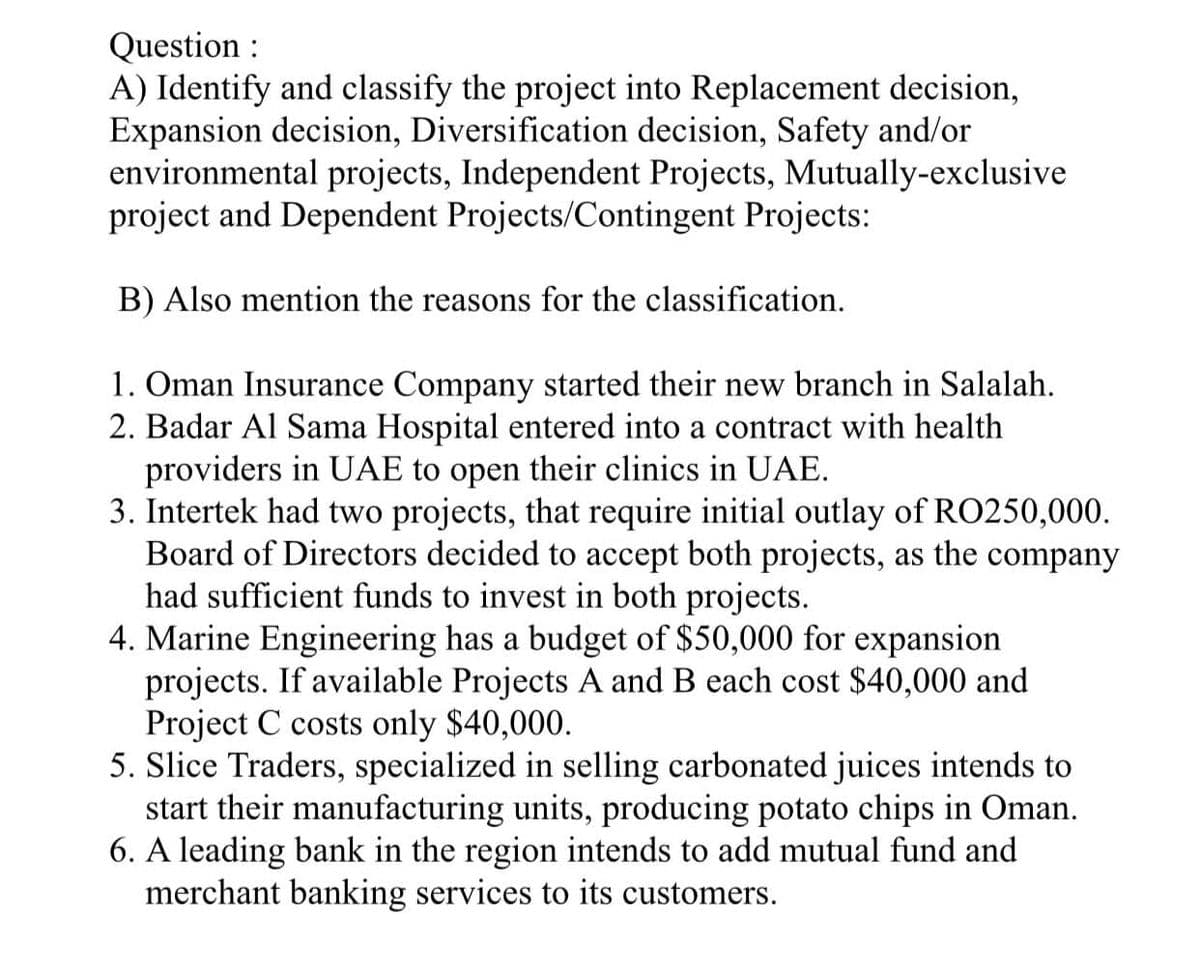

and classify the project into Replacement decision, lecision, Diversification decision, Safety and/or tal projects, Independent Projects, Mutually-exclusive Dependent Projects/Contingent Projects: ntion the reasons for the classification.

Q: The acronym TELOS provides guidance for accessing project feasibility. The term stands for…

A: The feasibility of the proposed project is evaluated by using the acronym TELOS. T - Technical – To…

Q: Differentiate between a project’s physical life and its economic life.

A: At the point when an organization purchases an asset it mulls over numerous things like the expense…

Q: Describe the Project selection rules under the IRR criterion?

A: IRR (Internal rate of return) is one of capital budgeting techniques which is used to evaluate the…

Q: Describe the process of Evaluating Mutually Exclusive Projects?

A: Mutually exclusive projects are the capital investment proposal where best proposal option is…

Q: Define Gordon model? Differentiate between independent and mutually exclusive projects with examples

A: Gordon model is a dividend valuation model.

Q: The MARR used for a project’s acceptance or rejection is set relative to what cost?

A: MARR is a discount return which is the lowest rate of return that must be accepted in the project.

Q: Replacement projects are a subcategory of the mutually exclusive projects. True or false?

A: Replacement project: A replacement project is an undertaking in which the corporation rejects a…

Q: Differentiate between Independent and Mutually Exclusive projects

A: In capital budgeting, mutually-exclusive projects refer to a set of projects where only one project…

Q: A project's terminal value is the ______.

A: A project's terminal value is the sum of the future values of the cash inflows compounded at the…

Q: Explain the decision rules of NPV, IRR, and BCR. Which one you think is important for project…

A: Net Present Value (NPV) is referred to as the difference between the PV of cash inflows as well as…

Q: In a table : Explain the difference between independent and mutually exclusive projects?

A: Independent and mutually exclusive projects are the part of Cash flows or cash flow statement.…

Q: How will you choose between two mutually exclusive projects which do differs in terms of their…

A: An investment appraisal is a capital budgeting technique that helps to analyze a proposed project's…

Q: Describe the methods of determining the Project Risk?

A: Project risk is an uncertain event or circumstance that affects at any rate one objective of a task,…

Q: Differentiate between divisible and indivisible projects

A: Capital rationing is the process of limiting the projects that the company. It will reduces the…

Q: , determine whether the project should be undertaken.

A: Net Present Value=Present Value of Inflow-Present Value of Outflow Present Value of…

Q: What is a special assessment project? How are special assessment projects reported?

A: Special assessment project: The special assessment project refers to the projects which are…

Q: Define single-project evaluation,

A: SOLUTION:- Single Project Evaluation is the systematic and objective study of the single ongoing or…

Q: Characterize the relative difficulty in valuing a real benefit of a natural resource.

A: Definition : In simple words, Natural resources can be understood as the properties that occur…

Q: Evaluating the mutually exclusive projects using the IRR and NPV approaches can be problematic'.…

A: It is a method under capital budgeting which includes the computation of the net present value of…

Q: Define each of the following terms:b. Independent projects; mutually exclusive projects

A: The Project evaluation and selection are one of the key components in Capital Budgetting decisions…

Q: Differentiate between independent and mutually exclusive projects.

A: Mutually exclusive projects: If two projects are termed to be mutually exclusive, when the…

Q: What is independent projects?

A: Introduction: Capital budgeting is an investment criterion or decision making mechanism for…

Q: In which situation are the project lives unequal?

A: Answer: A business will face a situation where multiple capital projects display a positive net…

Q: Is it possible for conflicts to exist between the NPV and the IRR when independent projects are…

A: Meaning of NPV= Net present Value NPV is used to analyse the decisions of investments in any project…

Q: How can we calculate the terminal project balance of the Project?

A: Firms always invest a huge amount in starting the project and from that project they generate…

Q: Explain the difference between independent and mutually exclusive projects?with examples..

A: Independent Project Independent project means the execution of the project with its cash flow will…

Q: What is the difference between “independent” and “mutuallyexclusive” projects?

A: Projects are categorized in capital budgeting as independent or as mutually exclusive. If a…

Q: Which of the following statements is correct? a. When there are two mutually exclusive projects, th

A: All of the following are incorrect: The payback period criterion properly considers the time value…

Q: Consider the following cash flows for two mutually exclusive capital investment projects. The…

A: Net Present Value (NPV) is the excess of present value of cash inflows over present value of cash…

Q: Does the Analysis Period differ from Project Lives? Explain how?

A: In a financial term, the Analysis Period is a period of financial analysis of financial statements…

Q: Describe the process of Evaluating a Single Project?

A: A single project can be evaluated using quantitative, qualitative or a combination of both. Project…

Q: How can we generalize the decision rule for comparing mutually exclusive projects?

A: A company can only select only one project from various projects because it requires huge capital…

Q: Which is the most important breakeven in the analysis of a project?

A: Projects could be analyzed by using net present value (NPV) method. In this method, projects are…

Q: What two conditions can lead to conflicts between the NPV and the IRR when evaluatingmutually…

A: NPV : NPV or net present value is defined as the difference between present value of cash inflows…

Q: What are the methods of describing Project Risk?

A: The project risk is an unpredictable occurrence or situation that has an effect on at least one…

Q: Explain the difference between independent and mutually exclusive projects?

A: Under capital budgeting, there are 2 types of projects selection basis: 1. When projects are…

Q: Explain how the Analysis Period Equals Project Lives?

A: Answer: For the present worth analysis, the definition of analysis period equivalent to project…

Q: Describe the evaluation techniques to consider multiple projects that are mutually exclusive?

A: Following are the evaluation techniques to consider multiple projects that are mutually exclusive:…

Q: A project will be preferred when it has:

A: Payback period is the time period in which the investment will pay its initial cost back. The…

Q: What should be done to calculate accurately a project's true IRR,?

A: The internal rate of return (IRR) is a capital budgeting metric used to gauge the benefit of…

Q: What are the three types of risk to which projects are exposed?Which type of risk is theoretically…

A: Types of risks associated with the projects are: Budget Risk Time risk Performance Risk Budget…

Q: What two characteristics can lead to conflicts between the NPV andthe IRR when evaluating mutually…

A: 1.When two projects are of different size and investment, NPV and IRR can throw up different…

Q: Illustrate the main factors of Project Risk?

A: The project risk is defined as the uncertain event or condition that occurs mainly on positive or…

Q: If these projects were independent, which project(s) would be accepted? Why? If these projects were…

A: We use different capital budgeting tools to determine the financial feasibility of projects that are…

Q: what is the cost of a project proposal and how is it structure to meet its goals

A: A cost of a project refers to the sum total of all expenditure to be incurred by an organization for…

Q: Which of the following is the correct calculation of project Delta's IRR?

A: Internal Rate of Return (IRR): It is the rate of return at which a project's net present value…

Q: Explain Evaluat ing a Single Project?

A: Capital budgeting is referred as the process of decision making which is used by companies to…

Step by step

Solved in 3 steps

- Five independent projects consisting of reinforcing dams, levees, and embankments are available for funding by a certain public agency. The following tabulation shows the equivalent annual benefits and costs for each: and that the agency is willing to invest money as long as the B–C ratio is at least one. Which alternatives should be selected for funding? b. What is the rank-ordering of projects from best to worst? c. If the projects involved intangible benefits that required considerable judgment in assigning their values, would your recommendation be affected?Instructions: You are an investment analyst for Mango Financial Management, anindependent financial consulting firm. Your latest assignment is to provide anindependent assessment of Big Rock Building Inc. Big Rock is a Caribbean basedcompany that manufactures building products and provides services for the constructionand engineering sectors. The company has several divisions which operate as separateentities.The case study analysis consists of four core sections, and you will have to eitherconduct research or perform calculations. The assessment must be completed within fivedays, because a meeting has been scheduled with the client to discuss your findings. Big Rock’s directors are looking to expand into a new suite of services. Although theyare doing quite well in their existing lines of business, analysts have identified some newareas for development. One of these is expansion into manufacturing prefabricatedhomes. However, this venture requires a large amount of funding. To raise…Instructions: You are an investment analyst for Mango Financial Management, anindependent financial consulting firm. Your latest assignment is to provide anindependent assessment of Big Rock Building Inc. Big Rock is a Caribbean basedcompany that manufactures building products and provides services for the constructionand engineering sectors. The company has several divisions which operate as separateentities.The case study analysis consists of four core sections, and you will have to eitherconduct research or perform calculations. The assessment must be completed within fivedays, because a meeting has been scheduled with the client to discuss your findings. The company’s pension plan is managed by Castle Fund Managers, a leading provider ofpension services. It is a defined contribution plan, where the employees’ contributions arematched by the employer. Each employee had to choose one of the following investmentoptions for their individual plans:a. Preferred Accumulator (PA):…

- The following information is available on two mutually exclusive projects. Project Year 0 Year 1 Year 2 Year 3 Year 4 A -$700 $200 $300 $400 $500 B -$700 $600 $300 $200 $100 At what cross-over rate would the firm be indifferent between the two projects? Group of answer choices 14.72% 16.53% 29.15% 37.49%NextG Limited is a leading manufacturer of automotive components. It supplies to the original equipment manufacturers as well as the replacement market. Its projects typically have a short life as it introduces new models periodically. You have recently joined NextG Limited as a financial analyst reporting to Mr. Atiamoh, the CFO of the company. He has provided you the following information about two mutually exclusive projects. A and B, that are being considered by the Executive Committee of NextG Limited:Project A is an extension of an existing line. Its cash flow will decrease over time. Project B involves a new product. Building its market will take some time and hence its cash flow will increase over time.The expected net cash flows of the two mutually exclusive projects are as follows. Mr. Atiamoh believes that all the two projects have risk characteristics similar to the average risk of the firm and hence NextG’s cost of capital of 10 percent will apply to them and both…Government had recently declared certain policy changes to setup and run heavy industries. The company have to obtain no-objection-certificate from National Green Tribunal to run the unit. A company XYZ engaged in manufacturing cement is searching to relocating their manufacturing facility. Explain various factors that cement company should consider while taking location decision, also explain how these factors will affect the bottom line of the company.

- A feasibility report is a report that evaluates a set of proposed project paths or solutions to determine if they are viable. Feasibility studies can be very helpful for guiding a community's decision-making process. They can provide neutral, third-party professional analysis including cost-benefit analysis, alternative options, and verification. In today's world, the undertaking of any major project requires proper planning. write a feasibility study for E-waste in sultanate of Oman includes: Describe the project. Outline the potential solutions resulting from the project. List the criteria for evaluating these solutions. State which solution is most feasible for the project. Make a conclusion statement.Investment Criteria. Consider two mutually exclusive projects, A and B, whose costs and cash flows are shown in the following table: Year Project A Project B 1 $(15,000) $(22,840) 2 9,000 8,000 3 8,000 8,000 4 2,500 8,000 5 3,000 24.192 8,000 15.00 Calculate the cross over rate.Based on my understanding, the operating process in a property developer starts from:a. Setting up budget to identify potential selling price per unit to achieve favorable profit margin and performing market research on the targeted areab. Once the project is finalized and approved by local authorities, we could start to market out the properties, even though it is at preliminary stagec. Prepare Sales & Purchase Agreement and sign with potential customers through collection of first 10% refundable depositd. Bill purchasers progressively based on approved architect certificatese. Handover key to purchasers after the project is completed Assuming that we are only selling bare units with no other features provided to our purchasers, explain the five steps approach to recognize revenue for property developers in accordance with IFRS 15 Revenue from contract with customers.

- The following information concern the ministry of local government for the last quarter of 2014 A. Foreign donor funding expected to be received in October 2014 will be GHC 500000 whiles those for November and December 2014 will be GHC 800000 each. The cash balance at the end of the third quarter 2014 was 700000 B. The fourth quarter allocation GHC 8000000 is expected to be received in October 2014 C. Payment of local purchases order of GHC 38000 issued to stationeries Ltd for supplies in august will be paid in November 2014 D. Net salaries after tax and and social social security fund çontribution for the month of October will be GHC 3000000 hills that of November and December 2014 will be increased by 20% of that October for each said month. These would be paid in the month of it relates. E. Payment of civil servants association dues GHC 140000 will be paid in November 2014 F. Purchase of vehicles of GHC 4000000 will be made in October but paid in November 2014 G. Supplementary…Your client is investigating two start-up companies that operate in the same construction sector in Australia. These two companies are investigating similar projects (not both) in which they will invest. However, your client is not sure which is better and has sent the relevant details to you to advise. The characteristics of the two projects are given below: (picture) Your client wishes you to provide detailed calculations indicating which project you believe to be the best. The client will then decide whether to invest into the company looking to invest in the projectTopic: Government Grant Question: How much should be grant income for the first year of grant foreach of the following cases? a. A 10-year, non-interest bearing, P20,000,000 term loan was received from the Philippine government. Without the loan from the government, the entity would need to pay 8% interest per year. b. P3,000,000 government grant was received to support the continued existence of the entity. The entity was heavily affected by the ashfall from a nearby volcano. The entity has a total legal life of 50 years and is on its 40th year.