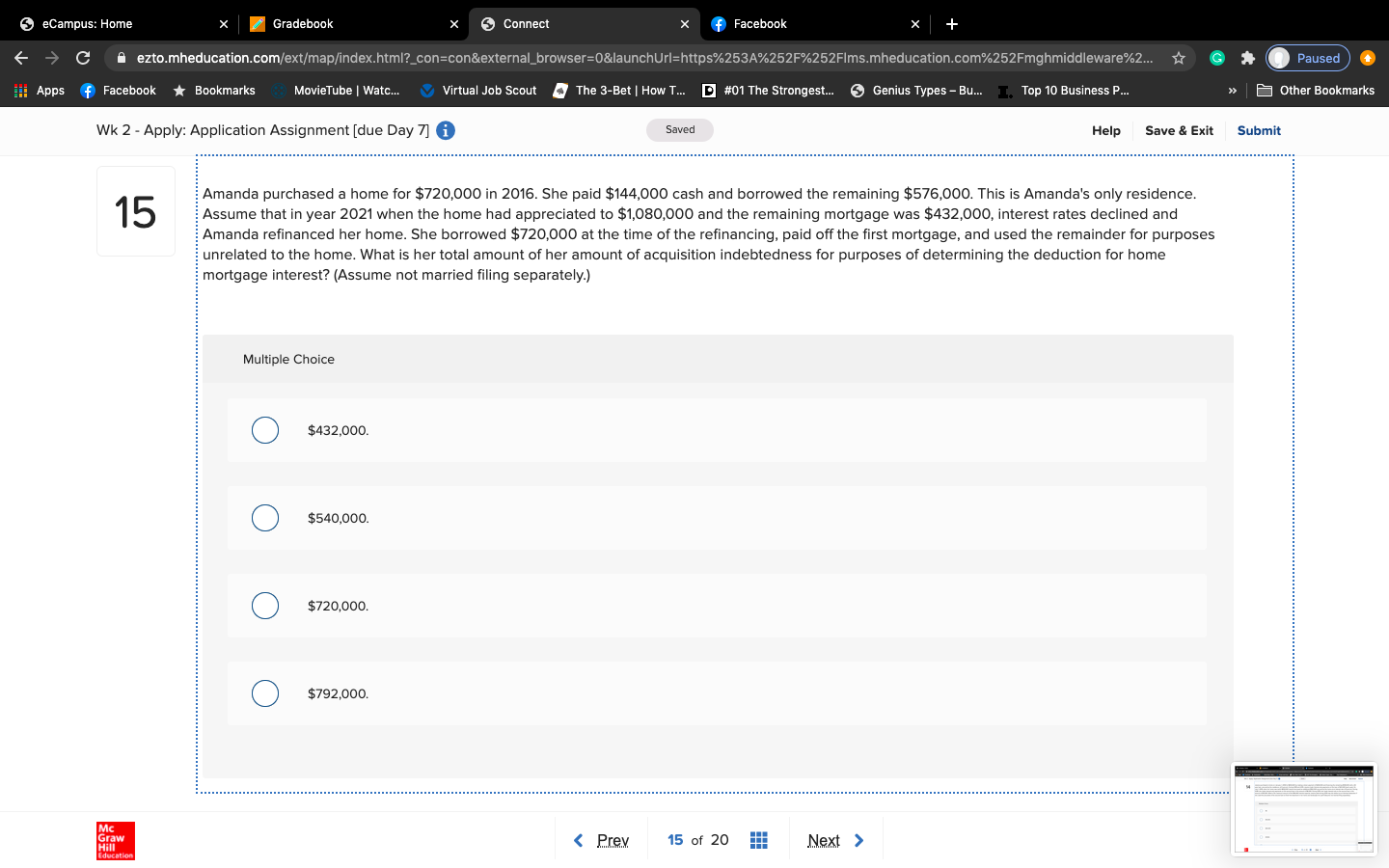

Amanda purchased a home for $720,000 in 2016. She paid $144,000 cash and borrowed the remaining $576,000. This is Amanda's only residence. Assume that in year 2021 when the home had appreciated to $1,080,000 and the remaining mortgage was $432,000, interest rates declined and Amanda refinanced her home. She borrowed $720,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.)

Amanda purchased a home for $720,000 in 2016. She paid $144,000 cash and borrowed the remaining $576,000. This is Amanda's only residence. Assume that in year 2021 when the home had appreciated to $1,080,000 and the remaining mortgage was $432,000, interest rates declined and Amanda refinanced her home. She borrowed $720,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home mortgage interest? (Assume not married filing separately.)

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 37P

Related questions

Topic Video

Question

Hello, I need help solving this accounting problem.

Transcribed Image Text:Amanda purchased a home for $720,000 in 2016. She paid $144,000 cash and borrowed the remaining $576,000. This is Amanda's only residence.

Assume that in year 2021 when the home had appreciated to $1,080,000 and the remaining mortgage was $432,000, interest rates declined and

Amanda refinanced her home. She borrowed $720,000 at the time of the refinancing, paid off the first mortgage, and used the remainder for purposes

unrelated to the home. What is her total amount of her amount of acquisition indebtedness for purposes of determining the deduction for home

mortgage interest? (Assume not married filing separately.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT