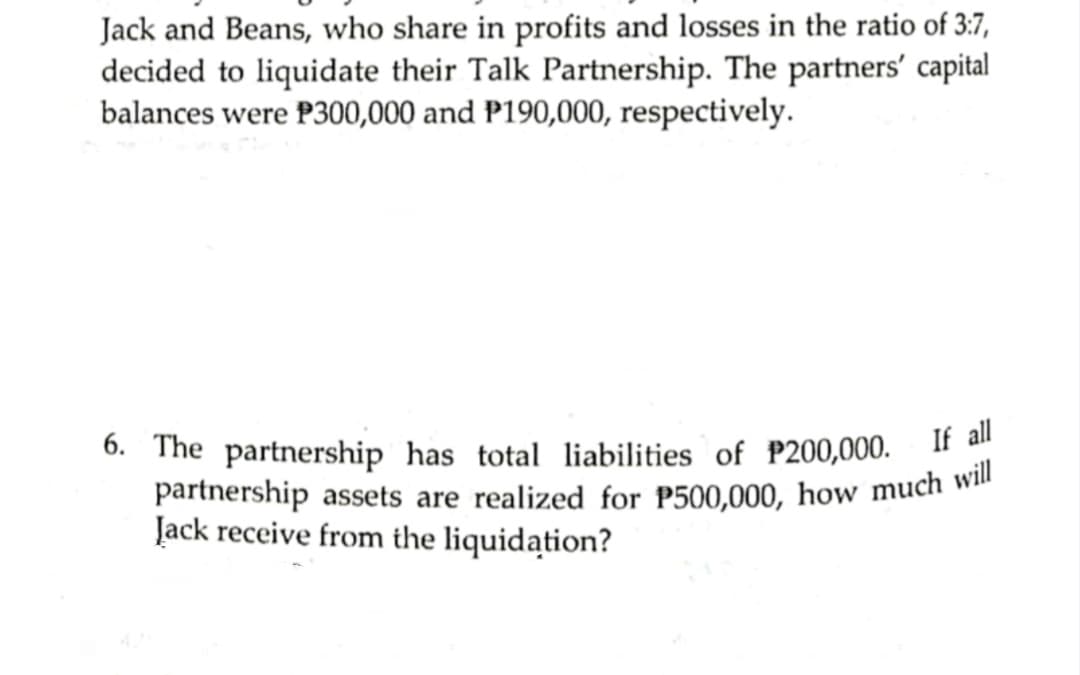

Jack and Beans, who share in profits and losses in the ratio of 3:7, decided to liquidate their Talk Partnership. The partners' capital balances were P300,000 and P190,000, respectively. 6. The partnership has total liabilities of P200,000. If partnership assets are realized for P500,000, how much wil Jack receive from the liquidation?

Jack and Beans, who share in profits and losses in the ratio of 3:7, decided to liquidate their Talk Partnership. The partners' capital balances were P300,000 and P190,000, respectively. 6. The partnership has total liabilities of P200,000. If partnership assets are realized for P500,000, how much wil Jack receive from the liquidation?

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

I got 191,000 as my answer but it is not included in the choices. The choices are 133,000 243,000 300,000 and 57,000. This is under liquidation partnership. Pls help in order for me to review also the answer and understand it. Thank you

Transcribed Image Text:partnership assets are realized for P500,000, how much will

Jack and Beans, who share in profits and losses in the ratio of 3:7,

decided to liquidate their Talk Partnership. The partners' capital

balances were P300,000 and P190,000, respectively.

6. The partnership has total liabilities of P200,000.

If all

Jack receive from the liquidation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT