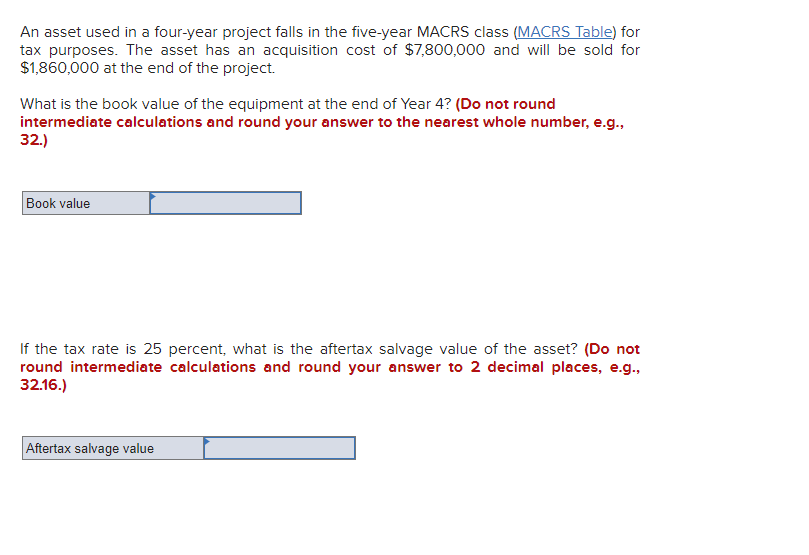

An asset used in a four-year project falls in the five-year MACRS class (MACRS Table) for tax purposes. The asset has an acquisition cost of $7,800,000 and will be sold for $1,860,000 at the end of the project. What is the book value of the equipment at the end of Year 4? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Book value If the tax rate is 25 percent, what is the aftertax salvage value of the asset? (Do not round intermediate calculations and round your answer to 2 decimal places, e.., 32.16.) Aftertax salvage value

An asset used in a four-year project falls in the five-year MACRS class (MACRS Table) for tax purposes. The asset has an acquisition cost of $7,800,000 and will be sold for $1,860,000 at the end of the project. What is the book value of the equipment at the end of Year 4? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Book value If the tax rate is 25 percent, what is the aftertax salvage value of the asset? (Do not round intermediate calculations and round your answer to 2 decimal places, e.., 32.16.) Aftertax salvage value

Chapter9: Capital Budgeting And Cash Flow Analysis

Section9.A: Depreciation

Problem 1P

Related questions

Question

Transcribed Image Text:An asset used in a four-year project falls in the five-year MACRS class (MACRS Table) for

tax purposes. The asset has an acquisition cost of $7,800,000 and will be sold for

$1,860,000 at the end of the project.

What is the book value of the equipment at the end of Year 4? (Do not round

intermediate calculations and round your answer to the nearest whole number, e.g.,

32.)

Book value

If the tax rate is 25 percent, what is the aftertax salvage value of the asset? (Do not

round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

Aftertax salvage value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College