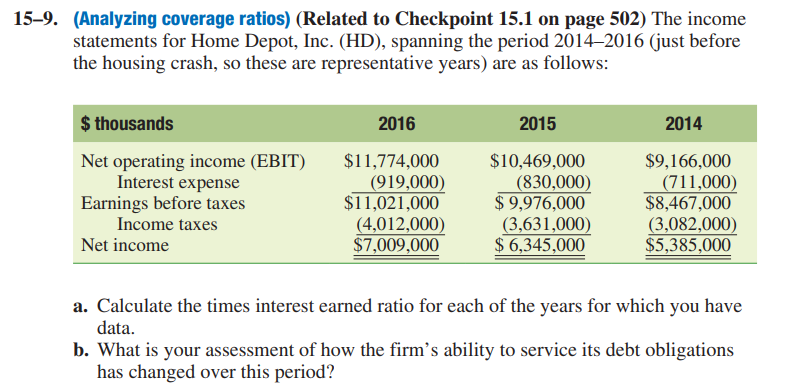

(Analyzing coverage ratios) (Related to Checkpoint 15.1 on page 502) The income statements for Home Depot, Inc. (HD), spanning the period 2014–2016 (just before the housing crash, so these are representative years) are as follows: $ thousands 2016 2015 2014 Net operating income (EBIT) Interest expense Earnings before taxes Income taxes $11,774,000 (919,000) $11,021,000 (4,012,000) $7,009,000 $10,469,000 (830,000) $ 9,976,000 (3,631,000) $ 6,345,000 $9,166,000 |(711,000) $8,467,000 (3,082,000) $5,385,000 Net income a. Calculate the times interest earned ratio for each of the years for which you have data. b. What is your assessment of how the firm's ability to service its debt obligations has changed over this period?

(Analyzing coverage ratios) (Related to Checkpoint 15.1 on page 502) The income statements for Home Depot, Inc. (HD), spanning the period 2014–2016 (just before the housing crash, so these are representative years) are as follows: $ thousands 2016 2015 2014 Net operating income (EBIT) Interest expense Earnings before taxes Income taxes $11,774,000 (919,000) $11,021,000 (4,012,000) $7,009,000 $10,469,000 (830,000) $ 9,976,000 (3,631,000) $ 6,345,000 $9,166,000 |(711,000) $8,467,000 (3,082,000) $5,385,000 Net income a. Calculate the times interest earned ratio for each of the years for which you have data. b. What is your assessment of how the firm's ability to service its debt obligations has changed over this period?

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter4: Profitability Analysis

Section: Chapter Questions

Problem 23PC

Related questions

Question

Transcribed Image Text:15-9. (Analyzing coverage ratios) (Related to Checkpoint 15.1 on page 502) The income

statements for Home Depot, Inc. (HD), spanning the period 2014–2016 (just before

the housing crash, so these are representative years) are as follows:

$ thousands

2016

2015

2014

Net operating income (EBIT)

Interest expense

Earnings before taxes

Income taxes

$11,774,000

(919,000)

$11,021,000

(4,012,000)

$7,009,000

$10,469,000

(830,000)

$ 9,976,000

(3,631,000)

$ 6,345,000

$9,166,000

(711,000)

$8,467,000

(3,082,000)

$5,385,000

Net income

a. Calculate the times interest earned ratio for each of the years for which you have

data.

b. What is your assessment of how the firm's ability to service its debt obligations

has changed over this period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning