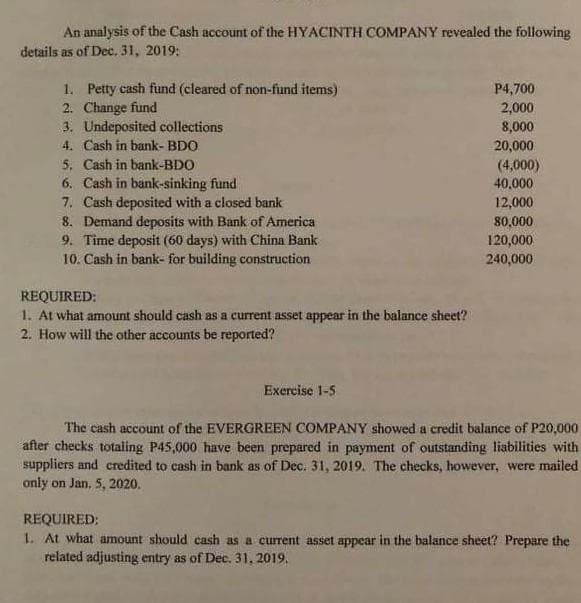

An analysis of the Cash account of the HYACINTH COMPANY revealed the following details as of Dec. 31, 2019: 1. Petty cash fund (cleared of non-fund items) 2. Change fund 3. Undeposited collections 4. Cash in bank- BDO 5. Cash in bank-BDO 6. Cash in bank-sinking fund 7. Cash deposited with a closed bank 8. Demand deposits with Bank of America Time deposit (60 days) with China Bank 10. Cash in bank- for building construction P4,700 2,000 8,000 20,000 (4,000) 40,000 12,000 80,000 9. 120,000 240,000 REQUIRED: 1. At what amount should cash as a current asset appear in the balance sheet?

An analysis of the Cash account of the HYACINTH COMPANY revealed the following details as of Dec. 31, 2019: 1. Petty cash fund (cleared of non-fund items) 2. Change fund 3. Undeposited collections 4. Cash in bank- BDO 5. Cash in bank-BDO 6. Cash in bank-sinking fund 7. Cash deposited with a closed bank 8. Demand deposits with Bank of America Time deposit (60 days) with China Bank 10. Cash in bank- for building construction P4,700 2,000 8,000 20,000 (4,000) 40,000 12,000 80,000 9. 120,000 240,000 REQUIRED: 1. At what amount should cash as a current asset appear in the balance sheet?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 5.4.3P

Related questions

Question

answer first one

Transcribed Image Text:An analysis of the Cash account of the HYACINTH COMPANY revealed the following

details as of Dec. 31, 2019:

1. Petty cash fund (cleared of non-fund items)

2. Change fund

3. Undeposited collections

4. Cash in bank- BDO

5. Cash in bank-BDO

6. Cash in bank-sinking fund

7. Cash deposited with a closed bank

8. Demand deposits with Bank of America

9. Time deposit (60 days) with China Bank

10. Cash in bank- for building construction

P4,700

2,000

8,000

20,000

(4,000)

40,000

12,000

80,000

120,000

240,000

REQUIRED:

1. At what amount should cash as a current asset appear in the balance sheet?

2. How will the other accounts be reported?

Exercise 1-5

The cash account of the EVERGREEN COMPANY showed a credit balance of P20,000

after checks totaling P45,000 have been prepared in payment of outstanding liabilities with

suppliers and credited to cash in bank as of Dec. 31, 2019. The checks, however, were mailed

only on Jan, 5, 2020.

REQUIRED:

1. At what amount should cash as a current asset appear in the balance sheet? Prepare the

related adjusting entry as of Dec. 31, 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub