Amarjeet graduated from the University of Calgary on May 2 and has student loans totalling $31,000.00. The prime rate upon graduation was 4.5%. He has decided to pay in full the interest charged during the grace period (i.e., he is not converting it to principal) before starting monthly payments of $800.00 at the fixed interest rate. Complete the table below, including calculations for the grace period and the first three months of his repayment schedule. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63") (Give all "Number of Days" quantities as fractions with denominator 365.) Payment Date Balance Annual before Interest Transaction Rate Number Interest Accrued of Days Charged Interest Advance (-) (+) or Principal Balance after Amount Transaction June 1 Nov 30 $31,000.00 7% (inclusive) Π $0.00 Dec 31 9.5% Jan 31 9.5% $800.00 $800.00 Feb 29 9.5% $800.00

Amarjeet graduated from the University of Calgary on May 2 and has student loans totalling $31,000.00. The prime rate upon graduation was 4.5%. He has decided to pay in full the interest charged during the grace period (i.e., he is not converting it to principal) before starting monthly payments of $800.00 at the fixed interest rate. Complete the table below, including calculations for the grace period and the first three months of his repayment schedule. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63") (Give all "Number of Days" quantities as fractions with denominator 365.) Payment Date Balance Annual before Interest Transaction Rate Number Interest Accrued of Days Charged Interest Advance (-) (+) or Principal Balance after Amount Transaction June 1 Nov 30 $31,000.00 7% (inclusive) Π $0.00 Dec 31 9.5% Jan 31 9.5% $800.00 $800.00 Feb 29 9.5% $800.00

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

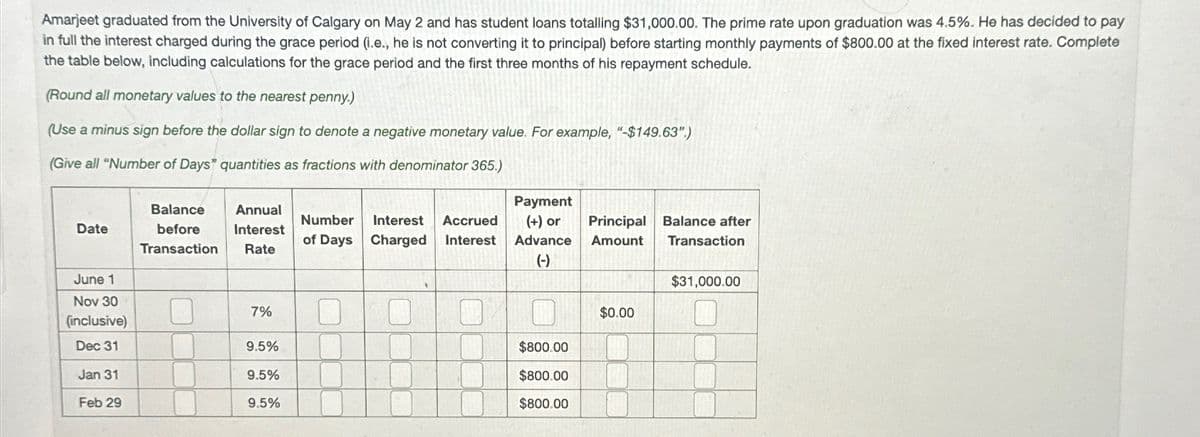

Transcribed Image Text:Amarjeet graduated from the University of Calgary on May 2 and has student loans totalling $31,000.00. The prime rate upon graduation was 4.5%. He has decided to pay

in full the interest charged during the grace period (i.e., he is not converting it to principal) before starting monthly payments of $800.00 at the fixed interest rate. Complete

the table below, including calculations for the grace period and the first three months of his repayment schedule.

(Round all monetary values to the nearest penny.)

(Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63")

(Give all "Number of Days" quantities as fractions with denominator 365.)

Payment

Date

Balance Annual

before Interest

Transaction Rate

Number

Interest Accrued

of Days Charged Interest Advance

(-)

(+) or

Principal Balance after

Amount Transaction

June 1

Nov 30

$31,000.00

7%

(inclusive)

Π

$0.00

Dec 31

9.5%

Jan 31

9.5%

$800.00

$800.00

Feb 29

9.5%

$800.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning