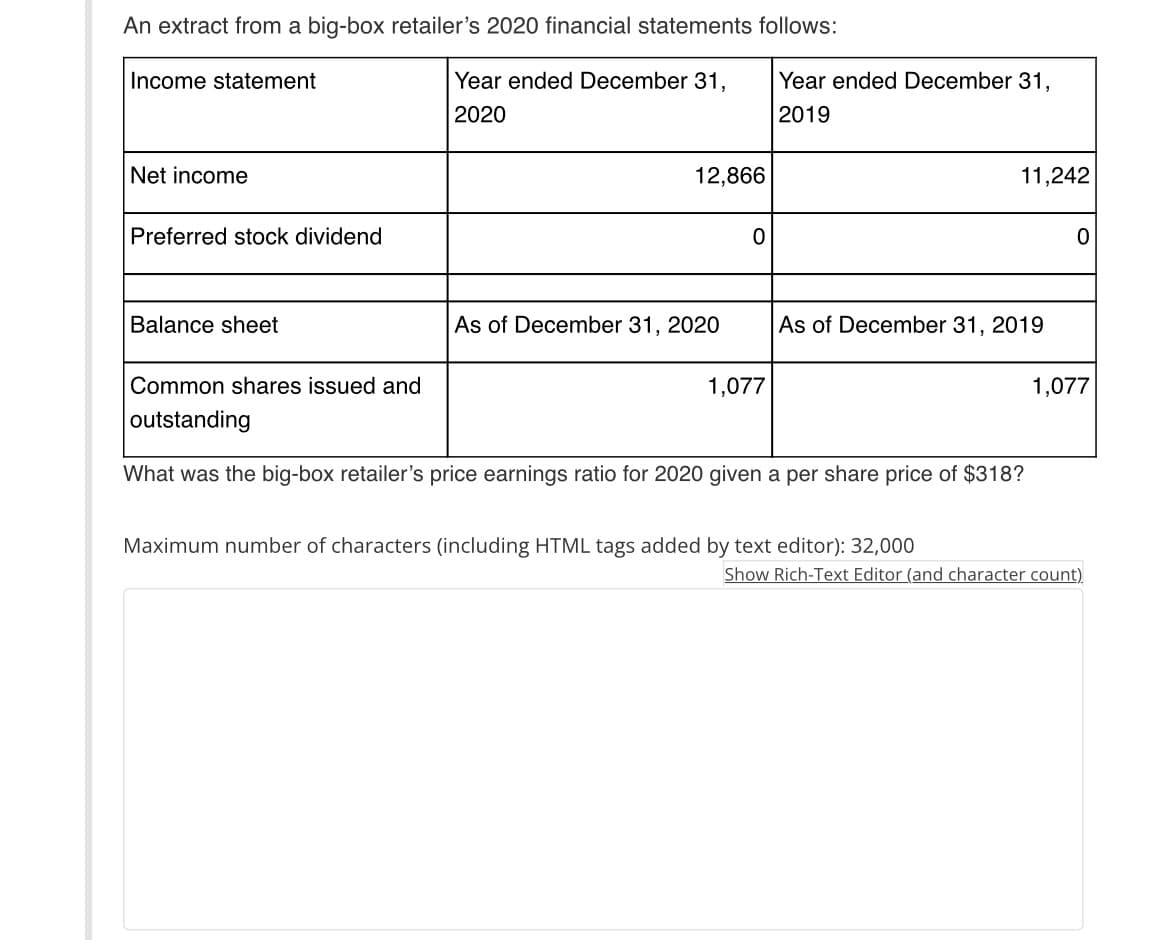

An extract from a big-box retailer's 2020 financial statements follows: Income statement Year ended December 31, 2020 Net income Preferred stock dividend Balance sheet 12,866 As of December 31, 2020 0 1,077 Year ended December 31, 2019 11,242 As of December 31, 2019 Common shares issued and outstanding What was the big-box retailer's price earnings ratio for 2020 given a per share price of $318? Maximum number of characters (including HTML tags added by text editor): 32,000 0 1,077 Show Rich-Text Editor (and character count)

An extract from a big-box retailer's 2020 financial statements follows: Income statement Year ended December 31, 2020 Net income Preferred stock dividend Balance sheet 12,866 As of December 31, 2020 0 1,077 Year ended December 31, 2019 11,242 As of December 31, 2019 Common shares issued and outstanding What was the big-box retailer's price earnings ratio for 2020 given a per share price of $318? Maximum number of characters (including HTML tags added by text editor): 32,000 0 1,077 Show Rich-Text Editor (and character count)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1E

Related questions

Question

Transcribed Image Text:An extract from a big-box retailer's 2020 financial statements follows:

Income statement

Year ended December 31,

2020

Net income

Preferred stock dividend

Balance sheet

12,866

As of December 31, 2020

0

Year ended December 31,

2019

1,077

11,242

As of December 31, 2019

Common shares issued and

outstanding

What was the big-box retailer's price earnings ratio for 2020 given a per share price of $318?

Maximum number of characters (including HTML tags added by text editor): 32,000

0

1,077

Show Rich-Text Editor (and character count)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning