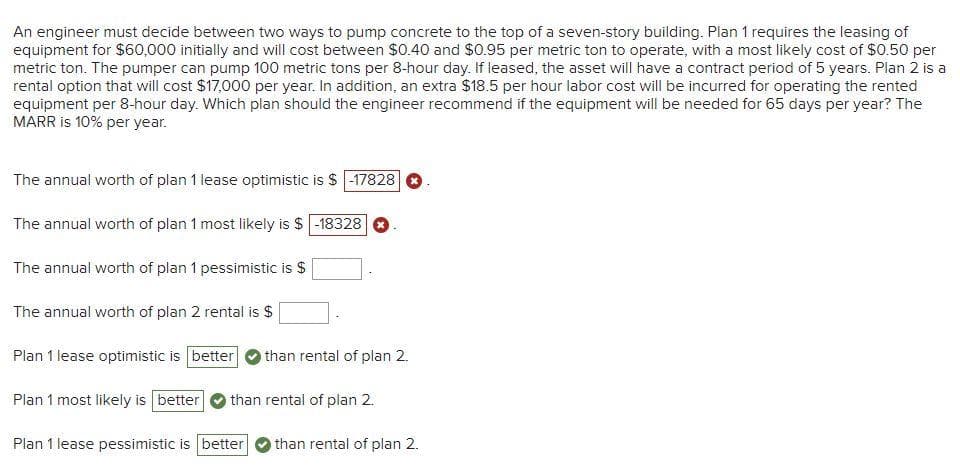

An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.50 per metric ton. The pumper can pump 100 metric tons per 8-hour day. If leased, the asset will have a contract period of 5 years. Plan 2 is a rental option that will cost $17,000 per year. In addition, an extra $18.5 per hour labor cost will be incurred for operating the rented equipment per 8-hour day. Which plan should the engineer recommend if the equipment will be needed for 65 days per year? The MARR is 10% per year. The annual worth of plan 1 lease optimistic is $ -17828 The annual worth of plan 1 most likely is $ -18328 The annual worth of plan 1 pessimistic is $ The annual worth of plan 2 rental is $ Plan 1 lease optimistic is better than rental of plan 2.

An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.50 per metric ton. The pumper can pump 100 metric tons per 8-hour day. If leased, the asset will have a contract period of 5 years. Plan 2 is a rental option that will cost $17,000 per year. In addition, an extra $18.5 per hour labor cost will be incurred for operating the rented equipment per 8-hour day. Which plan should the engineer recommend if the equipment will be needed for 65 days per year? The MARR is 10% per year. The annual worth of plan 1 lease optimistic is $ -17828 The annual worth of plan 1 most likely is $ -18328 The annual worth of plan 1 pessimistic is $ The annual worth of plan 2 rental is $ Plan 1 lease optimistic is better than rental of plan 2.

College Algebra (MindTap Course List)

12th Edition

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:R. David Gustafson, Jeff Hughes

Chapter6: Linear Systems

Section6.8: Linear Programming

Problem 5SC: If during the following year it is predicted that each comedy skit will generate 30 thousand and...

Related questions

Question

How is the AOC calculated and what are the solutions with steps? Fast solution

Transcribed Image Text:An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of

equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.50 per

metric ton. The pumper can pump 100 metric tons per 8-hour day. If leased, the asset will have a contract period of 5 years. Plan 2 is a

rental option that will cost $17,000 per year. In addition, an extra $18.5 per hour labor cost will be incurred for operating the rented

equipment per 8-hour day. Which plan should the engineer recommend if the equipment will be needed for 65 days per year? The

MARR is 10% per year.

The annual worth of plan 1 lease optimistic is $-17828

The annual worth of plan 1 most likely is $ -18328

The annual worth of plan 1 pessimistic is $

The annual worth of plan 2 rental is $

Plan 1 lease optimistic is better than rental of plan 2.

Plan 1 most likely is better than rental of plan 2.

Plan 1 lease pessimistic is better than rental of plan 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning