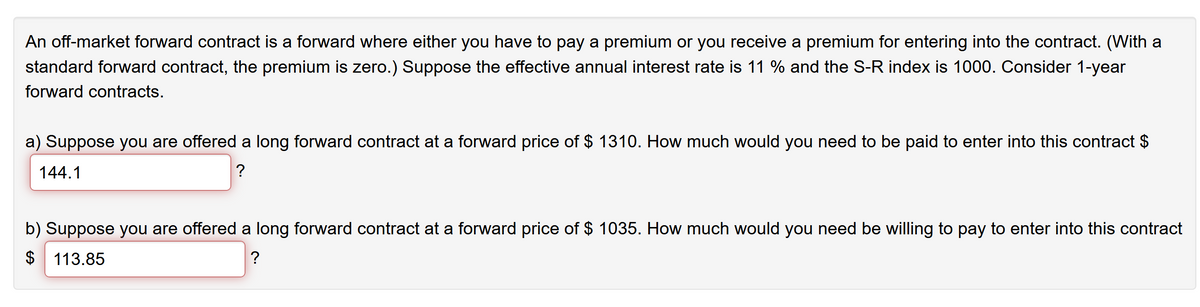

An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a standard forward contract, the premium is zero.) Suppose the effective annual interest rate is 11 % and the S-R index is 1000. Consider 1-year forward contracts. a) Suppose you are offered a long forward contract at a forward price of $ 1310. How much would you need to be paid to enter into this contract $ 144.1 b) Suppose you are offered a long forward contract at a forward price of $ 1035. How much would you need be willing to pay to enter into this contract 2$ 113.85 ?

An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a standard forward contract, the premium is zero.) Suppose the effective annual interest rate is 11 % and the S-R index is 1000. Consider 1-year forward contracts. a) Suppose you are offered a long forward contract at a forward price of $ 1310. How much would you need to be paid to enter into this contract $ 144.1 b) Suppose you are offered a long forward contract at a forward price of $ 1035. How much would you need be willing to pay to enter into this contract 2$ 113.85 ?

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 3SBD

Related questions

Question

Transcribed Image Text:An off-market forward contract is a forward where either you have to pay a premium or you receive a premium for entering into the contract. (With a

standard forward contract, the premium is zero.) Suppose the effective annual interest rate is 11 % and the S-R index is 1000. Consider 1-year

forward contracts.

a) Suppose you are offered a long forward contract at a forward price of $ 1310. How much would you need to be paid to enter into this contract $

144.1

?

b) Suppose you are offered a long forward contract at a forward price of $ 1035. How much would you need be willing to pay to enter into this contract

$ 113.85

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you