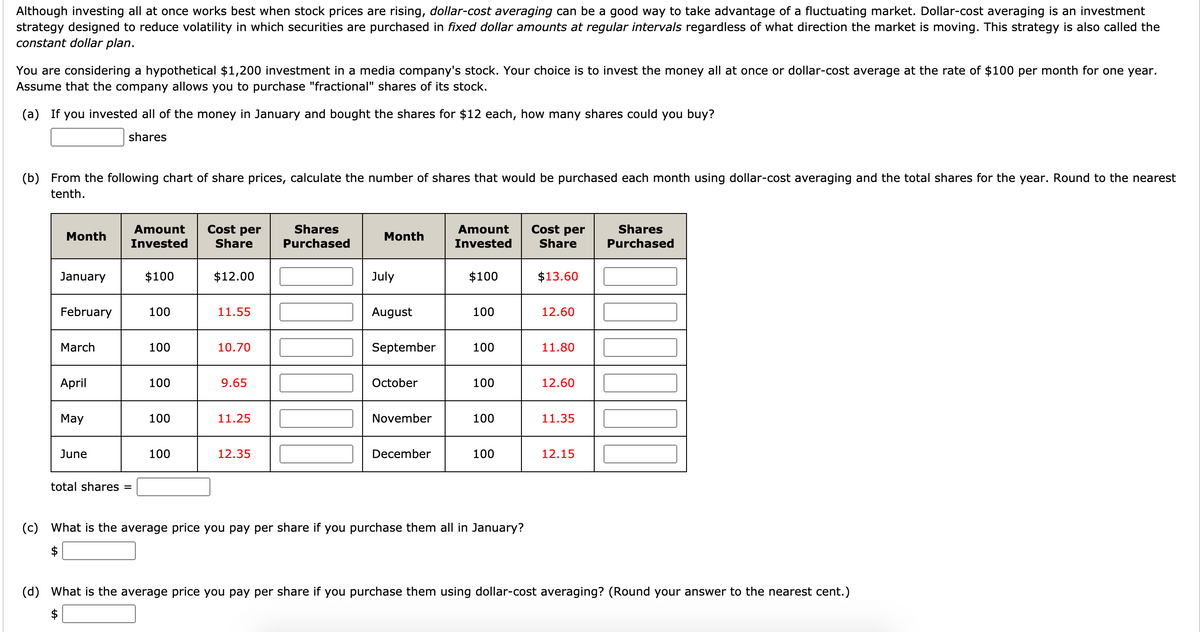

Although investing all at once works best when stock prices are rising, dollar-cost averaging can be a good way to take advantage of a fluctuating market. Dollar-cost averaging is an investment strategy designed to reduce volatility in which securities are purchased in fixed dollar amounts at regular intervals regardless of what direction the market is moving. This strategy is also called the constant dollar plan. You are considering a hypothetical $1,200 investment in a media company's stock. Your choice is to invest the money all at once or dollar-cost average at the rate of $100 per month for one year. Assume that the company allows you to purchase "fractional" shares of its stock. (a) If you invested all of the money in January and bought the shares for $12 each, how many shares could you buy? shares (b) From the following chart of share prices, calculate the number of shares that would be purchased each month using dollar-cost averaging and the total shares for the year. Round to the nearest tenth. Cost per Share Amount Shares Amount Shares Cost per Share Month Month Invested Purchased Invested Purchased January $100 $12.00 July $100 $13.60 February 100 11.55 J August 100 12.60 March 100 10.70 September 100 11.80 April 100 9.65 October 100 12.60 May 100 11.25 November 100 11.35 June 100 12.35 December 100 12.15 total shares = (c) What is the average price you pay per share if you purchase them all in January? $4 (d) What is the average price you pay per share if you purchase them using dollar-cost averaging? (Round your answer to the nearest cent.) $

Although investing all at once works best when stock prices are rising, dollar-cost averaging can be a good way to take advantage of a fluctuating market. Dollar-cost averaging is an investment strategy designed to reduce volatility in which securities are purchased in fixed dollar amounts at regular intervals regardless of what direction the market is moving. This strategy is also called the constant dollar plan. You are considering a hypothetical $1,200 investment in a media company's stock. Your choice is to invest the money all at once or dollar-cost average at the rate of $100 per month for one year. Assume that the company allows you to purchase "fractional" shares of its stock. (a) If you invested all of the money in January and bought the shares for $12 each, how many shares could you buy? shares (b) From the following chart of share prices, calculate the number of shares that would be purchased each month using dollar-cost averaging and the total shares for the year. Round to the nearest tenth. Cost per Share Amount Shares Amount Shares Cost per Share Month Month Invested Purchased Invested Purchased January $100 $12.00 July $100 $13.60 February 100 11.55 J August 100 12.60 March 100 10.70 September 100 11.80 April 100 9.65 October 100 12.60 May 100 11.25 November 100 11.35 June 100 12.35 December 100 12.15 total shares = (c) What is the average price you pay per share if you purchase them all in January? $4 (d) What is the average price you pay per share if you purchase them using dollar-cost averaging? (Round your answer to the nearest cent.) $

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 1MC

Related questions

Question

100%

Transcribed Image Text:Although investing all at once works best when stock prices are rising, dollar-cost averaging can be a good way to take advantage of a fluctuating market. Dollar-cost averaging is an investment

strategy designed to reduce volatility in which securities are purchased in fixed dollar amounts at regular intervals regardless of what direction the market is moving. This strategy is also called the

constant dollar plan.

You are considering a hypothetical $1,200 investment in a media company's stock. Your choice is to invest the money all at once or dollar-cost average at the rate of $100 per month for one year.

Assume that the company allows you to purchase "fractional" shares of its stock.

(a) If you invested all of the money in January and bought the shares for $12 each, how many shares could you buy?

shares

(b) From the following chart of share prices, calculate the number of shares that would be purchased each month using dollar-cost averaging and the total shares for the year. Round to the nearest

tenth.

Amount

Cost per

Shares

Amount

Cost per

Shares

Month

Month

Invested

Share

Purchased

Invested

Share

Purchased

January

$100

$12.00

July

$100

$13.60

February

100

11.55

August

100

12.60

March

100

10.70

September

100

11.80

April

100

9.65

October

100

12.60

Мay

100

11.25

November

100

11.35

June

100

12.35

December

100

12.15

total shares

(c) What is the average price you pay per share if you purchase them all in January?

$

(d) What is the average price you pay per share if you purchase them using dollar-cost averaging? (Round your answer to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning