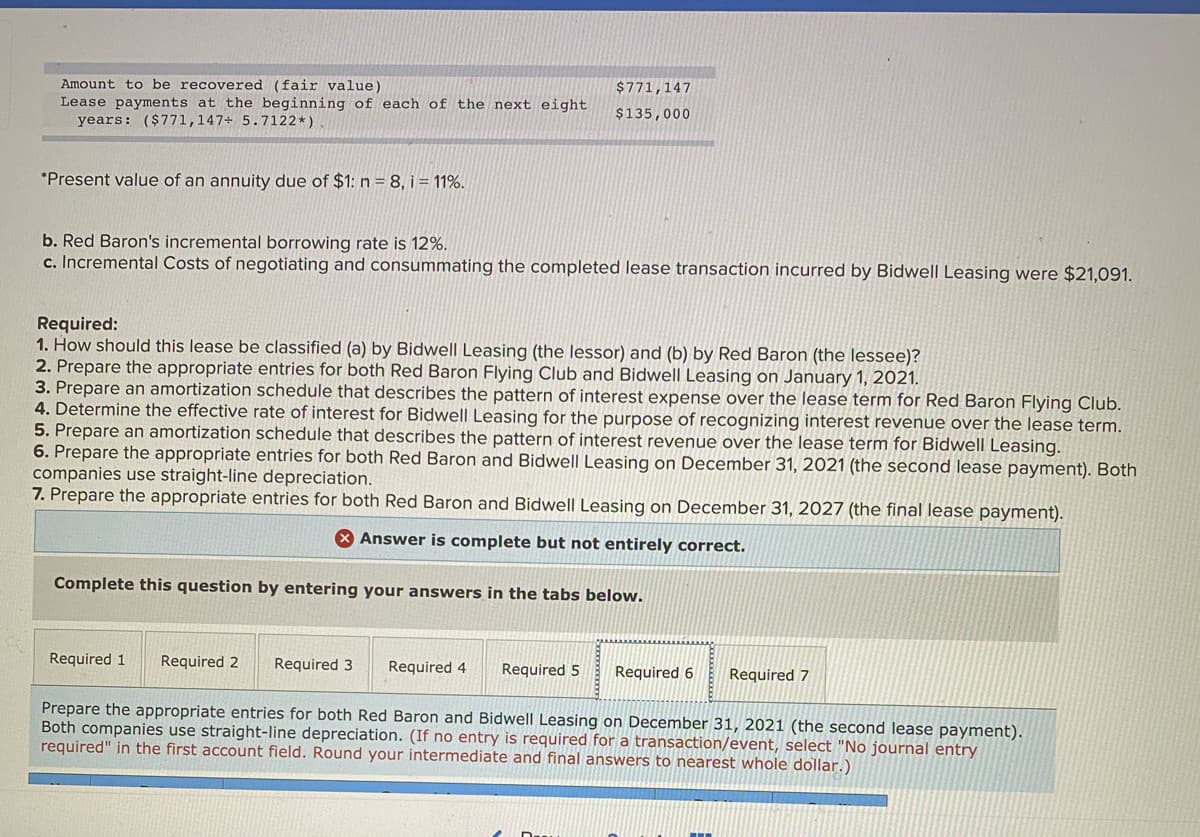

Amount to be recovered (fair value) Lease payments at the beginning of each of the next eight years: ($771,147+ 5.7122*) $771,147 $135,000 *Present value of an annuity due of $1: n = 8, i = 11%. b. Red Baron's incremental borrowing rate is 12%. c. Incremental Costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $21,091. Required: 1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)? 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment). X Answer is complete but not entirely correct.

Amount to be recovered (fair value) Lease payments at the beginning of each of the next eight years: ($771,147+ 5.7122*) $771,147 $135,000 *Present value of an annuity due of $1: n = 8, i = 11%. b. Red Baron's incremental borrowing rate is 12%. c. Incremental Costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $21,091. Required: 1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)? 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment). X Answer is complete but not entirely correct.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6P: Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a...

Related questions

Question

100%

I need help with only required 6 please

Transcribed Image Text:Amount to be recovered (fair value)

Lease payments at the beginning of each of the next eight

$771,147

$135,000

years: ($771,147+ 5.7122*)

*Present value of an annuity due of $1: n = 8, i = 11%.

b. Red Baron's incremental borrowing rate is 12%.

c. Incremental Costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $21,091.

Required:

1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)?

2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021.

3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club.

4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term.

5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing.

6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both

companies use straight-line depreciation.

7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment).

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Required 5

Required 6

Required 7

Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment).

Both companies use straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field. Round your intermediate and final answers to nearest whole dollar.)

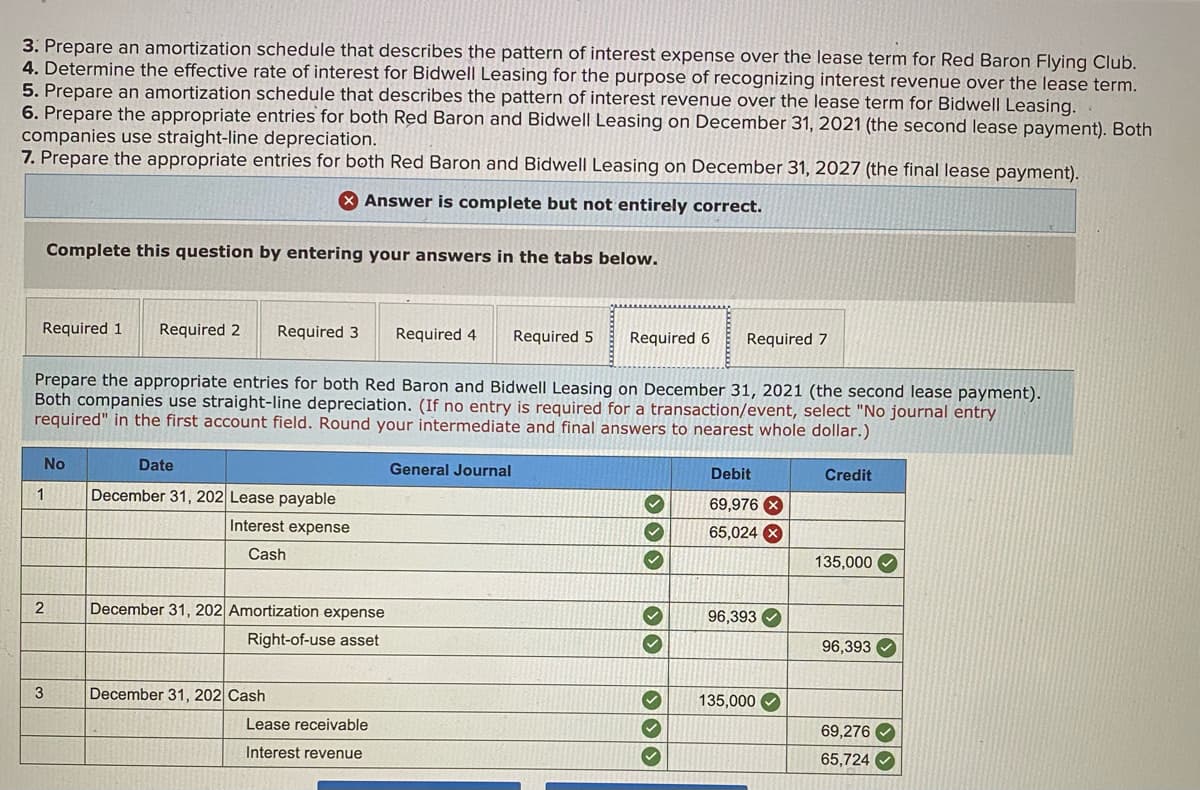

Transcribed Image Text:3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club.

4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term.

5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing.

6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both

companies use straight-line depreciation.

7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment).

X Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Required 5

Required 6

Required 7

Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment).

Both companies use straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field. Round your intermediate and final answers to nearest whole dollar.)

No

Date

General Journal

Debit

Credit

1

December 31, 202 Lease payable

69,976 X

Interest expense

65,024

Cash

135,000

2

December 31, 202 Amortization expense

96,393 O

Right-of-use asset

96,393

3

December 31, 202 Cash

135,000 O

Lease receivable

69,276 V

Interest revenue

65,724 O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT