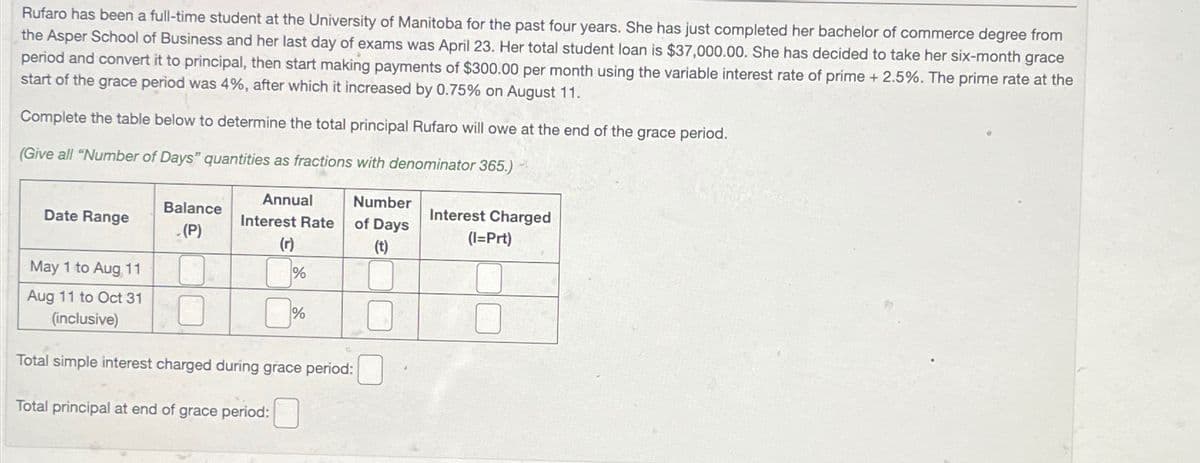

Rufaro has been a full-time student at the University of Manitoba for the past four years. She has just completed her bachelor of commerce degree from the Asper School of Business and her last day of exams was April 23. Her total student loan is $37,000.00. She has decided to take her six-month grace period and convert it to principal, then start making payments of $300.00 per month using the variable interest rate of prime + 2.5%. The prime rate at the start of the grace period was 4%, after which it increased by 0.75% on August 11. Complete the table below to determine the total principal Rufaro will owe at the end of the grace period. (Give all "Number of Days" quantities as fractions with denominator 365.) Date Range Balance .(P) Annual Interest Rate (r) Number of Days (t) Interest Charged (I=Prt) May 1 to Aug 11 % Aug 11 to Oct 31 % (inclusive) Total simple interest charged during grace period: Total principal at end of grace period:

Rufaro has been a full-time student at the University of Manitoba for the past four years. She has just completed her bachelor of commerce degree from the Asper School of Business and her last day of exams was April 23. Her total student loan is $37,000.00. She has decided to take her six-month grace period and convert it to principal, then start making payments of $300.00 per month using the variable interest rate of prime + 2.5%. The prime rate at the start of the grace period was 4%, after which it increased by 0.75% on August 11. Complete the table below to determine the total principal Rufaro will owe at the end of the grace period. (Give all "Number of Days" quantities as fractions with denominator 365.) Date Range Balance .(P) Annual Interest Rate (r) Number of Days (t) Interest Charged (I=Prt) May 1 to Aug 11 % Aug 11 to Oct 31 % (inclusive) Total simple interest charged during grace period: Total principal at end of grace period:

Chapter6: Business Expenses

Section: Chapter Questions

Problem 89TPC

Related questions

Question

Rufaro has been a full-time student at the University of Manitoba for the past four years. She has just completed her bachelor of commerce degree from the Asper School of Business and her last day of exams was April 23 . Her total student loan is $37,000.00. She has decided to take her six-month grace period and convert it to principal, then start making payments of $300.00 per month using the variable interest rate of prime +2.5%. The prime rate at the start of the grace period was 4%, after which it increased by 0.75% on August 11 . Complete the table below to determine the total principal Rufaro will owe at the end of the grace period. (Give all "Number of Days" quantities as fractions with denominator 365.) \table[[Date Range,\table[[Balance],[(P)]],\table[[Annual],[Interest Rate],[(r)]],\table[[Number],[of Days],[

Transcribed Image Text:Rufaro has been a full-time student at the University of Manitoba for the past four years. She has just completed her bachelor of commerce degree from

the Asper School of Business and her last day of exams was April 23. Her total student loan is $37,000.00. She has decided to take her six-month grace

period and convert it to principal, then start making payments of $300.00 per month using the variable interest rate of prime + 2.5%. The prime rate at the

start of the grace period was 4%, after which it increased by 0.75% on August 11.

Complete the table below to determine the total principal Rufaro will owe at the end of the grace period.

(Give all "Number of Days" quantities as fractions with denominator 365.)

Date Range

Balance

.(P)

Annual

Interest Rate

(r)

Number

of Days

(t)

Interest Charged

(I=Prt)

May 1 to Aug 11

%

Aug 11 to Oct 31

%

(inclusive)

Total simple interest charged during grace period:

Total principal at end of grace period:

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you