Amortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $23,000,000 of 5-year, 10% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 12%, resulting in Ebert receiving cash of $21,307,304. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Cash v 21,307,304 Discount on Bonds Payable v 1,692,696 Bonds Payable 23,000,000 V Feedback Check My Work 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense v Discount on Bonds Payable v Cash v Feedback Check My Work

Amortize Discount by Interest Method On the first day of its fiscal year, Ebert Company issued $23,000,000 of 5-year, 10% bonds to finance its operations. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 12%, resulting in Ebert receiving cash of $21,307,304. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Cash v 21,307,304 Discount on Bonds Payable v 1,692,696 Bonds Payable 23,000,000 V Feedback Check My Work 2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense v Discount on Bonds Payable v Cash v Feedback Check My Work

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

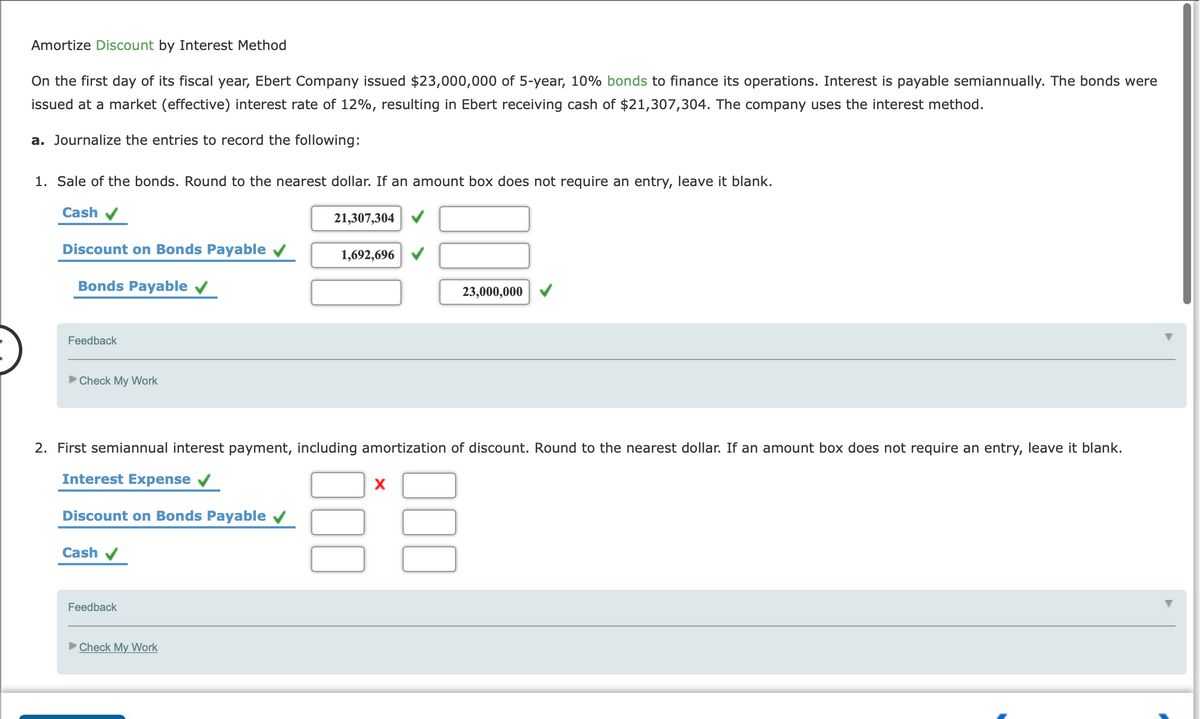

Transcribed Image Text:Amortize Discount by Interest Method

On the first day of its fiscal year, Ebert Company issued $23,000,000 of 5-year, 10% bonds to finance its operations. Interest is payable semiannually. The bonds were

issued at a market (effective) interest rate of 12%, resulting in Ebert receiving cash of $21,307,304. The company uses the interest method.

a. Journalize the entries to record the following:

1. Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.

Cash

21,307,304

Discount on Bonds Payable

1,692,696

Bonds Payable v

23,000,000

Feedback

Check My Work

2. First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.

Interest Expense v

Discount on Bonds Payable v

Cash v

Feedback

Check My Work

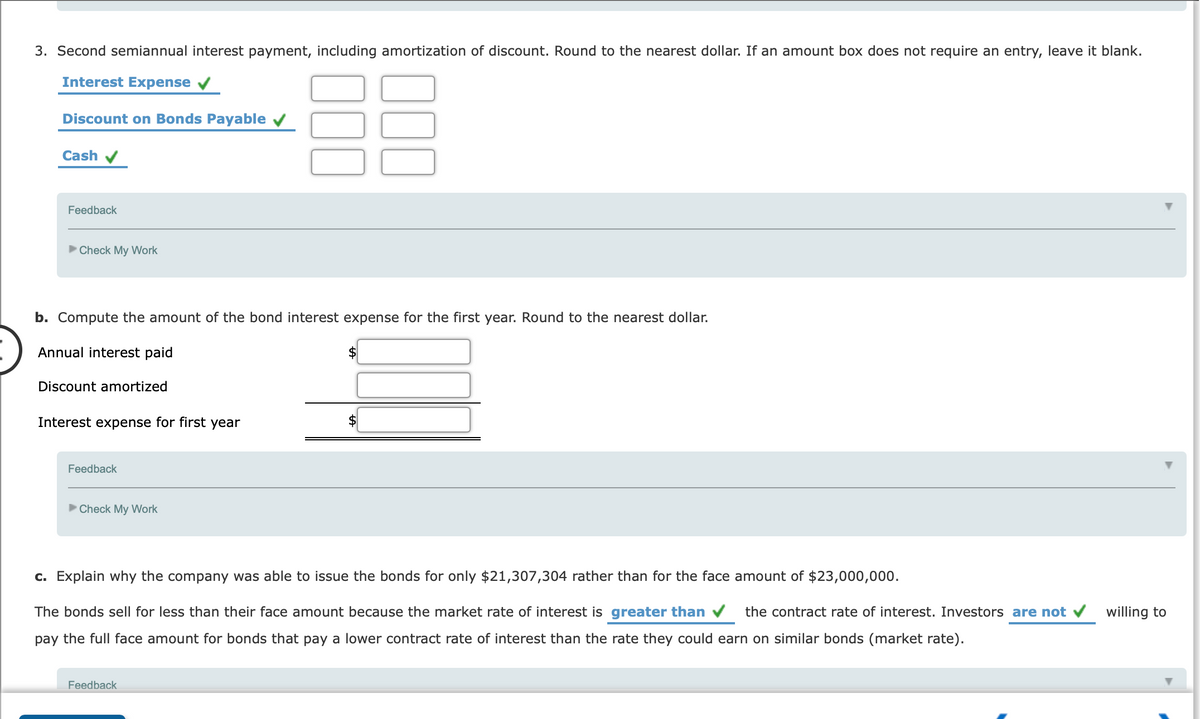

Transcribed Image Text:3. Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.

Interest Expense

Discount on Bonds Payable v

Cash v

Feedback

Check My Work

b. Compute the amount of the bond interest expense for the first year. Round to the nearest dollar.

Annual interest paid

Discount amortized

Interest expense for first year

$4

Feedback

Check My Work

c. Explain why the company was able to issue the bonds for only $21,307,304 rather than for the face amount of $23,000,000.

The bonds sell for less than their face amount because the market rate of interest is greater than

the contract rate of interest. Investors are not v willing to

pay the full face amount for bonds that pay a lower contract rate of interest than the rate they could earn on similar bonds (market rate).

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,