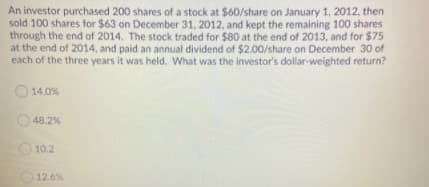

An investor purchased 200 shares of a stock at $60/share on January 1, 2012, then sold 100 shares for $63 on December 31, 2012, and kept the remaining 100 shares through the end of 2014. The stock traded for $80 at the end of 2013, and for $75 at the end of 2014, and paid an annual dividend of $2.00/share on December 30 of each of the three years it was held. What was the investor's dollar-weighted return? O 14.0% O 48.2% O 10.2 12.6%

Q: Marshall Company had 80,000 ordinary shares outstanding in January 2020. The entity distributed a…

A: Stockholder’s equity is a part of balance sheet which shows the total owner’s equity that is…

Q: On November 12, 2013, Berube Co. repurchased 10,000 shares of its own stock at a price of $20 per…

A: Date Accounts Debit Credit Nov. 12, 2013 Treasury stock (10000 shares x $20 per share) $200,000…

Q: Aranda Corporation made the following cash purchases of securities during 2020, which is the first…

A: Investments: Companies invest in stocks and bonds of other companies or governmental entity to…

Q: Early in 2008, Septa, Inc., was organized with authorization to issue 1,000 shares of $100 par value…

A: Shareholder's equity as on 32st Dec. 2011 Common share capital(80000*$1) $80000 Preferred share…

Q: In 2018, Borland Semiconductors entered into the transactions described below. In 2015, Borland had…

A:

Q: Early in 2007, Parker Industries was formed with authorization to issue 100,000 shares of $20 par…

A:

Q: If Frank Corporation sells 100,000 shares of its new $1 par value common stock to investors for $1…

A: Journal entry for the sale of common stock is:

Q: On January 1, 2016, Samuel Company had 21,000 shares of common stock outstanding and issued an…

A: Basic earning per share can be calculated by dividing net income after dividend by the weighted…

Q: Jocelyn Company received dividends from its ordinary share investments during the year 2023 as…

A: Dividend income includes the stock dividend received at market value of shares. If the investment is…

Q: In 2016, Borland Semiconductors entered into the transactions described below. In 2013, Borland had…

A:

Q: Answer all questions. Ch.10-1

A: Please find the answer in the attched pic

Q: On December 29, Adams Apples purchased 1,000 shares of General Electric common stock for $19,000 and…

A: As investment place in active trading account for immediate resale, therefore appropriate reporting…

Q: On July 1, 2022, Denver Company purchased 30,000 shares of Eagle Company's 100,000 outstanding…

A: Lets understand the basics. When one entity purchase more than 20% of the share and less than 50% of…

Q: Franklin Company had 100 shares of common stock issued and outstanding at December 31, 2017. On July…

A: The question is based on the concept of calculation of diluted earning per share. Formula as,…

Q: Knapp Industries began business on January 1, 2018 by issuing all of its 1,850,000 authorized shares…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: On June 1, 2020, Golden Warriors Corporation declared a share capital dividend entitling its…

A: The dividend is declared to the shareholders from the retained earnings of the business. The…

Q: On January 1, 2016, A company issued 100,000 cumulative preferred shares with a stated dividend of…

A: Share warrant signifies the holder of such financial instrument the right to buy or purchase a…

Q: What is the number of shares to be used in computing diluted earnings per share for the yea

A: Diluted earnings per share are used to measure the quality of the company's earnings per share if…

Q: Calculate the following. (Round all answers to two decimal places.) 1. Profit on this stock…

A: 1) Profit on this stock transaction = Ending value - beginning value Profit on this stock…

Q: Knapp Industries began business on January 1, 2018 by issuing all of its 1,600,000 authorized shares…

A: Treasury shares has debit account balance. It would be deducted to determine the stockholders'…

Q: Waterway Corporation was organized on January 2, 2020. During 2020, Waterway issued 39200 shares at…

A: Purchase of treasury stock will reduce the stockholders equity. The net income will be added to…

Q: During a recent year, Emerson Electric paid an annual dividend of $0.64 per share. Calculate the…

A: The share price is the current market price of the share. It is the price of the share at any…

Q: On January 1, 2020, Keith Company paid $96,000 for 8,000 shares of Jerry Company common stock. The…

A: What amount will be reported in the balance sheet of Keith Company for the investment in Jerry…

Q: On January 1, 2016, Tonge Industries had outstanding 440,000 common shares (par $l) that originally…

A:

Q: On October 17, 2021, LILAC Corporation exchanged 20,000 shares of its ₱200 par value stock for land.…

A: The shares are exchanged for their appraised value.

Q: Adams Industries holds 40,000 shares of FedEx common stock. On December 31, 2015, and December 31,…

A:

Q: Early in 2007, Parker Industries was formed with authorization to issue 100,000 shares of $20…

A: Stockholders equity sections represents the funds contributed by all types of shareholders such as…

Q: kholders' equity on that date. On April 1, 2021, Lapwing sold 20% interest (one-fourth of its…

A: Compare the cash received to the item's carrying value to determine if you earned a profit or a loss…

Q: Knapp Industries began business on January 1, 2018 by issuing all of its 1,000,000 authorized shares…

A: The purchase of own shares is known as treasury stock.

Q: Butler, Inc. had the following treasury stock transactions in 2024: July 8 Purchased 1,000 shares of…

A: The treasury stock is a stock in which the company buys back its own shares. The treasury stock is…

Q: SHOW THE JOURNAL ENTRY FOR EACH TRANSACTIONS Your inquiries and investigation revealed the…

A: * As per the bartleby guidelines in case of interlinked question, answer first 3 only Treasury…

Q: In January 2022, the management of Wildhorse Company concludes that it has sufficient cash to…

A: Bonds- A bond is a fixed-income tool that represents a loan made by a shareholder to a borrower…

Q: On January 1, 2020, Alpha Aviation issues 105,000 shares of stock. Shortly thereafter, Delta Tech…

A: Dividend refers to the profit distribution to its shareholders and when the business earns the…

Q: On October 1, 2015, Adoll Company acquired 1,000 shares of its $1 par value stock for $44 per share…

A: The company can raise capital by issuing financial instruments of the company. The financial…

Q: On December 10, 2010, Smitty Corporation reacquired2,000 shares of its own $5 par value common stock…

A: At the time of reacquisition of 2,000 shares of its own $5 par value common stock at a priceof $60…

Q: Abajo, Inc. went into business on January 1, 2017 when it issued 100 shares of stock for $10,000. No…

A: Return on Equity = Net IncomeShareholder's Equity it is the measure of financial performance and it…

Q: Mimi Corporation started business in 2007 by issuing 200,000 shares of P20 par common stock for P36…

A: Amount of paid-in capital from treasury stock = ( Market Price - Purchase Price ) x Number of shares

Q: In 1970, Wal-Mart offered 300,000 shares of itscommon stock to the public at a price of $16.50…

A: Stock price = $16.50 per share Number of shares purchased = 100 shares Value of share in 2014 =…

Q: Assume you purchased 1,000 shares of Pharma Group, a pharmaceuticals manufacturer, at the market's…

A: Initial value = Number of shares × Opening price=1,000 × $22=$22,000 Ending value = Number of…

Q: Lea Inc, owned 900,000 shares of Mia Corporation stock. On December 31, 2010, when Lea's account…

A: Answer with all workings are as follows:

Q: Doug Graves Cemetery had 50,000 shares of common stock issued and outstanding at January 1, 2018.…

A: Dividend is the incentive given to equity and preference shareholders of the company, in order to…

Q: On December 31, 2017, Jackson Company had 100,000 shares of common stock outstanding and 24,000…

A: Answer- Part 1 - Computation of Basic Earnings per share- Income after 7% dividend on cumulative…

Q: Jonah purchased 2% of Global Panda’s $15 par value common stock in 2017 for the market price of $20…

A:

Q: LASAY Company received dividends from its investments in ordinary shares during the year 2013 as…

A: Step 1 In the financial statements, the dividend in kind is reported as increase in the investment…

Q: In 2014, Eklund, Inc., issued for $103 per share, 70,000 shares of $100 par value convertible…

A: Preference shares and common stock shares are two types of shares that are being issued by the…

Q: Knapp Industries began business on January 1, 2018 by issuing all of its 1,000,000 authorized shares…

A: Journal Entry - It is record of every business transaction whether it economic or non economic for a…

Q: Early 2014, H industries was forms with authorization to issue 250,000 share of $10 par value common…

A: Stock holder’s equity: This section of the balance sheet shows the total balance in the stock…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.The following selected transactions and events occurred during 2013: a. Issued 200 shares of preferred stock for 20,000. b. Sold 800 shares of treasury stock for 2,800. c. Declared and issued a 4% common stock dividend. The market value on the date of declaration was 5 per share. d. Generated a net loss for the year of 16,000. e. Declared and paid the full years dividend on all the preferred stock and a dividend of 15 per share on common stock outstanding at the end of the year. Enter beginning balances for 2013 on STOCKEQ2. Then erase all 2012 entries and enter the transactions for 2013. Save the results as STOCKEQ4. Print the results.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.

- Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). As vice president of finance for the firm, you have been asked to calculate earnings per share for 2011. The worksheet EPS has been provided to assist you.Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2 convertible securities outstanding at the end of 2019. These are: 1. Convertible preferred stock: 1,000 shares of 9%, 100 par, preferred stock were issued in 2015 for 140 per share. Each share of preferred stock is convertible into 3.5 shares of common stock. The current dividends have been paid. To date, no preferred stock has been converted. 2. Convertible bonds: Bonds with a face value of 100,000 and an interest rate of 10% were issued at par on July 1, 2019. Each 1,000 bond is convertible into 35 shares of common stock. To date, no bonds have been converted. Percy earned net income of 54,000 during 2019. Its income tax rate is 30%. Required: Compute the 2019 diluted earnings per share. What earnings per share amount(s) would Percy report on its 2019 income statement?Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8% preferred stock outstanding on January 1, 2011. Each share of preferred stock is convertible into four shares of common stock. The stock has not been converted. During the year, Ponce Towers issued additional shares of common stock as follows: For 2011, Ponce Towers, Inc., had income from continuing operations of 545,000 and a 72,000 loss from discontinued operations (net of tax). Open the file EPS from the website for this book at cengagebrain.com. Enter all input items (AF) in the appropriate cells in the Data Section. Enter all formulas in the appropriate cells in the Answer Section. Enter your name in cell A1. Save the completed file as EPS2. Print the worksheet when done. Also print your formulas. Check figure: Basic earnings per share from continuing operations (cell D29), 5.94.

- Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000According to a company press release, on January 5, 2012, Hansen Natural Corporation changed its name to Monster Beverage Corporation. According to Yahoo Finance, on that day the value of the company stock (symbol: MNST) was $15.64 per share. On January 5, 2018, the stock closed at $63.49 per share. This represents an increase of nearly 306%. A. Discuss the factors that might influence the increase in share price. B. Consider yourself as a potential shareholder. What factors would you consider when deciding whether or not to purchase shares in Monster Beverage Corporation today?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.

- Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73