2. How many shares of common stock are outstanding at year-end? Number of outstanding shares 3. What is the amount of minimum legal capital (based on par value) at year-en Minimum legal capital 4. What is the total paid-in capital at year-end? Total paid-in capital

2. How many shares of common stock are outstanding at year-end? Number of outstanding shares 3. What is the amount of minimum legal capital (based on par value) at year-en Minimum legal capital 4. What is the total paid-in capital at year-end? Total paid-in capital

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 3R: Chen Corporation began 2012 with the following stockholders equity balances: The following selected...

Related questions

Question

..

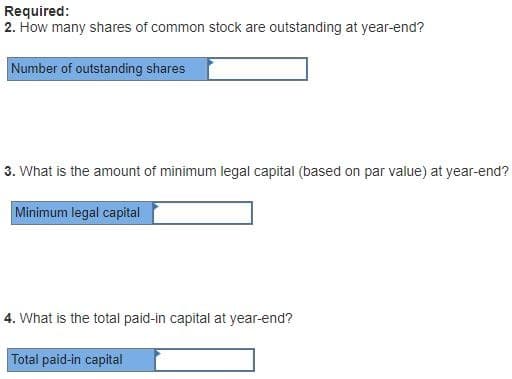

Transcribed Image Text:Required:

2. How many shares of common stock are outstanding at year-end?

Number of outstanding shares

3. What is the amount of minimum legal capital (based on par value) at year-end?

Minimum legal capital

4. What is the total paid-in capital at year-end?

Total paid-in capital

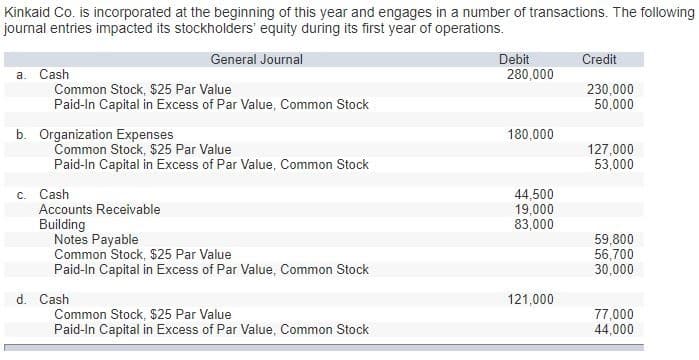

Transcribed Image Text:Kinkaid Co. is incorporated at the beginning of this year and engages in a number of transactions. The following

journal entries impacted its stockholders' equity during its first year of operations.

General Journal

a. Cash

Common Stock, $25 Par Value

Paid-In Capital in Excess of Par Value, Common Stock

b. Organization Expenses

Common Stock, $25 Par Value

Paid-In Capital in Excess of Par Value, Common Stock

c. Cash

Accounts Receivable

Building

Notes Payable

Common Stock, $25 Par Value

Paid-In Capital in Excess of Par Value, Common Stock

d. Cash

Common Stock, $25 Par Value

Paid-In Capital in Excess of Par Value, Common Stock

Debit

280,000

180,000

44,500

19,000

83,000

121,000

Credit

230,000

50,000

127,000

53,000

59,800

56,700

30,000

77,000

44,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning