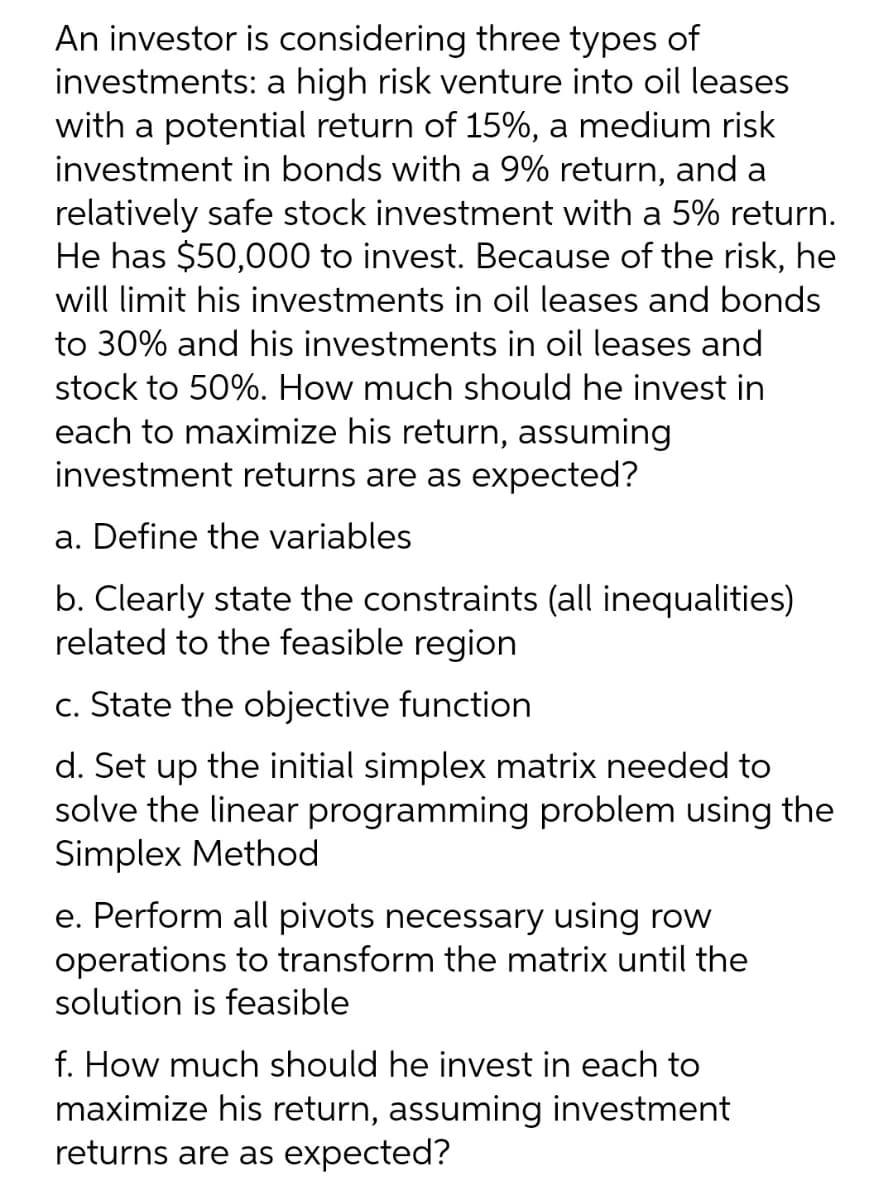

An investor is considering three types of investments: a high risk venture into oil leases with a potential return of 15%, a medium risk investment in bonds with a 9% return, and a relatively safe stock investment with a 5% return. He has $50,000 to invest. Because of the risk, he will limit his investments in oil leases and bonds to 30% and his investments in oil leases and stock to 50%. How much should he invest in each to maximize his return, assuming investment returns are as expected? a. Define the variables b. Clearly state the constraints (all inequalities) related to the feasible region c. State the objective function

An investor is considering three types of investments: a high risk venture into oil leases with a potential return of 15%, a medium risk investment in bonds with a 9% return, and a relatively safe stock investment with a 5% return. He has $50,000 to invest. Because of the risk, he will limit his investments in oil leases and bonds to 30% and his investments in oil leases and stock to 50%. How much should he invest in each to maximize his return, assuming investment returns are as expected? a. Define the variables b. Clearly state the constraints (all inequalities) related to the feasible region c. State the objective function

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 28EQ

Related questions

Question

Transcribed Image Text:An investor is considering three types of

investments: a high risk venture into oil leases

with a potential return of 15%, a medium risk

investment in bonds with a 9% return, and a

relatively safe stock investment with a 5% return.

He has $50,000 to invest. Because of the risk, he

will limit his investments in oil leases and bonds

to 30% and his investments in oil leases and

stock to 50%. How much should he invest in

each to maximize his return, assuming

investment returns are as expected?

a. Define the variables

b. Clearly state the constraints (all inequalities)

related to the feasible region

c. State the objective function

d. Set up the initial simplex matrix needed to

solve the linear programming problem using the

Simplex Method

e. Perform all pivots necessary using row

operations to transform the matrix until the

solution is feasible

f. How much should he invest in each to

maximize his return, assuming investment

returns are as expected?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell