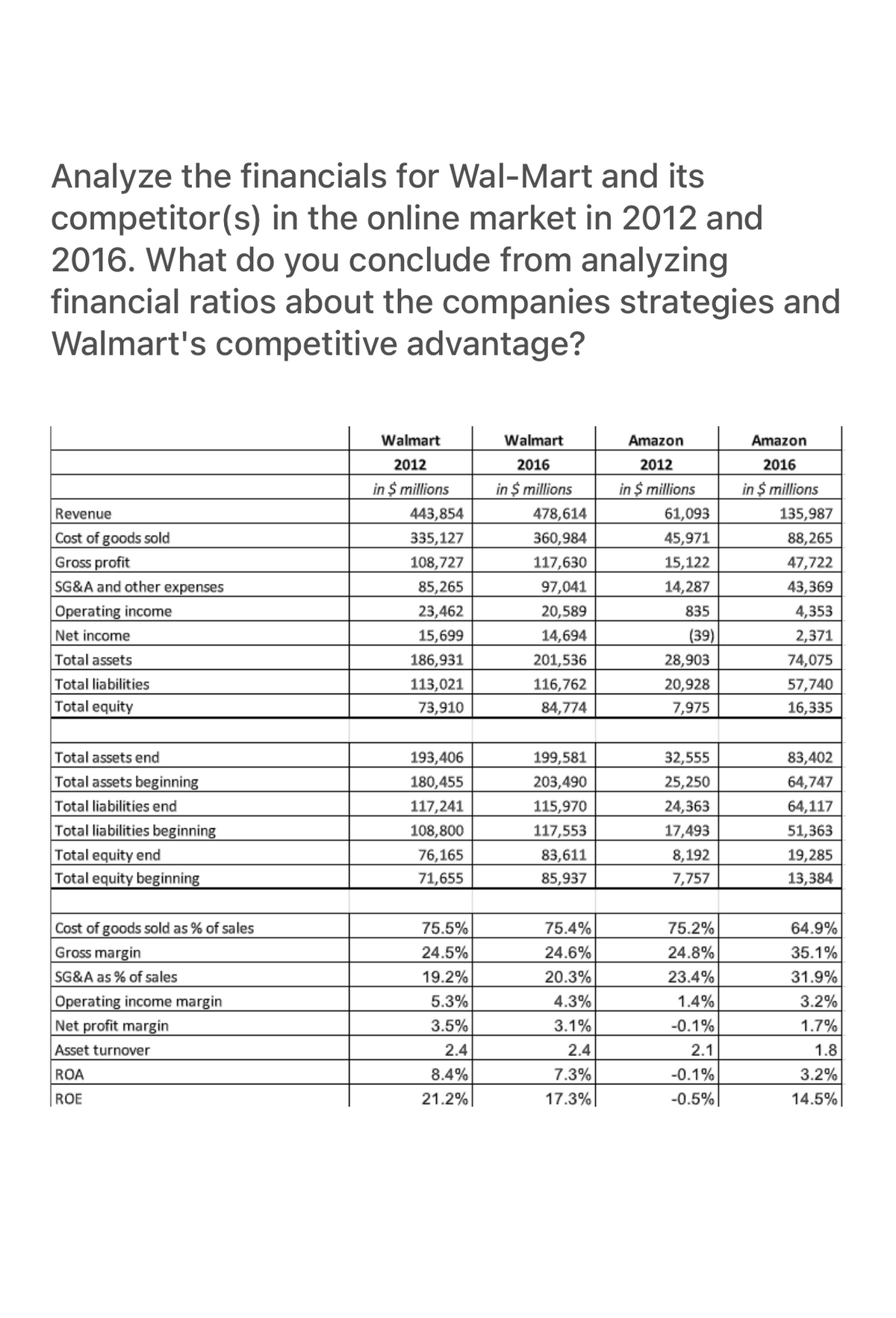

Analyze the financials for Wal-Mart and its competitor(s) in the online market in 2012 and 2016. What do you conclude from analyzing financial ratios about the companies strategies and Walmart's competitive advantage? Revenue Cost of goods sold Gross profit SG&A and other expenses Operating income Net income Total assets Total liabilities Total equity Total assets end Total assets beginning Total liabilities end Total liabilities beginning Total equity end Total equity beginning Cost of goods sold as % of sales Gross margin SG&A as % of sales Operating income margin Net profit margin Asset turnover ROA ROE Walmart 2012 in $ millions 443,854 335,127 108,727 85,265 23,462 15,699 186,931 113,021 73,910 193,406 180,455 117,241 108,800 76,165 71,655 75.5% 24.5% 19.2% 5.3% 3.5% 2.4 8.4% 21.2% Walmart 2016 in $ millions 478,614 360,984 117,630 97,041 20,589 14,694 201,536 116,762 84,774 199,581 203,490 115,970 117,553 83,611 85,937 75.4% 24.6% 20.3% 4.3% 3.1% 2.4 7.3% 17.3% Amazon 2012 in $ millions 61,093 45,971 15,122 14,287 835 (39) 28,903 20,928 7,975 32,555 25,250 24,363 17,493 8,192 7,757 75.2% 24.8% 23.4% 1.4% -0.1% 2.1 -0.1% -0.5% Amazon 2016 in $ millions 135,987 88,265 47,722 43,369 4,353 2,371 74,075 57,740 16,335 83,402 64,747 64,117 51,363 19,285 13,384 64.9% 35.1% 31.9% 3.2% 1.7% 1.8 3.2% 14.5%

Analyze the financials for Wal-Mart and its competitor(s) in the online market in 2012 and 2016. What do you conclude from analyzing financial ratios about the companies strategies and Walmart's competitive advantage? Revenue Cost of goods sold Gross profit SG&A and other expenses Operating income Net income Total assets Total liabilities Total equity Total assets end Total assets beginning Total liabilities end Total liabilities beginning Total equity end Total equity beginning Cost of goods sold as % of sales Gross margin SG&A as % of sales Operating income margin Net profit margin Asset turnover ROA ROE Walmart 2012 in $ millions 443,854 335,127 108,727 85,265 23,462 15,699 186,931 113,021 73,910 193,406 180,455 117,241 108,800 76,165 71,655 75.5% 24.5% 19.2% 5.3% 3.5% 2.4 8.4% 21.2% Walmart 2016 in $ millions 478,614 360,984 117,630 97,041 20,589 14,694 201,536 116,762 84,774 199,581 203,490 115,970 117,553 83,611 85,937 75.4% 24.6% 20.3% 4.3% 3.1% 2.4 7.3% 17.3% Amazon 2012 in $ millions 61,093 45,971 15,122 14,287 835 (39) 28,903 20,928 7,975 32,555 25,250 24,363 17,493 8,192 7,757 75.2% 24.8% 23.4% 1.4% -0.1% 2.1 -0.1% -0.5% Amazon 2016 in $ millions 135,987 88,265 47,722 43,369 4,353 2,371 74,075 57,740 16,335 83,402 64,747 64,117 51,363 19,285 13,384 64.9% 35.1% 31.9% 3.2% 1.7% 1.8 3.2% 14.5%

Chapter9: Projecting Financial Statements

Section: Chapter Questions

Problem 1aM

Related questions

Question

Transcribed Image Text:Analyze the financials for Wal-Mart and its

competitor(s) in the online market in 2012 and

2016. What do you conclude from analyzing

financial ratios about the companies strategies and

Walmart's competitive advantage?

Revenue

Cost of goods sold

Gross profit

SG&A and other expenses

Operating income

Net income

Total assets

Total liabilities

Total equity

Total assets end

Total assets beginning

Total liabilities end

Total liabilities beginning

Total equity end

Total equity beginning

Cost of goods sold as % of sales

Gross margin

SG&A as % of sales

Operating income margin

Net profit margin

Asset turnover

ROA

ROE

Walmart

2012

in $ millions

443,854

335,127

108,727

85,265

23,462

15,699

186,931

113,021

73,910

193,406

180,455

117,241

108,800

76,165

71,655

75.5%

24.5%

19.2%

5.3%

3.5%

2.4

8.4%

21.2%

Walmart

2016

in $ millions

478,614

360,984

117,630

97,041

20,589

14,694

201,536

116,762

84,774

199,581

203,490

115,970

117,553

83,611

85,937

75.4%

24.6%

20.3%

4.3%

3.1%

2.4

7.3%

17.3%

Amazon

2012

in $ millions

61,093

45,971

15,122

14,287

835

(39)

28,903

20,928

7,975

32,555

25,250

24,363

17,493

8,192

7,757

75.2%

24.8%

23.4%

1.4%

-0.1%

2.1

-0.1%

-0.5%

Amazon

2016

in $ millions

135,987

88,265

47,722

43,369

4,353

2,371

74,075

57,740

16,335

83,402

64,747

64,117

51,363

19,285

13,384

64.9%

35.1%

31.9%

3.2%

1.7%

1.8

3.2%

14.5%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning