An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals are as follows. Capital Budget Proposals Capital required Annual operating return $ 180,000 16, 200 $ 96, 000 $ 60,000 20,400 24,960 Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required return is 10 percent. a-1. Assume you are the investment center manager. Calculate the residual income for each project? a-2. Which project do you prefer? b-1. Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROl for the investment center's evaluation. Calculate the ROI for each project? b-2. Would your preferences for the projects listed change? Complete this question by entering your answers in the tabs below.

An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals are as follows. Capital Budget Proposals Capital required Annual operating return $ 180,000 16, 200 $ 96, 000 $ 60,000 20,400 24,960 Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required return is 10 percent. a-1. Assume you are the investment center manager. Calculate the residual income for each project? a-2. Which project do you prefer? b-1. Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROl for the investment center's evaluation. Calculate the ROI for each project? b-2. Would your preferences for the projects listed change? Complete this question by entering your answers in the tabs below.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 3P

Related questions

Question

Performance roi

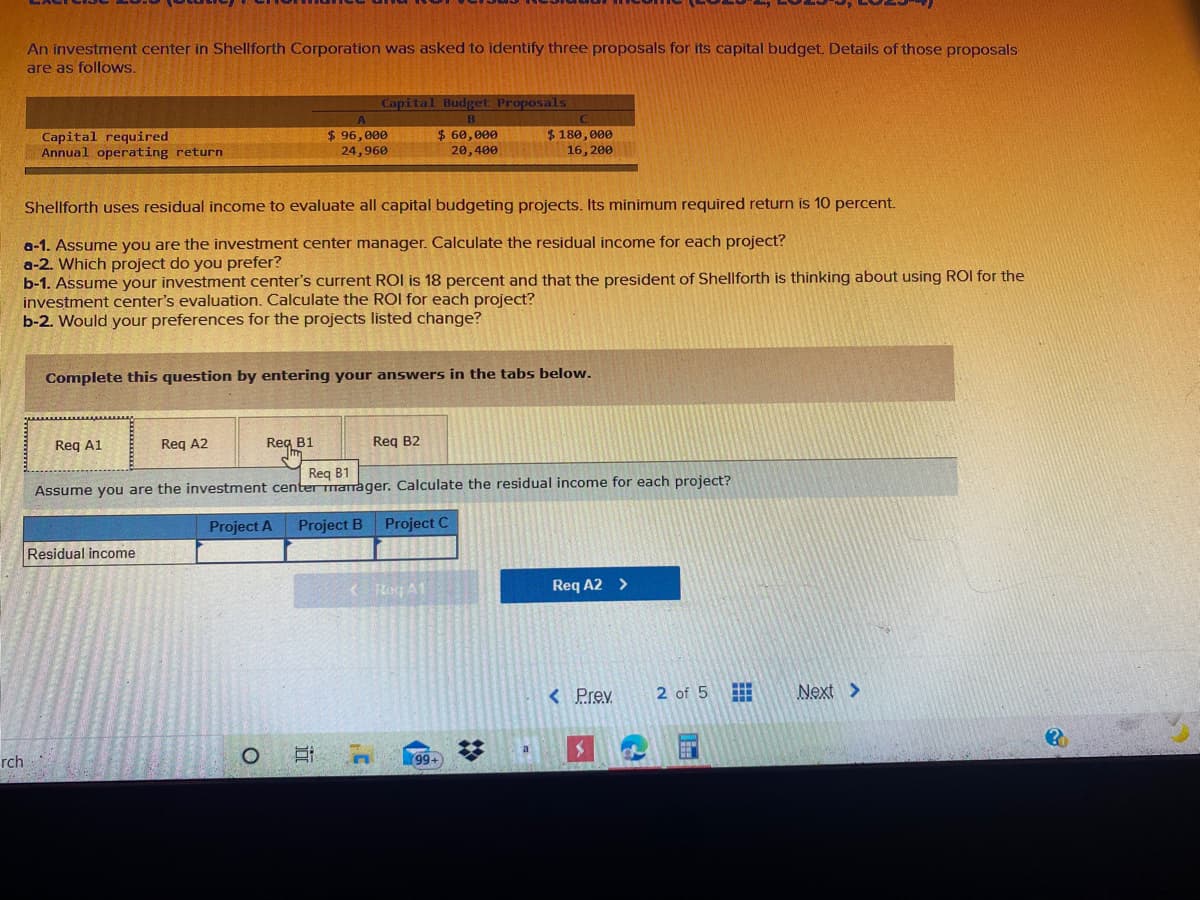

Transcribed Image Text:An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals

are as follows.

Capital Budget Proposals

Capital required

Annual operating return

$ 96,000

24,960

$ 60, 000

20,400

$ 180, 000

16, 200

Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required return is 10 percent.

a-1. Assume you are the investment center manager. Calculate the residual income for each project?

a-2. Which project do you prefer?

b-1. Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROI for the

investment center's evaluation. Calculate the ROI for each project?

b-2. Would your preferences for the projects listed change?

Complete this question by entering your answers in the tabs below.

Reg A1

Req A2

Reg B1

Reg B2

Reg B1

Assume you are the investment center manager. Calculate the residual income for each project?

Project A Project B

Project C

Residual income

< Reg A1

Req A2 >

< Prev

2 of 5

Next >

a

rch

+66

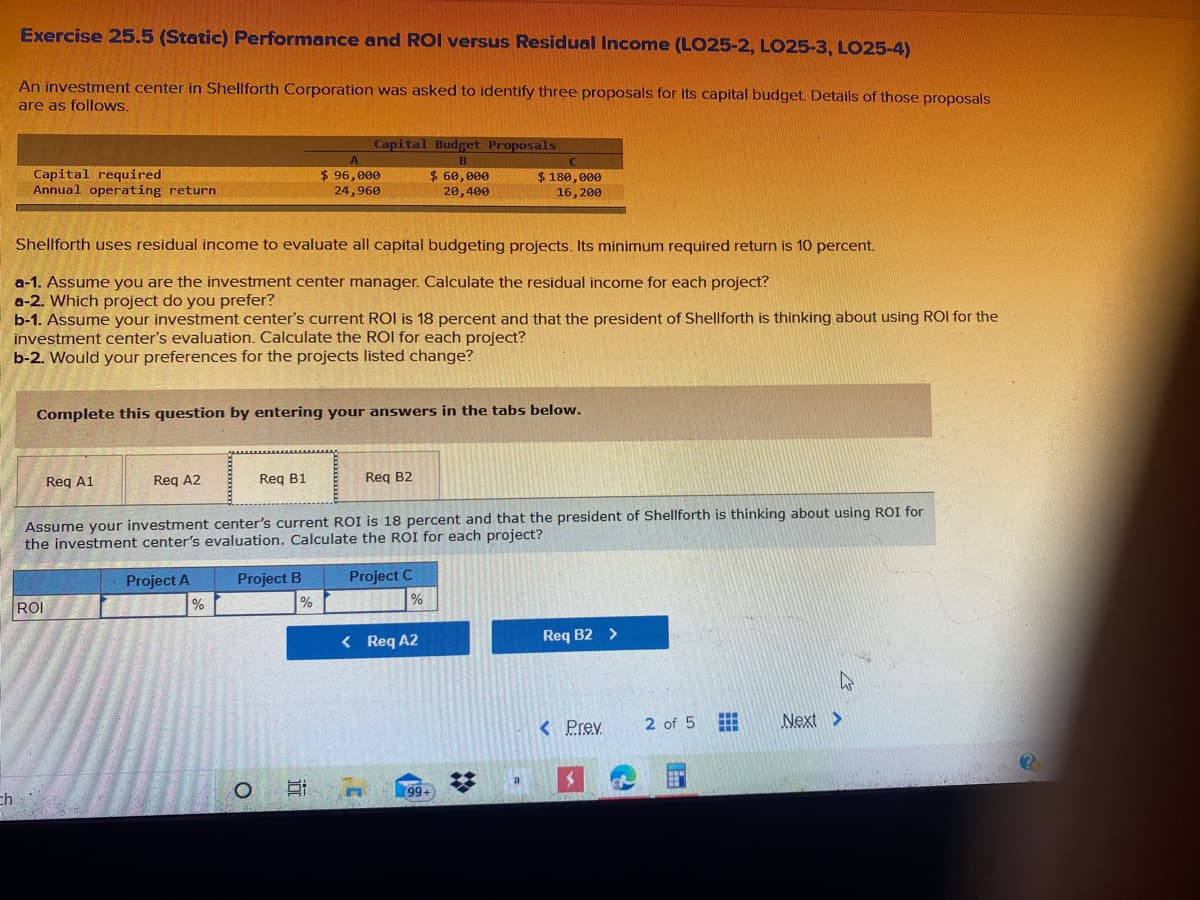

Transcribed Image Text:Exercise 25.5 (Static) Performance and ROI versus Residual Income (LO25-2, LO25-3, LO25-4)

An investment center in Shellforth Corporation was asked to identify three proposals for its capital budget. Details of those proposals

are as follows.

Capital Budget Proposals

B

Capital required

Annual operating return

$ 96,000

24,960

$ 60,000

$ 180,000

20,400

16, 200

Shellforth uses residual income to evaluate all capital budgeting projects. Its minimum required return is 10 percent.

a-1. Assume you are the investment center manager. Calculate the residual income for each project?

a-2. Which project do you prefer?

b-1. Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROI for the

investment center's evaluation. Calculate the ROI for each project?

b-2. Would your preferences for the projects listed change?

Complete this question by entering your answers in the tabs below.

Req A1

Reg A2

Req B1

Reg B2

Assume your investment center's current ROI is 18 percent and that the president of Shellforth is thinking about using ROI for

the investment center's evaluation. Calculate the ROI for each project?

Project A

Project B

Project C

ROI

%

< Req A2

Req B2 >

< Prev

2 of 5

Next >

99

ch

%23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College