Among the account balance of Jeffrey Corporation at December 31, 2009 are the following: Patent P2,450,000 P7,200,000 Installment contract receivable Relevant transactions and other information for 2010 were as follows: a. The patent was purchased from Inventor Company for P3,150,000 on September 1, 2006. On that date, the remaining legal life was fifteen years, which was also determined to be the useful life. b. The installment contract receivable represents the balance of the consideration received from the sale of a factory building to Eeebie Company on March 31, 2008, for P12,000,000. Eeebie, made a P3,000,000 down payment and signed a five-year 13% note for the P9,000,000 balance. The first of equal annual principal payments of P1,800,000 was received on March 31, 2009 together with interest to that date. The note is collateralized by the factory building with a fair value of P10,000,000 at December 31, 2010. The 2010 payment was received on time. c. On January 2, 2010, Jeffrey purchased a trademark from Cool Corporation for P2,500,000. Jeffrey considers the life of the trademark to be indefinite. d. On May 1, 2010, Jeffrey sold the patent to Simple Company in exchange for a P5,000,000 non- interest-bearing note due on May 1, 2013. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at May 1, 2010 was at 14%. The present value of 1 for three periods at 14% is 0.675. The collection of the note receivable from Simple is reasonably assured. e. On July 1, 2010, Jeffrey paid P18,800,000 for P750,000 ordinary shares of Pure Corporation, which represented a 25% investment in Pure. The fair value of all of Pure's identifiable assets net of liabilities equals their carrying amount of P64,000,000. The market price of Pure's ordinary share on December 31, 2010 was P26,000 per share. f. Pure reported the profit and paid dividends of: Profit Dividends per share Six months ended, 6/30/10 P5,760,000 Six months ended, 12/31/10 P7,040,000 None P2

Among the account balance of Jeffrey Corporation at December 31, 2009 are the following: Patent P2,450,000 P7,200,000 Installment contract receivable Relevant transactions and other information for 2010 were as follows: a. The patent was purchased from Inventor Company for P3,150,000 on September 1, 2006. On that date, the remaining legal life was fifteen years, which was also determined to be the useful life. b. The installment contract receivable represents the balance of the consideration received from the sale of a factory building to Eeebie Company on March 31, 2008, for P12,000,000. Eeebie, made a P3,000,000 down payment and signed a five-year 13% note for the P9,000,000 balance. The first of equal annual principal payments of P1,800,000 was received on March 31, 2009 together with interest to that date. The note is collateralized by the factory building with a fair value of P10,000,000 at December 31, 2010. The 2010 payment was received on time. c. On January 2, 2010, Jeffrey purchased a trademark from Cool Corporation for P2,500,000. Jeffrey considers the life of the trademark to be indefinite. d. On May 1, 2010, Jeffrey sold the patent to Simple Company in exchange for a P5,000,000 non- interest-bearing note due on May 1, 2013. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at May 1, 2010 was at 14%. The present value of 1 for three periods at 14% is 0.675. The collection of the note receivable from Simple is reasonably assured. e. On July 1, 2010, Jeffrey paid P18,800,000 for P750,000 ordinary shares of Pure Corporation, which represented a 25% investment in Pure. The fair value of all of Pure's identifiable assets net of liabilities equals their carrying amount of P64,000,000. The market price of Pure's ordinary share on December 31, 2010 was P26,000 per share. f. Pure reported the profit and paid dividends of: Profit Dividends per share Six months ended, 6/30/10 P5,760,000 Six months ended, 12/31/10 P7,040,000 None P2

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 8P

Related questions

Question

Compute for the gain on sale of patent under the following problem

A) P2,620,000

B) P925,000

C) P1,078,125

D) P995,000

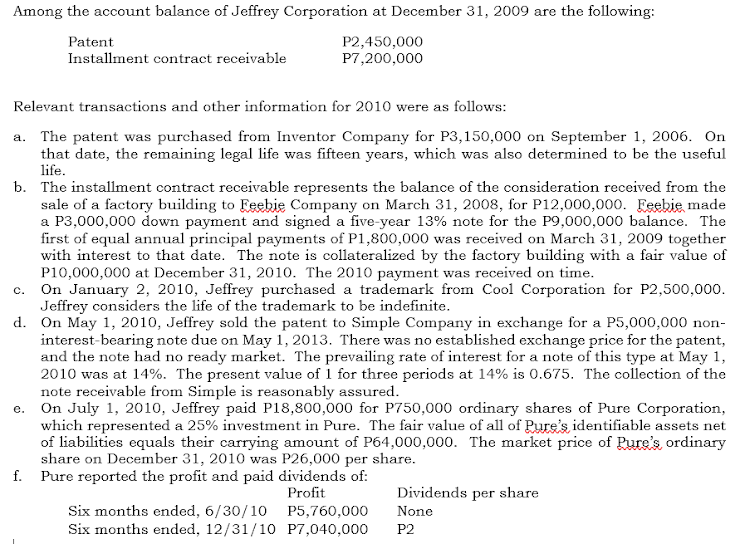

Transcribed Image Text:Among the account balance of Jeffrey Corporation at December 31, 2009 are the following:

Patent

P2,450,000

P7,200,000

Installment contract receivable

Relevant transactions and other information for 2010 were as follows:

a. The patent was purchased from Inventor Company for P3,150,000 on September 1, 2006. On

that date, the remaining legal life was fifteen years, which was also determined to be the useful

life.

b. The installment contract receivable represents the balance of the consideration received from the

sale of a factory building to Eeebie Company on March 31, 2008, for P12,000,000. Eeebie made

a P3,000,000 down payment and signed a five-year 13% note for the P9,000,000 balance. The

first of equal annual principal payments of P1,800,000 was received on March 31, 2009 together

with interest to that date. The note is collateralized by the factory building with a fair value of

P10,000,000 at December 31, 2010. The 2010 payment was received on time.

c. On January 2, 2010, Jeffrey purchased a trademark from Cool Corporation for P2,500,000.

Jeffrey considers the life of the trademark to be indefinite.

d. On May 1, 2010, Jeffrey sold the patent to Simple Company in exchange for a P5,000,000 non-

interest-bearing note due on May 1, 2013. There was no established exchange price for the patent,

and the note had no ready market. The prevailing rate of interest for a note of this type at May 1,

2010 was at 14%. The present value of 1 for three periods at 14% is 0.675. The collection of the

note receivable from Simple is reasonably assured.

On July 1, 201o, Jeffrey paid P18,800,000 for P750,000 ordinary shares of Pure Corporation,

which represented a 25% investment in Pure. The fair value of all of Pure's identifiable assets net

of liabilities equals their carrying amount of P64,000,000. The market price of Rure's ordinary

share on December 31, 2010 was P26,000 per share.

f. Pure reported the profit and paid dividends of:

е.

Profit

Dividends per share

Six months ended, 6/30/10 P5,760,000

None

Six months ended, 12/31/10 P7,040,000

P2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning