Calculate the net present value of a project which requires an initial investment of ₱1,000,000 with a 5% discount rate. Net cash flows for six years of the investment are ₱250,000 with each cash flow occurring at the end of the year. questions: What is the IRR of the project? Using the IRR as your basis, should the project be accepted? What is the profitability index of the project?

Calculate the net present value of a project which requires an initial investment of ₱1,000,000 with a 5% discount rate. Net cash flows for six years of the investment are ₱250,000 with each cash flow occurring at the end of the year. questions: What is the IRR of the project? Using the IRR as your basis, should the project be accepted? What is the profitability index of the project?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Calculate the

questions:

What is the IRR of the project?

Using the IRR as your basis, should the project be accepted?

What is the profitability index of the project?

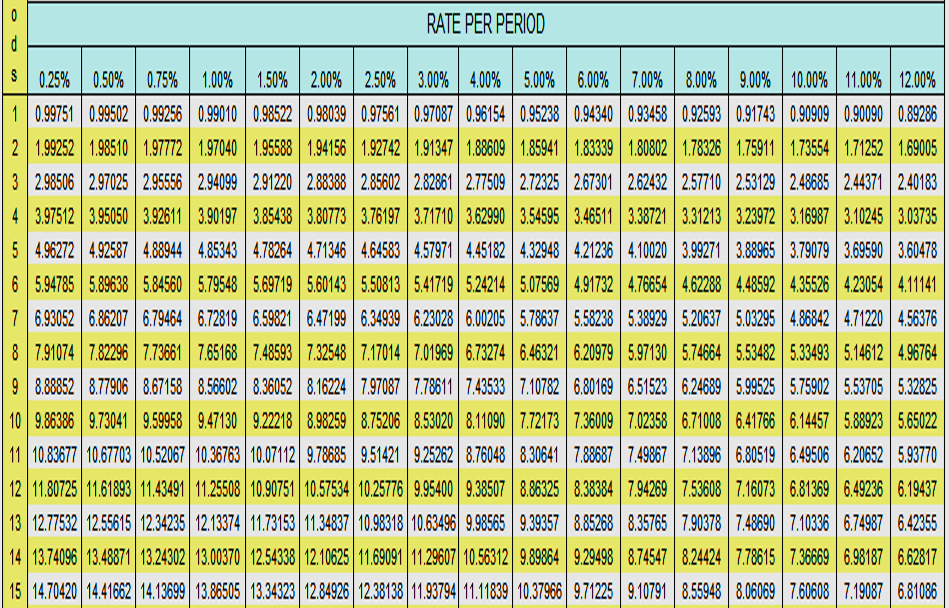

Transcribed Image Text:RATE PER PERIOD

d

S 0.25% 0.50% 0.75% 1.00% 1.50% 2.00% 2.50% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00%

1 0.99751 0.99502 0.99256 0.99010 0.98522 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286

2 1.99252 1.98510 1.97772 1.97040 1.95588 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005

3 2.98506 2.97025 2.95556 2.94099 2.91220 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.53129 2.48685 2.44371 2.40183

4 3.97512 3.95050 3.92611 3.90197 3.85438 3.80773 3.76197 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16987 3.10245 3.03735

5 4.96272 4.92587 4.88944 4.85343 4.78264 4.71346 4.64583 4.57971 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478

6 5.94785 5.89638 5.84560 5.79548 5.69719 5.60143 5.50813 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141

7 6.93052 6.86207 6.79464 6.72819 6.59821 6.47199 6.34939 6.23028 6.0205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376

8 7.91074 7.82296 7.73661 7.65168 7.48593 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764

9 8.88852 8.77906 8.67158 8.56602 8.36052 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825

10 9.86386 9.73041 9.59958 9.47130 9.22218 8.98259 8.75206 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022

11 10.83677 10.67703 10.52067 10.36763 10.07112 9.78685 9.51421 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770

12 11.80725 11.61893 11.43491 11.25508 10.90751 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437

13 12.77532 12.55615 12.34235 12.13374 11.73153 11.34837 10.98318 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355

14 13.74096 13.48871 13.24302 13.00370 12.54338 12.10625 11.69091 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817

15 14.70420 14.41662 14.13699 13.86505 13.34323 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education