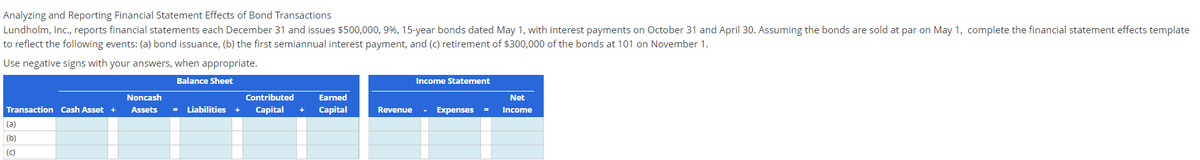

Analyzing and Reporting Financial Statement Effects of Bond Transactions Lundholm, Inc., reports financial statements each December 31 and issues $500,000, 9%, 15-year bonds dated May 1, with interest payments on October 31 and April 30. Assuming the bonds are sold at par on May 1, complete the financial statement effects template to reflect the following events: (a) bond issuance, (b) the first semiannual interest payment, and (c) retirement of $300,000 of the bonds at 101 on November 1. Use negative signs with your answers, when appropriate. Balance Sheet Transaction Cash Asset + (a) (b) (c) Noncash Contributed Assets - Liabilities + Capital Earned Capital Revenue Income Statement Expenses - Net Income

Analyzing and Reporting Financial Statement Effects of Bond Transactions Lundholm, Inc., reports financial statements each December 31 and issues $500,000, 9%, 15-year bonds dated May 1, with interest payments on October 31 and April 30. Assuming the bonds are sold at par on May 1, complete the financial statement effects template to reflect the following events: (a) bond issuance, (b) the first semiannual interest payment, and (c) retirement of $300,000 of the bonds at 101 on November 1. Use negative signs with your answers, when appropriate. Balance Sheet Transaction Cash Asset + (a) (b) (c) Noncash Contributed Assets - Liabilities + Capital Earned Capital Revenue Income Statement Expenses - Net Income

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 13M

Related questions

Question

Transcribed Image Text:Analyzing and Reporting Financial Statement Effects of Bond Transactions

Lundholm, Inc., reports financial statements each December 31 and issues $500,000, 9%, 15-year bonds dated May 1, with interest payments on October 31 and April 30. Assuming the bonds are sold at par on May 1, complete the financial statement effects template

to reflect the following events: (a) bond issuance, (b) the first semiannual interest payment, and (c) retirement of $300,000 of the bonds at 101 on November 1.

Use negative signs with your answers, when appropriate.

Balance Sheet

Transaction Cash Asset +

(a)

(b)

(C)

Noncash

Assets

Liabilities +

Contributed

Capital +

Earned

Capital

Revenue

Income Statement

Expenses

Net

Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please explain the calculation of C transactions

Solution

Follow-up Question

Please explain calculation of transaction b) Where the value 612 is coming

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,