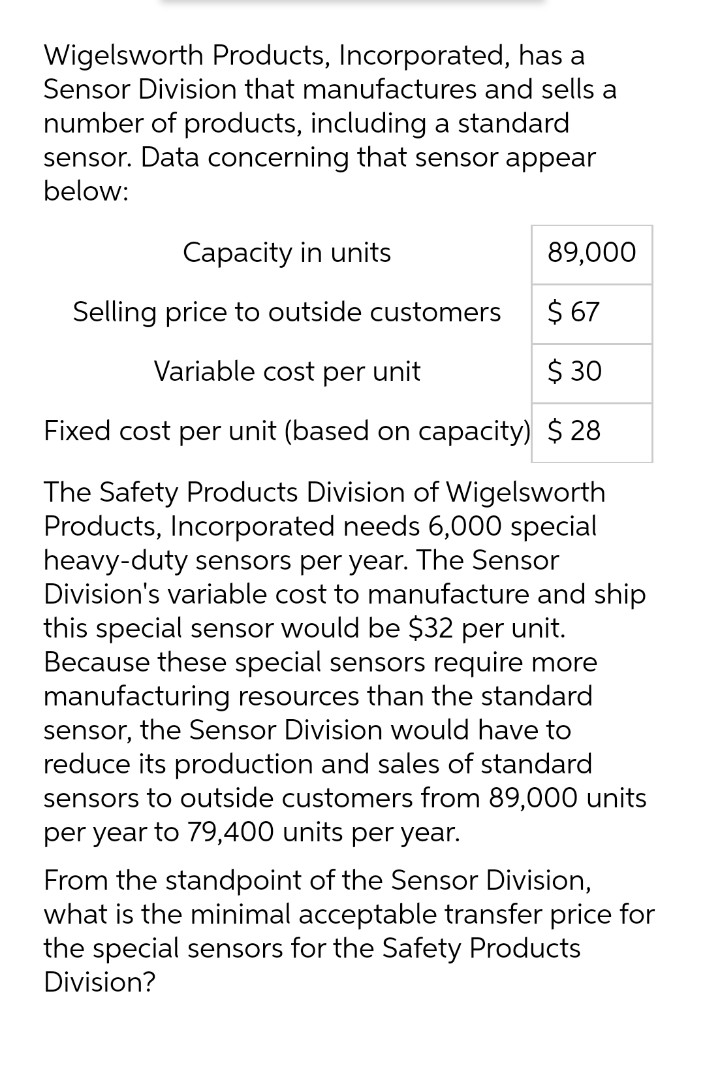

Variable cost per unit cost per unit (based on capacit afety Products Division of Wige ucts, Incorporated needs 6,000 J-duty sensors per year. The Se nn'r uariahlo co to manufactu

Q: Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks.…

A: Answer- Working note- Calculation of Units to be produced - Particular January February…

Q: a. Journalize the contingent liabilities associated with the hazardous materials spill. Use the…

A: Particulars…

Q: Meadow Company produces hand tools. A sales budget for the next four months is as follows: March…

A: Number of units to be produced in March = Ending finished goods inventory + Budgeted sales -…

Q: William's Watches sold goods to Colin's Clocks for $1,760 including GST. Colin's Clocks paid their…

A: Introduction:- The following basic information as follows under:- Journal entry is the first step…

Q: Do you think that what Pearlman would do without reporting the product as a falling product? Are…

A: Richmond, Inc. operates 44 shopping malls. Linda Pearlman, assistant financial manager, was asked to…

Q: Del Spencer is the owner and founder of Del Spencer’s Men’s Clothing Store. Del Spencer’s hasits own…

A: Calculation of total cash receipts for August and September August September Cash Sales…

Q: The balance sheets for Crosby Inc. and Gretzky Company reflect the following. Crosby Inc Gretzky…

A: For Crosby Inc. a. Total liabilities to equity ratio = (Current liabilities + long term…

Q: 6. [Para. 4-a-6] General Fund payrolls for the year totaled $4,460,212. Of that amount, $936,701 was…

A: In general fund Amount due to federal government account = Amount withheld for employees federal…

Q: e year are expected to total 960,000 units. Quarterly sales are 22%, 27%, 27%, and 24%,…

A: The production budget calculates the number of units of products that must be manufactured, and is…

Q: Which 2 of these datasets can be visualized using custom charts in the Performance Center?

A: Some times back, Business performance dashboard introduced performance centre. It is found within…

Q: Testing the information on the aged trial balance for detail tie-in is a necessary audit procedure,…

A: Trial balance is the summary of all general ledger accounts being used in business. Audit is the…

Q: ABC Corp. has net credit sales of P1,440,000 yearly with credit terms of n/30, which is also the…

A: Formula: Accounts receivable turnover = Net credit sales / Average accounts receivable Average…

Q: Which is often the third step in a new business? Multiple Choice Investing Financing…

A: A cash flow statement, sometimes known as a "statement of cash flows," is one of the three most…

Q: Internet giant Zoidle, a U.S. company, generated sales of £2.5 billion in the United Kingdom in 2013…

A: Generally we can say that tax avoidance is not illegal but avoiding tax is avoiding a social…

Q: Ponderosa, Inc., produces wiring harness assemblies used in the production of semi-trailer trucks.…

A: Production Budget: Production budget is a plan which is drawn to determine the number of units…

Q: Zoning laws set certain parameters concerning the right to use and build on property. If a landowner…

A: When the ways and methods to use land are guided and directed by the local municipal governments or…

Q: At the end of the year, Mercy Cosmetics' balance of Allowance for Uncollectible Accounts is $440…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: What is the amount of current assets, assuming the acce Accounts Payable $12,000 Buildings 70.000…

A: Current assets are those assets which are readily converted into cash within a short period of 1…

Q: Problem 3. CORPORATE EQUITY TRANSACTIONS 1. Issued 5,000 shares of no-par common stock. The market…

A: The company can raise funds by various methods. Some of them are, by way of issuing common stock,…

Q: Bramble Company is preparing its master budget for 2022. Relevant data pertaining to its sales,…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Explain the difference between a fixed and flexible budget stating which one is more appropriate for…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Direct labor standard (4 hours @ $6.90/hour) Actual hours worked Actual rate per hour $ 27.60 per…

A: The direct labor efficiency variance represents the comparison of standard labor efficiency and…

Q: partnership of Tom Jones and Rita Charles is considering admitting a new partner Terry Adams. After…

A: partnership is a such a form of business where two or more person combined there is skill capital…

Q: Replacement analysis should be done at the end of the useful life of the property.

A: Replacement analysis is the analysis in which the company analyse the different aspects of the…

Q: ompany’s flexible budget for 19,000 units of production showed sales; $87,400; variable costs,…

A: Basic Concept of CVP Analysis

Q: For the fiscal year 2015, Zeus Inc. recorded $1,750,000 in credit sales. On December 31, 2015, the…

A: Solution:- Preparation of necessary adjusting journal entries as follows under:- Journal entry is…

Q: ACCT 102 - Please Do All Subparts

A: The work in process account is prepared to record the direct costs incurred and manufacturing…

Q: Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring harness assemblies used…

A: A cash budget is the presentation of total cash available as reduced by the cash disbursements…

Q: Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2020. The…

A: Inventory costing, often known as inventory cost accounting, is the process through which businesses…

Q: PREPARE BRS? Bank Balance = $4,487 Book Balance = S$5,899 Interest income = $35 %3D Deposit in…

A: Introduction: Bank reconciliation statement: To Reconcile between the cash and pass book balances…

Q: Problem 1. The stockholders' equity section of MaiStyle Corporation's balance sheet at December 31…

A: Stockholders equity section is to be divided in three parts which shows the common stock , preferred…

Q: M8

A: The quantity demanded of a commodity is equal to the quantity supplied is known as equilibrium…

Q: A company had the following cash flows for the year: (a) Purchased land, $60,000 (b) Borrowed from…

A: CASH FLOW FROM FINANCING ACTIVITY COVERS REVENUE EARNED OR ASSETS SPENT ON FINANCING ACTIVITIES…

Q: The standard hours allowed for the work performed are:

A: Standard hours allowed for actual output Standard hours allowed is the number of hours of production…

Q: Bannister Motors Corporation reported the following var

A: Variance manages the cost gauge of the project. It furnishes you with data about whether you are an…

Q: 8.10 Operating Budget, Comprehensive Analysis Ponderosa, Inc., produces wiring harness assemblies…

A: What is meant by Budgeting? It is the process of forecasting future production, sales, cashflow…

Q: Business transaction analysis 1. Paid loan payables amounting to 15,000 2. Bought office supplies on…

A: The journal entries are prepared to record day to day transactions of the business on regular basis…

Q: Required: Prepare the company's flexible budget for July. Alyeski Tours Flexible Budget For the…

A: Budget means the expected value of future. Budget is not affected by the actual value as it is…

Q: TAP & Brothers Third-Quarter Budget Data July August September Credit Sales 256,167 262,962…

A: Cash Budget is an Future estimation of all expected cash receipts and cash payments to be made for…

Q: Require: 1. Analyze the following transactions and use the table below. 2. Indicate increases by…

A: Under an accounting equation, assets are always equal to sum of owner's equity and outside…

Q: ifferences to explain why the three former staff, even though affected by the collapse of the banks…

A: Individual differences are characteristics that distinguish pupils during the teaching and learning…

Q: Your company has a cus

A: The forecast may also be done about the cash balance in hand the organization forecasts to keep and…

Q: Anxious Company acquired two items of machinery. On December 31, 2020, Anxious Company purchased a…

A: Note means an instrument issued by company acknowledging the debt due from company to bond holder.…

Q: On November 1, 2006, Naruto Company issued P8,000,000 of its 10-year, 8% term bonds dated October 1,…

A: A balance sheet is a report that shows an entity's assets, liabilities, and equity at a certain…

Q: Toole Corporation uses a job order costing system and allocates manufacturing overhead at a rate of…

A: Journal entries are recorded in the books of an entity so as to maintain a proper record of…

Q: 1/01/2019 Purchases and Purchases Returns Cash in Hand 600 Bank Balance Freehold Premises Trade…

A: Income Statement- An income statement is a simple statement that shows all of a company's income and…

Q: Hanging Valley plc has issued share price of 2m ordinary shares, nominal value £1. The board of the…

A: Theoretical Ex Right price means price per share after the issue of right ordinary shares. Formula :…

Q: Use the information for the next two (2) questions. Bold Company estimated annual warranty expense…

A: Introduction: Warranty liability means repairing the products which was sold earlier. Warranty…

Q: How does the length of the time horizon affect the classification of a cost as fixed or variable?…

A: Cost are being classified as variable and fixed normally. It is necessary to bifurcate the cost in…

Q: Required information [The following information applies to the questions displayed below] Fitness…

A: Solution... Net operating income = $27,840 - $3,480 = $24,360 Average operating assets =…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Assume that at the beginning of 20x2, Cicleta trained the 2 assembly workers in a new approach that had the objective of increasing the efficiency of the assembly process. Cicleta also began moving toward a JIT purchasing and manufacturing system. When JIT is fully implemented, the demand for expediting is expected to be virtually eliminated. It is expected to take two to three years for full implementation. Assume that receiving cost is a step-fixed cost with steps of 1,500 orders. The other three activities employ resources that are acquired as used and needed. At the end of 20x2, the following results were reported for the four activities: Required: 1. Prepare a trend report that shows the non-value-added costs for each activity for 20x1 and 20x2 and the change in costs for the two periods. Discuss the reports implications. 2. Explain the role of activity reduction for receiving and for expediting. What is the expected value of SQ for each activity after JIT is fully implemented? 3. What if at the end of 20x2, the selling price of a competing product is reduced by 27 per unit? Assume that the firm produces and sells 20,000 units of its product and that its product is associated only with the four activities being considered. By virtue of the waste-reduction savings, can the competitors price reduction be matched without reducing the unit profit margin of the product that prevailed at the beginning of the year? If not, how much more waste reduction is needed to achieve this outcome? In this case, what price decision would you recommend?Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:Hatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its products is 65 minutes per unit. The budgeted conversion costs for the manufacturing cell dedicated to the product are 12,960,000 per year. The total labor minutes available are 1,440,000. During the year, the cell was able to produce 0.6 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per minute (the amount of conversion cost actually assigned to the product). 3. Discuss how this approach to assigning conversion cost can improve delivery time performance. Explain how conversion cost acts as a performance driver for on-time deliveries.

- Keleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows:Carltons Kitchens makes two types of pasta makers: Strands and Shapes. The company expects to manufacture 70,000 units of Strands, which has a per-unit direct material cost of $10 and a per-unit direct labor cost of $60. It also expects to manufacture 30.000 units of Shapes, which has a per-unit material cost of $15 and a per-unit direct labor cost of $40. It is estimated that Strands will use 140,000 machine hours and Shapes will require 60,000 machine hours. Historically, the company has used the traditional allocation method and applied overhead at a rate of $21 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is shown: The cost driver for each cost pool and its expected activity is shown: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing?Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.

- Evans Company had total sales of 3,000,000 for fiscal 20x5. The costs of quality-related activities are given below. Required: 1. Prepare a quality cost report, classifying costs by category and expressing each category as a percentage of sales. What message does the cost report provide? 2. Prepare a bar graph and pie chart that illustrate each categorys contribution to total quality costs. Comment on the significance of the distribution. 3. What if, five years from now, quality costs are 7.5 percent of sales, with control costs being 65 percent of the total quality costs? What would your conclusion be?Corazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?Aldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?Remarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?