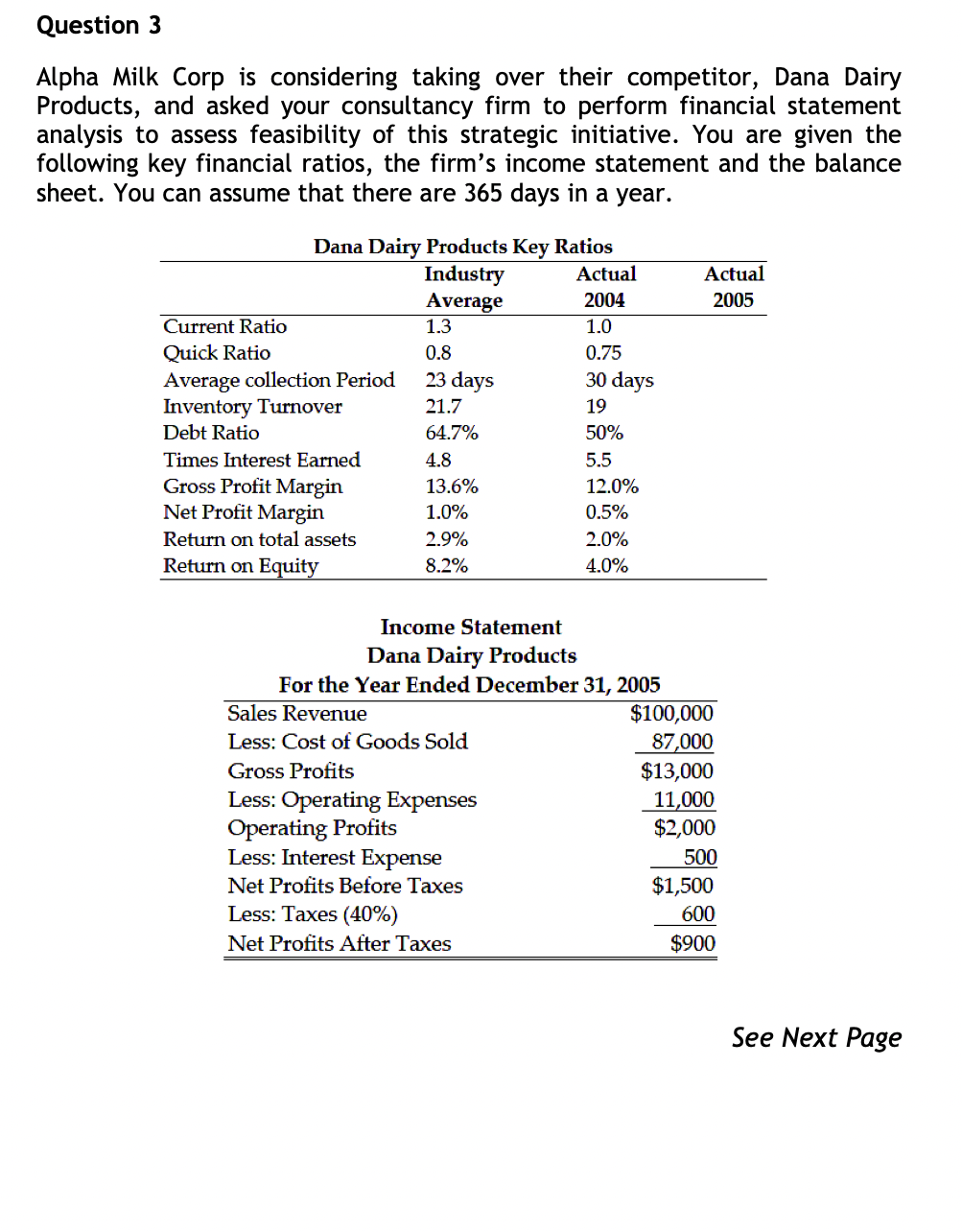

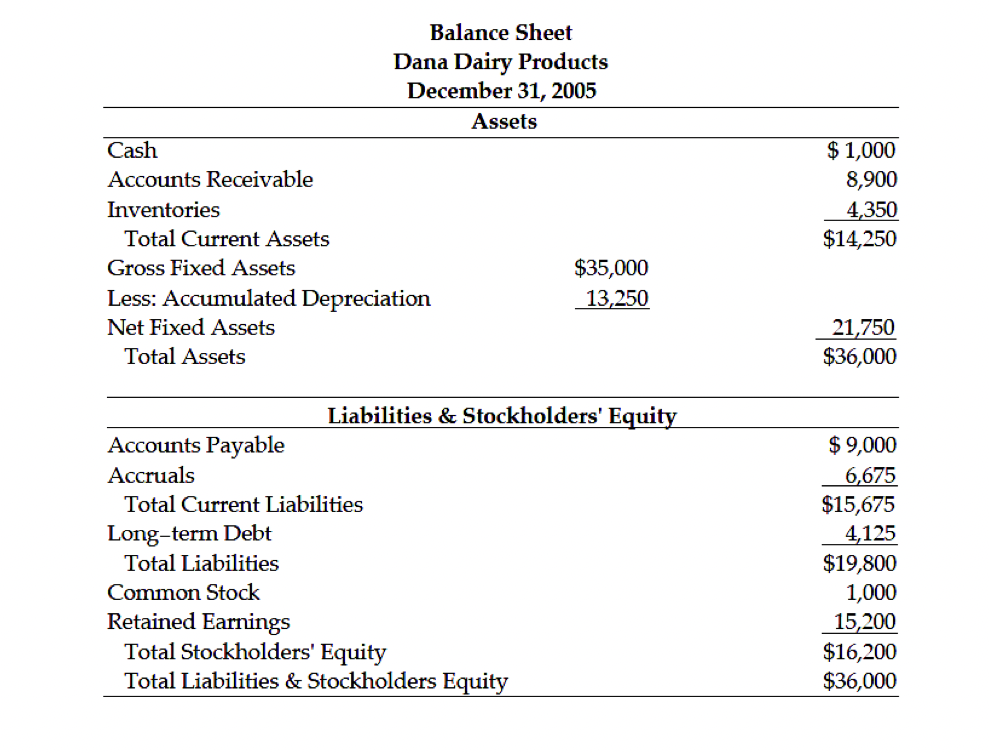

Alpha Milk Corp is considering taking over their competitor, Dana Dairy Products, and asked your consultancy firm to perform financial statement analysis to assess feasibility of this strategic initiative. You are given the following key financial ratios, the firm’s income statement and the balance sheet. You can assume that there are 365 days in a year. a) Using the information provided for 31 Dec 2005, calculate the following: net working capital, current ratio, quick ratio

Alpha Milk Corp is considering taking over their competitor, Dana Dairy Products, and asked your consultancy firm to perform financial statement analysis to assess feasibility of this strategic initiative. You are given the following key financial ratios, the firm’s income statement and the balance sheet. You can assume that there are 365 days in a year.

a) Using the information provided for 31 Dec 2005, calculate the following: net working capital, current ratio, quick ratio, inventory turnover, average collection period, total debt ratio, gross profit margin, net profit margin,

b) Evaluate the company’s performance against industry average ratios and compare with last year’s results.

To answer, please refer to pictures attached

Step by step

Solved in 2 steps