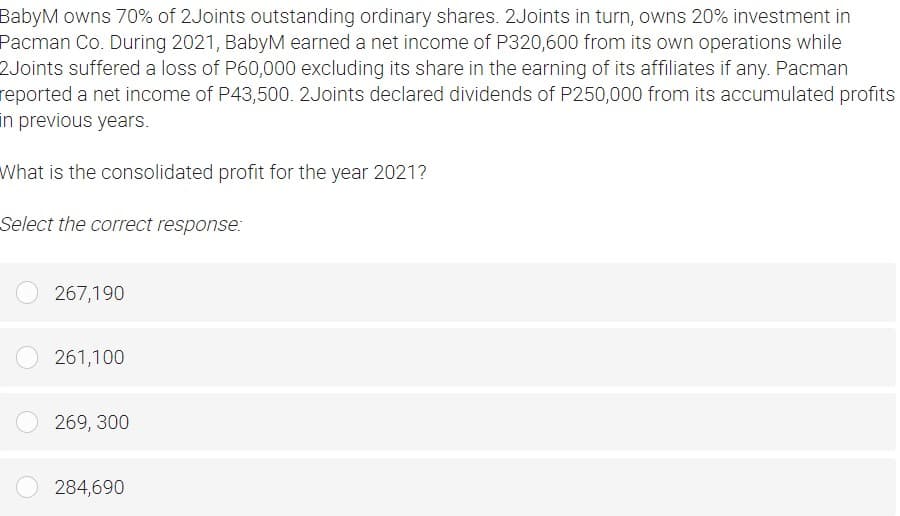

an Co. During 2021, BabyM earned a net income of P320,600 from its own operatic s suffered a loss of P60,000 excluding its share in the earning of its affiliates if any ed a net income of P43,500. 2Joints declared dividends of P250,000 from its accu ious years. s the consolidated profit for the year 2021? the correct response:

Q: On September 30, 20x1, the warehouse of A Company for inventory in progress and all inventories…

A: In such type of problems it is best to go step by step and by preparing memorandum accounts to find…

Q: Loan type Interest rate (per annum) 4.5% Bad-debt percentage Education 2.1% Home Car 1.6% 0.7% 1.9%…

A: A rate of return (RoR) is the flow of an asset over a certain time period expressed as a percentage…

Q: Aztec Inc. produces soft drinks. Mixing is the first department, and its output is measured in…

A:

Q: The following information has been extracted from the books of accounts of Pabz, Inc. for the…

A: Answer In the given question, the unadjusted balance of allowance for doubtful accounts is 42,500.…

Q: 1. Acer Computer Services is owned by Pepito Manoloto. Prepare the Balance Sheet of the business.…

A: Since, basic accounting equation is Total assets = Total liabilities + owners equity

Q: On January 1, 2020, Edgar Company entered into a six-year lease with a lessor. Annual lease payments…

A: a)Annual lease payments=P1,200,000 Annual executory payments=P200,000 PV of an ordinary annuity of 1…

Q: Casper Hospital bases its budgets on patient-visits. The hospital's static planning budget for May…

A: Fixed cost will remain constant. It remains Fixed irrespective of change in output.

Q: On January 1, 2019, Jerome Company signed a 12-year lease for a building. The entity has an option…

A: Carrying amount refers to the difference between book value and depreciation.

Q: Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks.…

A: Production Budget: Production budget is a plan which is drawn to determine the number of units…

Q: Variable cost per unit cost per unit (based on capacit afety Products Division of Wige ucts,…

A: Transfer pricing The price that one division of a firm charges another division for products and…

Q: Use the following to answer the questions DO NOT INCLUDE COMMAS OR DOLLAR SIGNS IN YOUR ANSWERS…

A: The current ratio measures the organization's ability to meet the short-term liabilities due within…

Q: Low Falls Corporation (lessor) entered into a lease agreement on January 1, 2017, to provide Amazon…

A: Present value denotes the present worth of money by discounting the future cash flows whereas future…

Q: The allowance method of estimating uncollectible accounts receivable based on an analysis of…

A: Introduction: Journals: Recording of a business transactions in a chronological order. Each and…

Q: Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring harness assemblies used…

A: The direct materials budget is prepared to estimate the raw materials required during the period and…

Q: List two circumstances in which obtaining capital allowances on the reducing balance basis is more…

A: Depreciation is the reducing value of an asset, If we buy something from the market or any fixed…

Q: Replacement analysis should be done at the end of the useful life of the property.

A: Replacement analysis is the analysis in which the company analyse the different aspects of the…

Q: In October, Pine Company reports 21,000 actual direct labor hours, and it incurs $125,500 of…

A: Standard overhead = Standard hours*Predetermined overhead rate Total overhead variance = Actual…

Q: Accounts Payable $12,000 Buildings 70,000 Cash 8,000 Accounts Recelvable 7,000 Seles Tex Payable…

A: Introduction: Current Assets: The assets which can be easily converted in to cash with in 12 months…

Q: Mr. Go, a contractor who won the bid for the construction of a public highway, claims as an expense,…

A: Facilitation fees or payment is considered as the small bribe which is regarded as the speed payment…

Q: In depreciation analysis, the method that will yield the highest book value at the end of n years is…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: which of the following is a 1231 asset? a. equipment used in a trade or business for 3 hears b.…

A: In USA section 1231 property refers to those depreciable business property that is held for a…

Q: One of the following is not a requisite for deduction of Premium Payments on Hospitalization and…

A: Concept of deductibility of insurance premium.

Q: Output (units ) Total Cost ($) 200 7000 300…

A: Variable cost per unit = Change in total cost/change in output

Q: Assume a company has only one service department and one operating department. The service…

A: The overhead cost will be allocated to actual production on the basis of actual number of units…

Q: 5. Archer's cost accountant prepared the following static budget based on expected activity of 4,000…

A: A flexible budget is something that could be altered to account for fluctuations in real income…

Q: On January 1, 2017, Naruto Company issued its P2,000,000, 10%, 5-year-term bonds for 1.125. Bond…

A: Carrying amount of the bond liability = Cash proceeds from bonds issue - Amortized bond premium for…

Q: Use the following to answer the questions DO NOT INCLUDE COMMAS OR DOLLAR SIGNS IN YOUR ANSWERS…

A: Introduction: Current ratio: It tells the ability of the Company to pay to its short term…

Q: a. If Canace Company, with a break-even point at $244,200 of sales, has actual sales of $370,000,…

A: Introduction: Margin of safety: Deduction of Break even sales from the current sales value Derives…

Q: Assume a company reported the following results: Sales Variable expenses Contribution margin Fixed…

A: Residual income: Residulal income means excess of income earned over the desired income. Desired…

Q: A computer, printer, and copier were purchased for a total price of Php 250,000 on August 1, 2013.…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: On August 1, Rantoul Stores Inc. is considering leasing a building and purchasing the necessary…

A: Differential analysis is a decision-making approach that analyses the net effects of two…

Q: Which of the following statement is correct? Statement I – The renunciation by the surviving…

A: Answer:- Donation definition:- Donation can be defined as something donated to charity, specially a…

Q: In October, Pine Company reports 21,000 actual direct labor hours, and it incurs $125,500 of…

A: Total overhead variance = Actual manufacturing overhead costs - Standard manufacturing overhead…

Q: please help me. i please fill up the missing parts of this journal entry

A: 7,000 credited in interest income then debited to receivable account 124, 000 debited in…

Q: Prepare a horizontal analysis of both the balance sheet and income statement. Complete this question…

A: Increase/(decrease) = Year 4 amount - Year 3 amount % change = Increase (decrease)/Year 3 amount

Q: Lieu Company is a specialty print shop. Usually, printing jobs are priced at standard cost plus 50…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: On January 1, 2023, Jones Corporation issued $2.982.000, 9%, 5-year bonds with interest payable on…

A: Interest expense on bonds is calculated at the market rate of interest on the issue value of the…

Q: Walstrom's Electronics year-end balance sheet consisted of the following amounts: Cash $75,000,…

A: Introduction: Assets: Assets are of two types: 1 ) Current Assets 2 ) Non current Assets. Assets…

Q: Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2020. The…

A:

Q: f. Why are multiple security holdings of potentially dilutive securities ranked? why is this useful?…

A: Earnings Per Share (EPS) Earning per share is considered to be one of the important crucial tool in…

Q: You have a business manufacturing Artfarts for Dogtown, Inc. Following is the costing data you have…

A: Activity-based costing is a costing approach in which a company's activities are identified and the…

Q: Aztec Inc. produces soft drinks. Mixing is the first department, and its output is measured in…

A:

Q: wift, LLC purchased equipment (7-year property) for use in its business on October 15, 2021. This…

A: MACRS Depreciation To calculate the tax adjusted basis of the assets first to determine the cost of…

Q: On June 19, 20X0, a fire destroyed the entire uninsured merchandise inventory of the ABC…

A: Sales revenue is calculated as sum of cost of inventory and mark up value. Net sales is calculated…

Q: Indicate whether the following items are treated as "Separately stated item" or "Nonseparately…

A: Meaning: S Corporation means corporations which don't pay income tax themselves but act as a channel…

Q: Cash $13,000; Short-term Debt $21,00o; Buildings and Equipment $420,000; Inventory, $44,000; Notes…

A: Introduction: Assets: The resource having economic value called as Assets. Assets are of two types 1…

Q: On January 2, 2021, ABC Co. acquired 80% of XYZ Co. ordinary shares for P810,000. An amount of…

A: The net consolidated profit to be reported by ABC Co. would be adjusted with the impairment loss,…

Q: Clyde Corp is considering the purchase of a new piece of equipment. The cost savings from the…

A: Following formula used for answering above questions: Accounting rate of return = Annual Income /…

Q: If a company erroneously records a $50 check received from a customer as $500 in its records, which…

A: Since the company has made error in its books, the rectification also needs to eb done in its own…

Q: 14. Partner's Basis. (Obj. 4) At the beginning of the vear, Robin's basis in her 250 e loss of R&B…

A: A partner's basis in partnership can be used to analyze whether the transaction occurring between a…

Step by step

Solved in 2 steps

- On January 2, 2020, Tuao Company purchased 10% of Abulug Company's outstanding ordinary shares for P20,000,000. Tuao is the largest single shareholder in Abulug and this gives Tuao the power to participate in the financial and operating policy decisions of the Abulug but is not control or joint control over those policies. Abulug reported profit of P10,000,000 and paid dividend of P4,000,000. What should be the balance in Tuao's investment in Abulug Company at the end of 2020? A.P21,400,000 B.P21,000,000 C.P20,600,000 D.P20,000,000On December 31, 2020, R papa Company, an entity with no subsidiary, purchased 10,000 ordinary shares from Marcos Corp. at $150 per share. At the time of purchase, Marcos has an outstanding 50,000 shares with a total shareholders’ equity of $7,500,000. For the year 2021, Marcos reported a profit of $3,000,000. On December 30, 2021, R papa received a cash dividend of $50 per share. What is the carrying value of the investment at December 31, 2021?On January 2, 2020, Samantha Company bought 10% of Camille Company's outstanding ordinary shares for $400,000. Samantha Company is the largest single shareholder in Camille Company, and Samantha Company's officers are a majority on Camille Company's board of directors. Camille Company reported net income of $500,000 for 2020, and paid dividends of P150,000. In its December 31, 2020 balance sheet, what amount should Samantha Co. report as investment in Camille Co.?

- Handley Ltd. acquired 42% of the common shares of Lecce Ltd. on January 1, 2024, by paying $5.68 million for 142,000 shares. Lecce declared a cash dividend of $0.60 per share in each quarter that Handley received on March 20, June 20, September 20, and December 20. Lecce reported net income of $1.42 million for the year. At December 31, the market price of the Lecce shares was $44 per share.Promise corp owns 70% of Brown corp and 25% of Grower corp. In addition, Brown owns 40% of Grower stocks. In 2021, Promise, Brown and Grower reported net income of $90,000, $60,000 and $40,000 and paid dividends of $45,000, $30,000 and $10,000 respectively. Instructions: 1. What amount of consolidated net income will Promise report for 2021. 2. What amount of income will be assigned to noncontrolling interest in 2021. 3. What amount of dividends will be assigned to noncontrolling interest in 2021.On January 1, 2021, ABC purchased 90% of the outstanding shares of JKL Company at a cost of P1,632,000. On that date, JKL had P1,020,000 worth of outstanding shares and P1,020,000 worth of accumulated profits. For 2021, ABC Company had income of P571,200 from its own operations and paid dividends of P306,000. For 2021, JKL Company reported income of 132,600 and paid dividends of P61,200. All of the assets and liabilities of JKL have book values equal to their market values. On January 1, 2021, ABC sold equipment to JKL for P204,000. The book value of the equipment on that date was P244,800. The loss of P40,800 is reflected in the income of ABC indicated above. The equipment is expected to have a useful life of five years from the date of sale. In the December 21, 2021 consolidated statement of financial position, what will be the net income attributable to equity holders of ABC?

- On January 1, 2021, ABC purchased 90% of the outstanding shares of JKL Company at a cost of P1,632,000. On that date, JKL had P1,020,000 worth of outstanding shares and P1,020,000 worth of accumulated profits. For 2021, ABC Company had income of P571,200 from its own operations and paid dividends of P306,000. For 2021, JKL Company reported income of 132,600 and paid dividends of P61,200. All of the assets and liabilities of JKL have book values equal to their market values. On January 1, 2021, ABC sold equipment to JKL for P204,000. The book value of the equipment on that date was P244,800. The loss of P40,800 is reflected in the income of ABC indicated above. The equipment is expected to have a useful life of five years from the date of sale. In the December 21, 2021 consolidated statement of financial position, the net income attributable to equity holders of ABC should be presented at: Your answerEduardo, a large entity, owns 50% and 20% of Letecia Corporation’s ordinary and preference shares, respectively. Letecia’s shares outstanding at December 31, 2021 follow: Ordinary share, P5,000,000 10% non-cumulative preference share, P1,200,000 Letecia reported net income of P750,000 for the year ended December 31, 2021. What amount should Eduardo report as total revenue related to its investment in Letecia Company for the year ended December 31, 2021?On January 1, 2008, Pedestal Company purchased 80% of the outstanding shares of StarletCompany at a cost of P800,000. On that date, Starlet Company had P300,000 of Ordinary ShareCapital and P600,000 of Retained Earnings.For 2008, Pedestal Company had income of P300,000 from its own operations and paiddividends of P150,000. On the other hand, Starlet Company reported a net income of P100,000and paid dividends of P40,000. All assets and liabilities of Starlet Company have book valuesapproximately equal to their respective market values.Pedestal Company uses the equity method to account for its investment in StarletCompany. Impairment loss on goodwill for 2008 is P4,000.1. The amount Pedestal Company should record as Equity in Starlet Company Income for2008 isa. P78,000 c. P82,000b. P80,000 d. P76,000

- (TCO A) Bend Inc. holds 25% of the outstanding voting shares of Calico Co. and appropriately applies the equity method of accounting. Amortization associated with this investment equals $9,000 per year. For 20X3, Calico reported earnings of $80,000 and paid cash dividends of $30,000. During 20X3, Calico acquired inventory for $57,600, which was then sold to Bend for $90,000. At the end of 20X3, Bend still held some of this inventory at its transfer price of $40,000.Required:(1) Determine the amount of intra-entity profit at the end of 20X3.(2) Determine the amount of Equity in Investee Income that Bend should have reported for 20X3.On December 31, 2020, Naengmyeon Company, an entity with no subsidiary, purchased 10,000 ordinary shares from Bibim Corp. at P150 per share. At the time of purchase, Bibim has an outstanding 50,000 shares with a total shareholders’ equity of P7,500,000. For the year 2021, Bibim reported a profit of P3,000,000. On December 30, 2021, Naengmyeon received a cash dividend of P50 per share. What is the carrying value of the investment at December 31, 2021? a. P1,600,000 b. P2,100,000 c. P1,500,000 d. P2,600,000