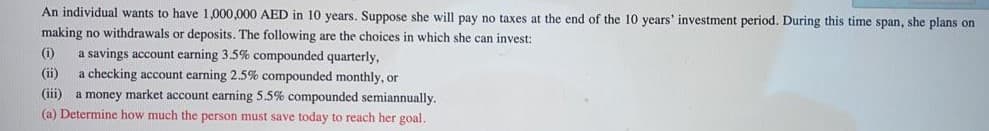

An individual wants to have 1,000,000 AED in 10 years. Suppose she will pay no taxes at the end of the 10 years' investment period. During this time span, she plans on making no withdrawals or deposits. The following are the choices in which she can invest: a savings account earning 3.5% compounded quarterly, a checking account earning 2.5% compounded monthly, or (iii) a money market account earning 5.5% compounded semiannually. (i) (ii) (a) Determine how much the person must save today to reach her goal.

An individual wants to have 1,000,000 AED in 10 years. Suppose she will pay no taxes at the end of the 10 years' investment period. During this time span, she plans on making no withdrawals or deposits. The following are the choices in which she can invest: a savings account earning 3.5% compounded quarterly, a checking account earning 2.5% compounded monthly, or (iii) a money market account earning 5.5% compounded semiannually. (i) (ii) (a) Determine how much the person must save today to reach her goal.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:An individual wants to have 1,000,000 AED in 10 years. Suppose she will pay no taxes at the end of the 10 years' investment period. During this time span, she plans on

making no withdrawals or deposits. The following are the choices in which she can invest:

a savings account earning 3.5% compounded quarterly,

a checking account earning 2.5% compounded monthly, or

(iii) a money market account earning 5.5% compounded semiannually.

(a) Determine how much the person must save today to reach her goal.

(i)

(ii)

Transcribed Image Text:(b) What is her optimal choice and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College