An investor can design a risky portfolio based on two stocks, S and B. Stock S has an expected return of 18% and a standard deviation of returm of 20%. Stock B has an expected return of 14% and a standard deviation of return of 5 %. The correlation coefficient between the returns of S and B is 0.50. The risk-free rate of return is 10%. The standard deviation of return on the optimal risky portfolio is (E(r)-r,)o-(E(r,)-r,)P0 (E(r,) -,)০; + (F(;,) -r,)০;-[EC,) -r, + E(G,) - 7,\p.an0, Wa %D 7% 0% 20% O 5%

An investor can design a risky portfolio based on two stocks, S and B. Stock S has an expected return of 18% and a standard deviation of returm of 20%. Stock B has an expected return of 14% and a standard deviation of return of 5 %. The correlation coefficient between the returns of S and B is 0.50. The risk-free rate of return is 10%. The standard deviation of return on the optimal risky portfolio is (E(r)-r,)o-(E(r,)-r,)P0 (E(r,) -,)০; + (F(;,) -r,)০;-[EC,) -r, + E(G,) - 7,\p.an0, Wa %D 7% 0% 20% O 5%

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.5: Comparing Sets Of Data

Problem 14PPS

Related questions

Question

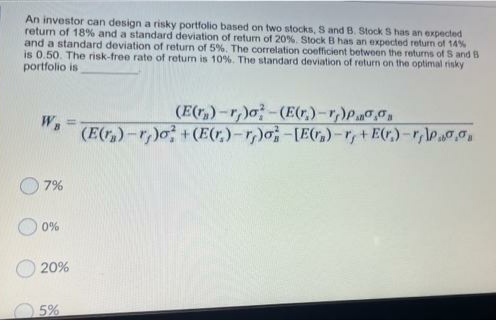

Transcribed Image Text:An investor can design a risky portfolio based on two stocks, S and B. Stock S has an expected

retun of 18% and a standard deviation of return of 20%. Stock B has an expected return of 14%

and a standard deviation of return of 5 %. The correlation coefficient between the returms of S and B

is 0.50. The risk-free rate of retun is 10%. The standard deviation of return on the optimal risky

portfolio is

(E(r,)-r,)o-(E(r,)-r,)P0

(E(r,)-r)o +(E(r,)-r,)o-[Er,)-r,+E(r)-r,\Pao.

WB

7%

O 0%

20%

5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill