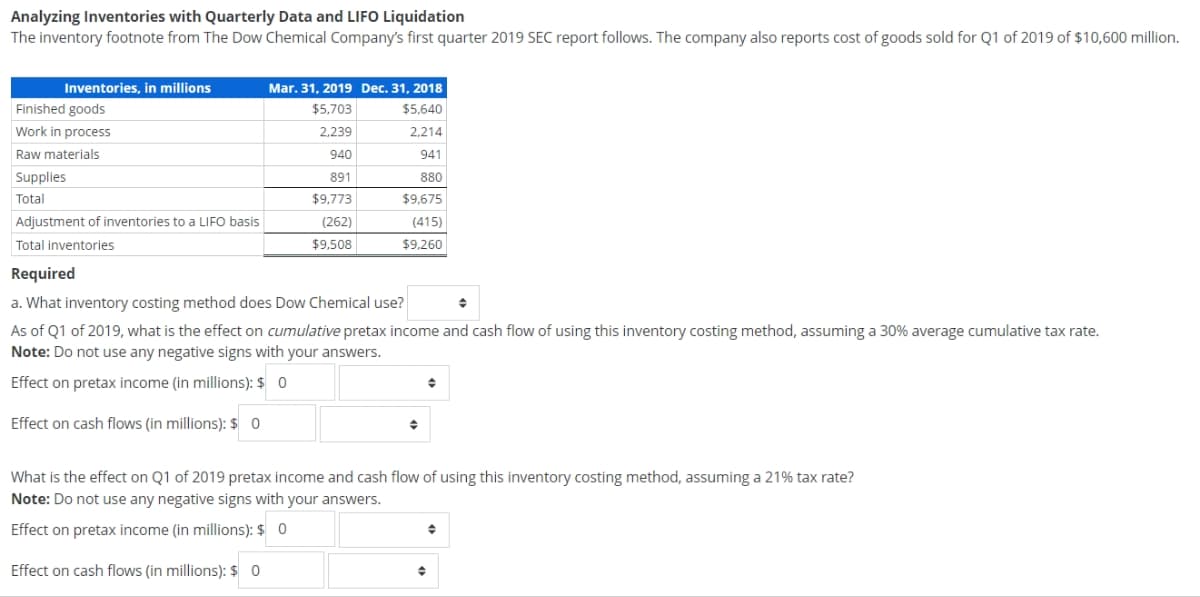

Analyzing Inventories with Quarterly Data and LIFO Liquidation The inventory footnote from The Dow Chemical Company's first quarter 2019 SEC report follows. The company also reports cost of goods sold for Q1 of 2019 of $10,600 million. Inventories, in millions Finished goods Work in process Raw materials Supplies Total Adjustment of inventories to a LIFO basis. Total inventories Mar. 31, 2019 Dec. 31, 2018 $5,703 $5,640 2,239 2,214 940 941 891 880 $9,773 $9,675 (262) (415) $9,508 $9,260 Required a. What inventory costing method does Dow Chemical use? ♦ As of Q1 of 2019, what is the effect on cumulative pretax income and cash flow of using this inventory costing method, assuming a 30% average cumulative tax rate. Note: Do not use any negative signs with your answers. Effect on pretax income (in millions): $ 0 Effect on cash flows (in millions): $ 0 ♦ What is the effect on Q1 of 2019 pretax income and cash flow of using this inventory costing method, assuming a 21% tax rate? Note: Do not use any negative signs with your answers. Effect on pretax income (in millions): $ 0 Effect on cash flows (in millions): $ 0 ◆

Analyzing Inventories with Quarterly Data and LIFO Liquidation The inventory footnote from The Dow Chemical Company's first quarter 2019 SEC report follows. The company also reports cost of goods sold for Q1 of 2019 of $10,600 million. Inventories, in millions Finished goods Work in process Raw materials Supplies Total Adjustment of inventories to a LIFO basis. Total inventories Mar. 31, 2019 Dec. 31, 2018 $5,703 $5,640 2,239 2,214 940 941 891 880 $9,773 $9,675 (262) (415) $9,508 $9,260 Required a. What inventory costing method does Dow Chemical use? ♦ As of Q1 of 2019, what is the effect on cumulative pretax income and cash flow of using this inventory costing method, assuming a 30% average cumulative tax rate. Note: Do not use any negative signs with your answers. Effect on pretax income (in millions): $ 0 Effect on cash flows (in millions): $ 0 ♦ What is the effect on Q1 of 2019 pretax income and cash flow of using this inventory costing method, assuming a 21% tax rate? Note: Do not use any negative signs with your answers. Effect on pretax income (in millions): $ 0 Effect on cash flows (in millions): $ 0 ◆

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 13RE: Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a...

Related questions

Question

Please do not give image format and solve with explanation

Transcribed Image Text:Analyzing Inventories with Quarterly Data and LIFO Liquidation

The inventory footnote from The Dow Chemical Company's first quarter 2019 SEC report follows. The company also reports cost of goods sold for Q1 of 2019 of $10,600 million.

Inventories, in millions

Finished goods

Work in process

Raw materials

Supplies

Total

Adjustment of inventories to a LIFO basis

Total inventories

Mar. 31, 2019 Dec. 31, 2018

$5,703

$5,640

2,239

2,214

940

941

891

880

$9,773

(262)

$9,508

$9,675

(415)

$9,260

Required

a. What inventory costing method does Dow Chemical use?

→

As of Q1 of 2019, what is the effect on cumulative pretax income and cash flow of using this inventory costing method, assuming a 30% average cumulative tax rate.

Note: Do not use any negative signs with your answers.

Effect on pretax income (in millions): $ 0

Effect on cash flows (in millions): $ 0

What is the effect on Q1 of 2019 pretax income and cash flow of using this inventory costing method, assuming a 21% tax rate?

Note: Do not use any negative signs with your answers.

Effect on pretax income (in millions): $ 0

Effect on cash flows (in millions): $ 0

◆

◆

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning