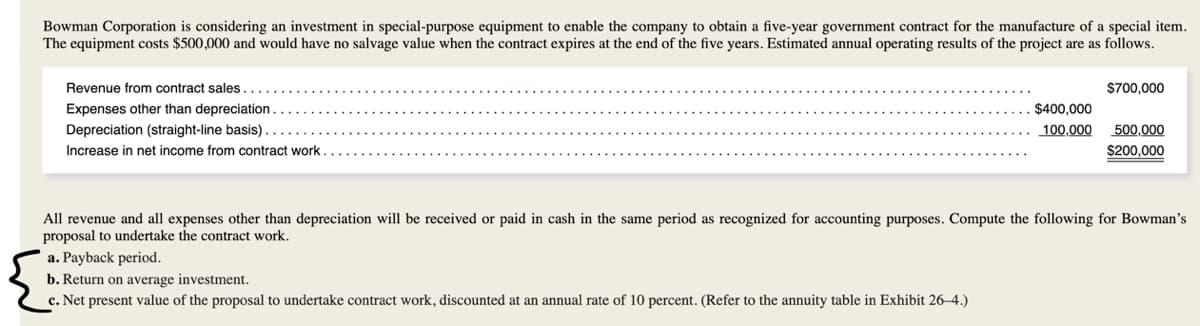

Bowman Corporation is considering an investment in special-purpose equipment to enable the company to obtain a five-year government contract for the manufacture of a special item. The equipment costs $500,000 and would have no salvage value when the contract expires at the end of the five years. Estimated annual operating results of the project are as follows. Revenue from contract sales.. $700,000 Expenses other than depreciation. . $400,000 Depreciation (straight-line basis). 100,000 500.000 Increase in net income from contract work. $200,000 All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Bowman's proposal to undertake the contract work. a. Payback period. b. Return on average investment. c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to the annuity table in Exhibit 26–4.)

Bowman Corporation is considering an investment in special-purpose equipment to enable the company to obtain a five-year government contract for the manufacture of a special item. The equipment costs $500,000 and would have no salvage value when the contract expires at the end of the five years. Estimated annual operating results of the project are as follows. Revenue from contract sales.. $700,000 Expenses other than depreciation. . $400,000 Depreciation (straight-line basis). 100,000 500.000 Increase in net income from contract work. $200,000 All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Bowman's proposal to undertake the contract work. a. Payback period. b. Return on average investment. c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to the annuity table in Exhibit 26–4.)

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 17P

Related questions

Question

100%

how would i do {abc on the first image?

Transcribed Image Text:Bowman Corporation is considering an investment in special-purpose equipment to enable the company to obtain a five-year government contract for the manufacture of a special item.

The equipment costs $500,000 and would have no salvage value when the contract expires at the end of the five years. Estimated annual operating results of the project are as follows.

Revenue from contract sales.

$700,000

Expenses other than depreciation

$400,000

Depreciation (straight-line basis)

100,000

500,000

Increase in net income from contract work.

$200,000

All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Bowman's

proposal to undertake the contract work.

a. Payback period.

b. Return on average investment.

c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to the annuity table in Exhibit 26-4.)

Transcribed Image Text:Chrome File

Edit View History Bookmarks Profiles Tab Window Help

100% A Thu 3:54 PM

a G b

EJE x

a

PQ

i bookshelf.vitalsource.com/#/books/9781260006520/cfi/6/70!/4/6/18/134/4/2@0:36.8

Update :

E Apps M Gmail

O

YouTube Maps

KILLERANDASWE. A VitalSource Books. C A Delightful Buyin. P PaperCut MF : We.

E Reading List

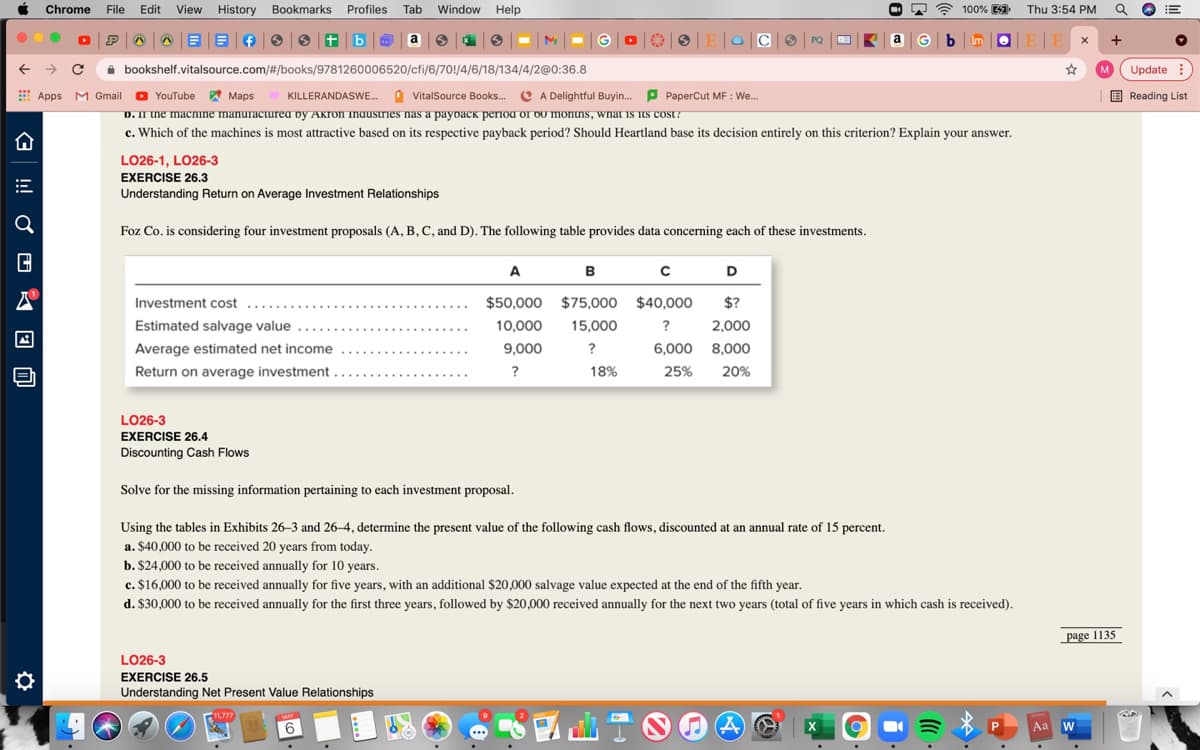

D. Ir ne macnine manuracturea by Akron inaustries nas a paydack periou or ou monuns, wnar is Tis cost?

c. Which of the machines is most attractive based on its respective payback period? Should Heartland base its decision entirely on this criterion? Explain your answer.

LO26-1, LO26-3

EXERCISE 26.3

Understanding Return on Average Investment Relationships

Foz Co. is considering four investment proposals (A, B, C, and D). The following table provides data concerning each of these investments.

A

B

D

Investment cost

$50,000 $75,000 $40,000

$?

Estimated salvage value

10,000

15,000

?

2,000

Average estimated net income

9,000

?

6,000 8,000

Return on average investment

?

18%

25%

20%

LO26-3

EXERCISE 26.4

Discounting Cash Flows

Solve for the missing information pertaining to each investment proposal.

Using the tables in Exhibits 26–3 and 26–4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent.

a. $40,000 to be received 20 years from today.

b. $24,000 to be received annually for 10 years.

c. $16,000 to be received annually for five years, with an additional $20,000 salvage value expected at the end of the fifth year.

d. $30,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received).

page 1135

LO26-3

EXERCISE 26.5

Understanding Net Present Value Relationships

11,777

MAY

X

Aa W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College